What's the Difference Between Quarterly Taxes vs. Annual Taxes?

Editor’s note: Please be aware that we’re not tax professionals and this is not tax advice, just a general guideline.

The federal income tax is a pay-as-you-go tax, meaning you pay taxes as you earn or receive income throughout the year. Depending on your financial situation, you may pay these taxes through withholding earnings or making estimated quarterly tax payments.

So, how do you know whether you should make quarterly payments or stick with traditional annual taxes? This will largely depend on the type of work you do and how you’re paid for that work.

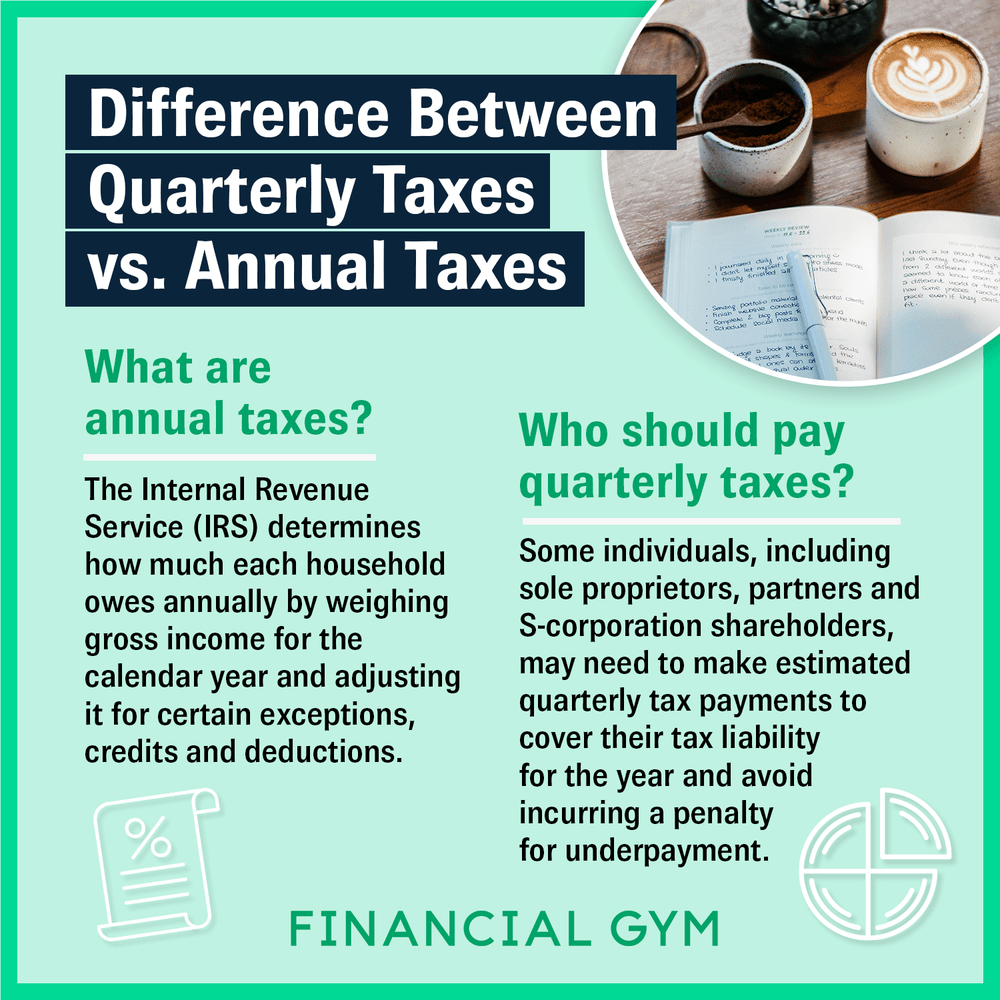

What are annual taxes?

The Internal Revenue Service (IRS) determines how much each household owes annually by weighing gross income for the calendar year and adjusting it for certain exceptions, credits and deductions.

Most people who receive salaries and wages pre-pay their tax liability throughout the year by having a portion of their income withheld from their earnings. The final amount owed is then balanced when they file their annual income tax return, which primarily occurs in April of the following tax year.

Every financial situation is different, so you may need to adjust this withholding amount to better suit your needs. You can do this at any time by filling out a new IRS Form W-4 with your employer. This will help ensure you aren’t hit with a large tax balance at the end of the year due to underpayment, nor are you sacrificing a smaller paycheck throughout the year because of overpayment.

If you don’t pay taxes on your income through withholding, you may need to make quarterly estimated tax payments instead.

Who should pay quarterly taxes?

Some individuals, including sole proprietors, partners and S-corporation shareholders, may need to make estimated quarterly tax payments to cover their tax liability for the year and avoid incurring a penalty for underpayment.

If you fall into the following scenarios, you may need to make estimated quarterly tax payments.

You aren’t withholding enough. You may need to begin making estimated tax payments every three months if you’ll owe at least $1,000 in federal income taxes when your return is filed.

You’re self-employed. If you’re a freelancer, independent contractor, or in business for yourself, you’ll likely need to make quarterly tax payments. Your estimated taxes will pay for your income tax, self-employment tax, and alternative minimum tax.

You receive untaxed income. You may need to make estimated tax payments if you receive income from interest, dividends, alimony, capital gains, prizes, or awards. This may also include rental income and other investments.

If you don’t pay enough in taxes throughout the year, you may have to pay a penalty for underpayment. This can become particularly tricky if you receive income from both regular wages and untaxed income.

For instance, if you don’t factor your untaxed income into your wage withholdings, you could be hit with an estimated tax penalty without even realizing you needed to be making estimated payments all along.

How to calculate estimated taxes

There are several ways to calculate the amount you’ll owe for taxes depending on your financial situation.

You have a steady income. Estimate how much you’ll owe for the year and then divide that amount by four. This will give you your quarterly tax payment amounts. For example, if you think you’ll owe $4,000 for 2019, you’d send $1,000 to the IRS for each quarter.

Your income varies. Estimate how much you’ll owe based on what you’ve already earned during the current year. Use this IRS worksheet to help you determine your tax liability and payments.

While these calculations may appear to be simple, you’ll need to factor in your expected adjusted gross income, taxable income, taxes, deductions and credits for the year to determine what you’ll owe. Because taxes can become complicated fairly quickly, you may benefit from seeking help from a tax professional.

If you overestimate or underestimate your tax liability, use IRS Form 1040-ES to refigure your tax liability and adjust your next quarterly payment. You want to ensure you’re estimating your income as accurately as possible to avoid any penalties.

When to pay estimated taxes

Quarterly payments are made four times a year — in April, June and September of the current year, and January of the following year. You can also choose to make smaller payments more often if it’s more financially feasible. For example, if your tax liability is $12,000 for the tax year, you might choose to make monthly payments of $1,000 throughout the year rather than four larger payments of $3,000 at a time.

The IRS makes it convenient to make these quarterly payments online or by phone at no cost using the Electronic Federal Tax Payment System (EFTPS). You can also make payments via your checking or savings account with DirectPay or choose to pay cash through an IRS retail partner.

It’s very important that you stay on top of your taxes to avoid unnecessary penalties and unmanageable tax payments at the end of each tax year. Always consult a tax professional if you have any questions or uncertainties, and keep accurate income financial records to make tax filing easier.

Keep reading: 5 Tax Write-Offs That You Might Not Know About