What to Know About Credit Card Balance Transfers

This post contains affiliate links and The Financial Gym may earn a commission on products that you purchase or apply for through these links. To learn more about why TFG participates in affiliate programs, read this message from our CEO.

Managing debt can be a daily challenge if you’re waist-deep in it. Staying on top of multiple payment deadlines, balances, and interest rates for each account can complicate the issue even further.

A balance transfer credit card is one method of consolidating your debt. It works by transferring your various consumer debt — like credit cards and loans — into one, no-interest credit card. This debt repayment strategy can help you streamline your payments and may also help you spend less money toward paying down your debt.

Here’s what you need to know before using this debt approach.

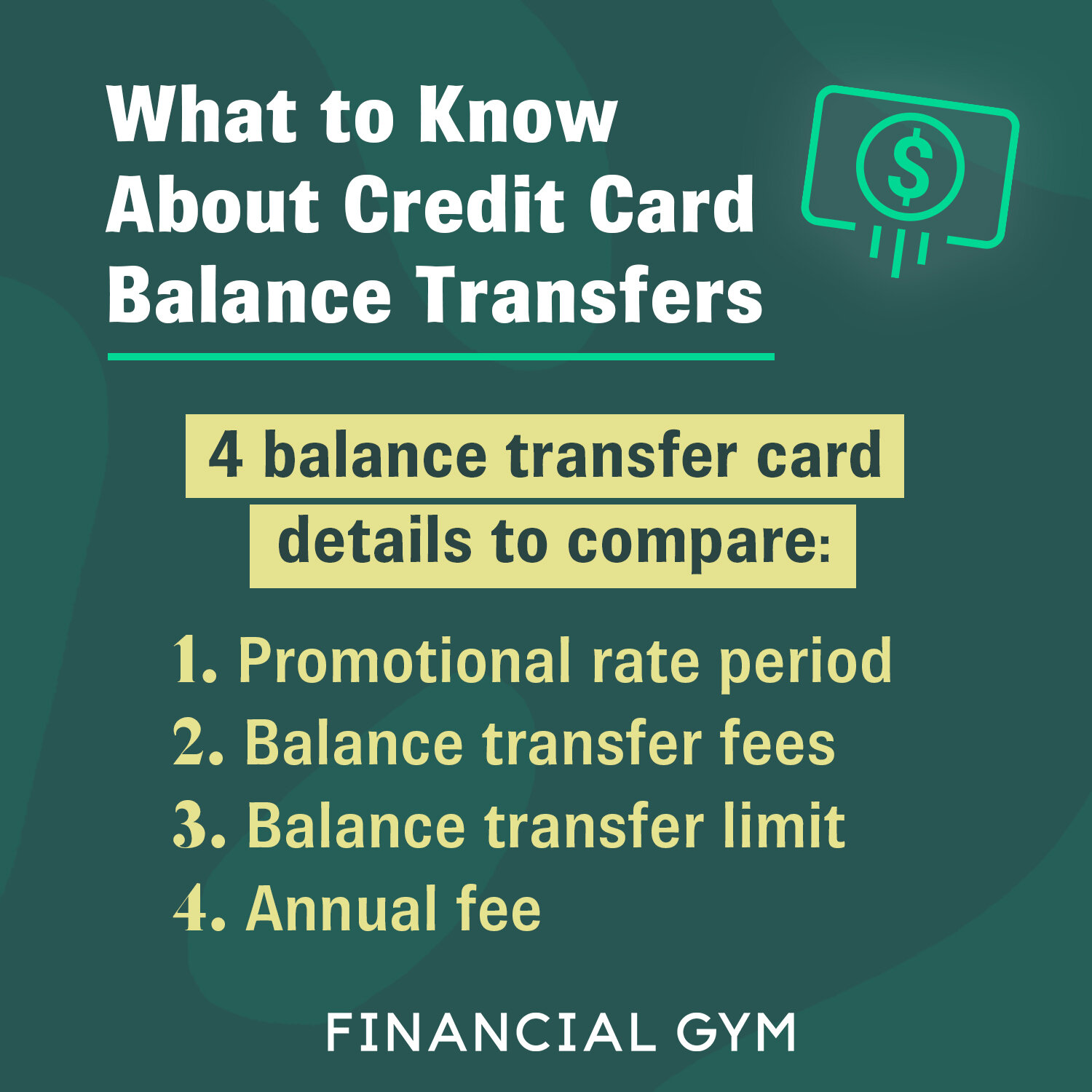

4 balance transfer card details to compare

When taking the balance figuring out how to transfer your credit card balance, you’ll first need to find the right credit card. As you shop around for the best balance transfer credit cards, here are a few card details to compare.

1. Promotional rate period

The best balance transfer credit cards are the ones that offer a zero-percent interest promotional rate. This means that third-party debt balances that are transferred onto the newly opened credit card have interest charges waived for a limited period. Some promotions last just a few months while some 0% interest credit cards offer its promotional rate for as long as 18 months.

Depending on the amount of debt you’re consolidating, the savings on interest charges over time can be hundreds or thousands of dollars. Remember, that this timeline is temporary. After the promotional period expires, you’ll get charged interest on the remaining balance, if it’s not paid in full within the statement cycle.

2. Balance transfer fees

Although you can potentially save money through a 0% interest credit card, transferring a balance is rarely free. A balance transfer card may charge a flat balance transfer fee, based on a certain dollar amount that’s transferred. Similarly, a card may charge a fee equivalent to a percentage of the amount being transferred, for example, 3% of the balance being transferred.

Some cards don’t charge a balance transfer fee, but card issuers make up some profit by shortening the promotional rate period. It’s very important to calculate whether the balance transfer fee still makes financial sense in the end.

3. Balance transfer limit

It’s unlikely that a bank will allow you to transfer an unlimited balance onto your new balance transfer credit card. Typically, the total debt you can transfer into your account can’t exceed your credit limit. Card issuers determine what your credit card limit is based on your credit score and income.

4. Annual fee

Another factor to look at when finding a balance transfer credit card is the annual fee. Regardless of the promotional interest rate, annual fee cards will charge this fee from the beginning — there’s no grace period or no-annual fee timeline.

Some annual fees can be as low as $30 per month and as high as $550, for premium credit cards. If during the promotional interest rate period, your interest savings are eaten up by the cost of the annual fee, this detail is a key consideration.

Is applying for a balance transfer credit card worth it?

Ultimately, whether a balance transfer credit card is worthwhile, really depends on the amount you’re currently spending on interest across your other debt versus how much money a particular card might save you.

There are many online balance transfer calculators, like this one by Discover, which can help simplify these calculations.

Check out our favorite balance transfer credit cards or see what balance transfer cards you can get prequalified for with our Card Match Tool.