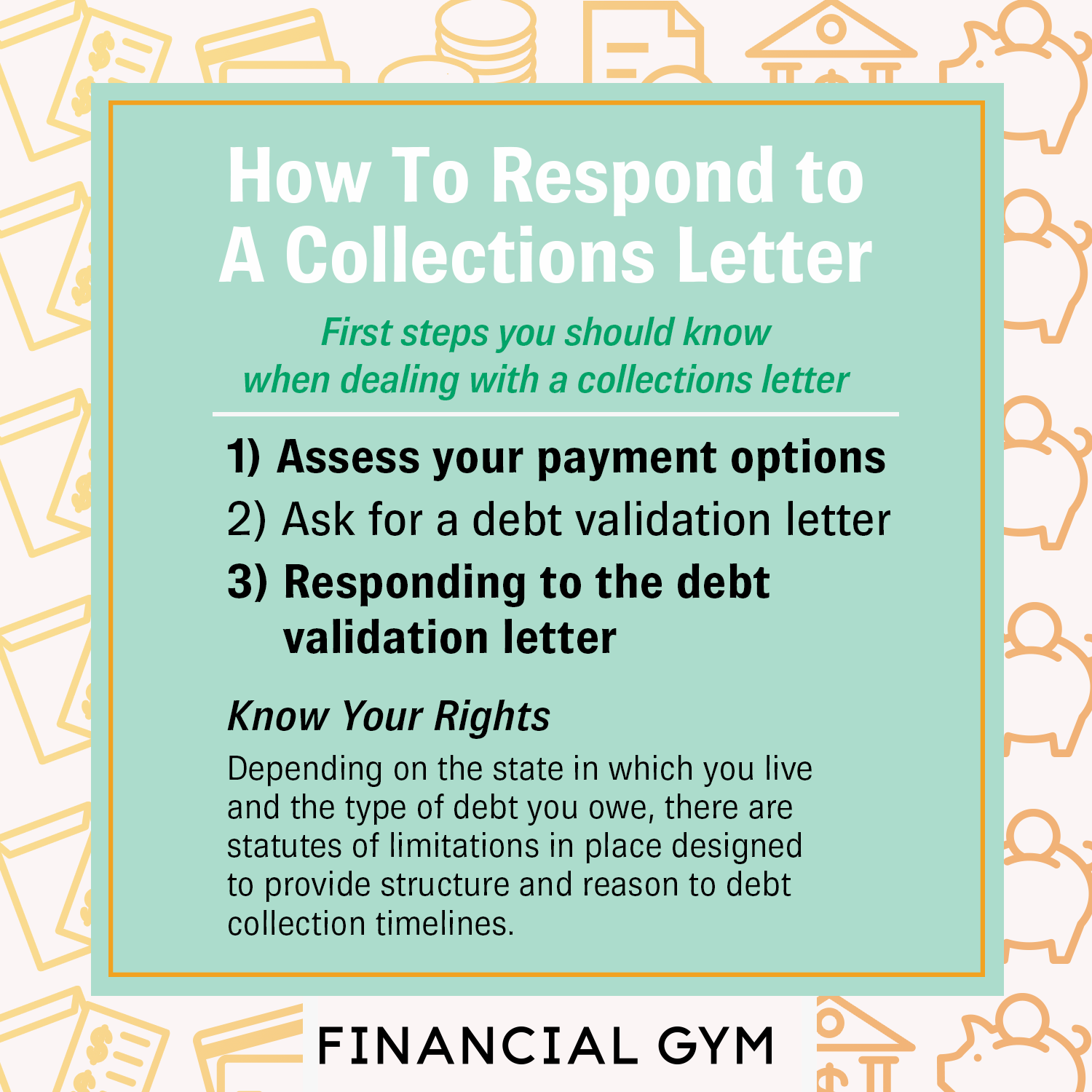

Debt Collection Series: How to Respond to a Collections Letter

If your debt was delinquent and sent to a debt collection agency, you might have received a letter from a debt collector. Communicating with debt collectors, by phone or in writing, can be intimidating.

It’s important to know your rights as a consumer before responding, as the information you share with collectors can and will be used against you, if your case is taken to court. How you handle communications with the collections agency is crucial. Here are the first steps you should know when dealing with a collections letter.

1. Assess your payment options

If you have a credit account that you’ve failed to make payments toward, your credit can be negatively impacted. Aside from having difficulty opening new credit accounts or getting approved for a loan, failure to pay off your debt can result in aggressive outreach from debt collectors. Often looking for a promise of repayment, debt collectors are trained to negotiate with debtors in exchange for settling the outstanding balance.

Regardless of your financial ability to repay your debt, refrain from making impulsive promises to debt collectors before confirming that the debt is yours.

2. Ask for a debt validation letter

A debt validation letter is a document that is legally required from debt collectors which states the details of the collection. You can use the debt validation letter to confirm the accuracy and legitimacy of the debt in question. This includes the amount of the debt that’s unpaid, whether the person named on the letter is actually you, and other details regarding the collection that may help you dispute the debt, if needed.

Here’s what a debt validation letter typically includes:

The dollar amount of the debt

Original creditor’s name and information

Statements about the validity and timeline of your debt repayment

Clear points of contact

Your right to dispute the collection, as well as instructions and required timeline

The collector must also provide more information about the debt or original creditor if you ask within 30 days of receiving a debt validation letter.

3. Responding to the debt validation letter

Whether you plan to validate, dispute or request more information about the debt reported in the debt validation letter, you have 30 days to do so before the debt collector can legally make assumptions about your ownership of the unpaid debt.

For example, if you fail to dispute your debt within 30 days of receiving a debt validation letter, your debt collector is allowed to assume the debt as valid and is yours.

When it comes to repaying your debt, timing is important. Make sure you read the fine print of your debt validation letter and respond promptly if you need more information.

Knowing your rights

Depending on the state in which you live and the type of debt you owe, there are statutes of limitations in place designed to provide structure and reason to debt collection timelines.

Their primary purpose is to outline the amount of time a creditor or debt collector can legally sue you to pursue payment. Debt is categorized into four different types of agreement:

Oral agreements

Written contracts

Promissory notes

Open-ended accounts

The statute of limitations which corresponds to your debt is determined based on how your debt was agreed upon. Once the statute of limitations on unpaid debt expires, it’s considered “time-barred” and the collector legally can’t sue or threaten to sue you.

Debt collectors can, however, continue trying to collect the debt. If they do and know that the debt is time-barred, they’re lawfully required to disclose that information up front. Make sure you know the statute of limitations for the debt, before making promissory statements or making payments to a debt collector.

Certain actions by you, like making a partial payment, can reset the clock on the time-barred debt, thereby allowing the collector to take you to court to collect the full amount due.

The Fair Debt Collection Practices Act

The Federal Trade Commission established the Fair Debt Collection Practices Act (FDCPA) to protect the general public from unlawful harassment from debt collectors. The FDCPA safeguards against false or misleading representations, abusive or excessive communication and unfair practices as they pertain to debt collectors.

FDCPA violations by debt collectors include: misrepresenting the value of the debt, being deceptive or lying about why they’re contacting you, making false claims or threatening you to get you to pay. These FDCPA violations are a serious offense, and it’s important to hold debt collectors accountable for their business practices.

If you have experienced debt collection outreach that you feel violates your rights under the FDCPA, you can report the debt collector. Contact the FTC, your state attorney general’s office or the Consumer Financial Protection Bureau to file your claim.

If you’re unclear about the details of your debt, or feel that you’ve been wrongfully charged, contact the debt collector to request more information. For additional help with your particular debt collection case, it may be worthwhile to speak with a lawyer who specializes in debt.