5 Goals to Save Towards Your Financial Plan

When it comes to managing your money, you have a lot of different priorities. You need to pay your bills, focus on paying down your debt and think about the future. But there are also some goals you should be saving for consistently. Here are the top five goals you should focus on for your financial plan.

Photo via PhotoCut

1. Having a fully-funded emergency fund

You never know when an emergency will strike. The universe has a sense of humor and emergencies typically happen when it hurts the most. You know the saying “when it rains, it pours” — these financial roadblocks happen.

In order to prepare for this, and not go into debt or be thrown off course, you want to have a financial plan that gives you a safety net. A fully-funded emergency fund is six months' worth of expenses (up to a year’s worth of expenses, if you’re self-employed). So if you lose your job or need to deal with a costly car repair, you can handle it without ruining your finances.

Start by opening a separate high-interest savings account with Ally or Marcus and set up automatic contributions. Keep saving until you reach a savings amount you’d feel comfortable with in the event of a crisis.

For example, if your base expenses are $3,000 per month, might save $18,000. Yes, it’s a lot, but you’ll save it over time. Once it’s funded, you can redirect extra cash flow toward your other goals in your financial plan.

2. Get your retirement on lock

Your retirement might seem like it’s not going to happen in forever. But if you’re wise about personal financial planning, you’ll start now! In fact, the best time to get your retirement savings on lock is as soon as you start working and earning your own income. Start by contributing to your 401(k) and if there’s a match by your employer, contribute to the match.

It’s free money, that you deserve and have earned! If you don’t have access to a 401(k), you can look into saving through a Traditional or Roth IRA.

This is a goal that you want to keep in mind always, even if it’s far away. To do that, automate a certain amount each month and set it and forget it. Keep contributing and reevaluate when you have big life events like moving, having kids, or if you have a drop or surge in income.

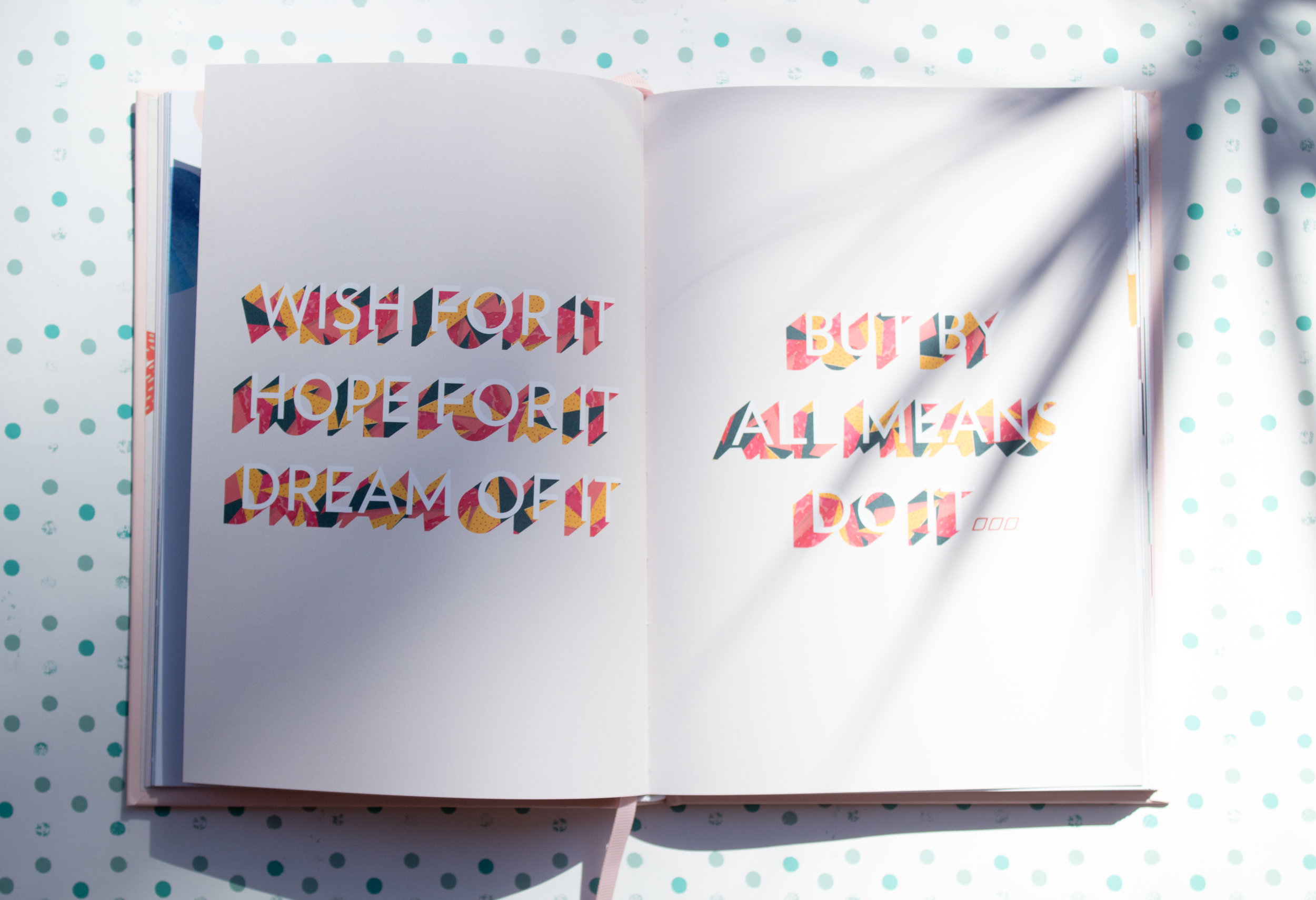

3. Save for your Big Life Dream

At The Financial Gym, we’re all about getting you financially fit. That means getting your financial plan mapped out. But it’s not just emergencies and retirement we’re thinking about. We want you to save up for your Big Life Dream. Our founder and CEO Shannon McLay’s Big Life Dream was opening The Gym.

What will your Big Life Dream be? Is quitting your job? Is it backpacking abroad for a year? Building a house from scratch? Life is about living and we want you to have a Big Life Dream that you’re actively saving toward.

Doing so will help you enjoy the money you worked so hard for and also keep you financially balanced.

4. An opportunity fund

Most people know about emergency funds for personal financial planning which we definitely advocate at The Gym. But you should also be saving up for an opportunity fund. Think of an opportunity fund as a savings account that can help you take those random and special opportunities that come your way.

You might get invited to travel abroad with a friend for a special event, and you know your answer is contingent on money. Perhaps you’re invited for a professional training opportunity that could really help your career, but once again, the out-of-pocket cost would cramp your budget.

An opportunity fund means that you can say yes to these experiences without having to mull it over so much. Strive to have $1,000 to $2,000 in this fund. Evaluate the opportunities that come your way on a case-by-case basis. When you know it’s too good to pass up, let your opportunity fund help you pay for the experience without going into debt.

5. Pay cash for big ticket items

We all have big ticket items like computers, cars, or electronics that cost a pretty penny. Though you might have all of those things now, eventually they’ll need to be replaced. Instead of going into credit card debt, start saving $30 per month to help fund big ticket items in the future.

If you know you will need to buy something sooner, fit it into your financial plan and boost the amount you put into this fund ahead of time. The key is to save now so that when it’s time to buy, you have cash available, can avoid debt and make the best purchase for you.

Working in top goals in your financial plan

Get started saving now toward these five goals. You can open numerous savings accounts and in some cases you can even nickname them so you know what they’re for. Having money in the bank can give you peace of mind. Having your goals clearly outlined can help you stay focused with your financial plan.

Need additional help? Find your new B.F.F. to help you with money coaching.