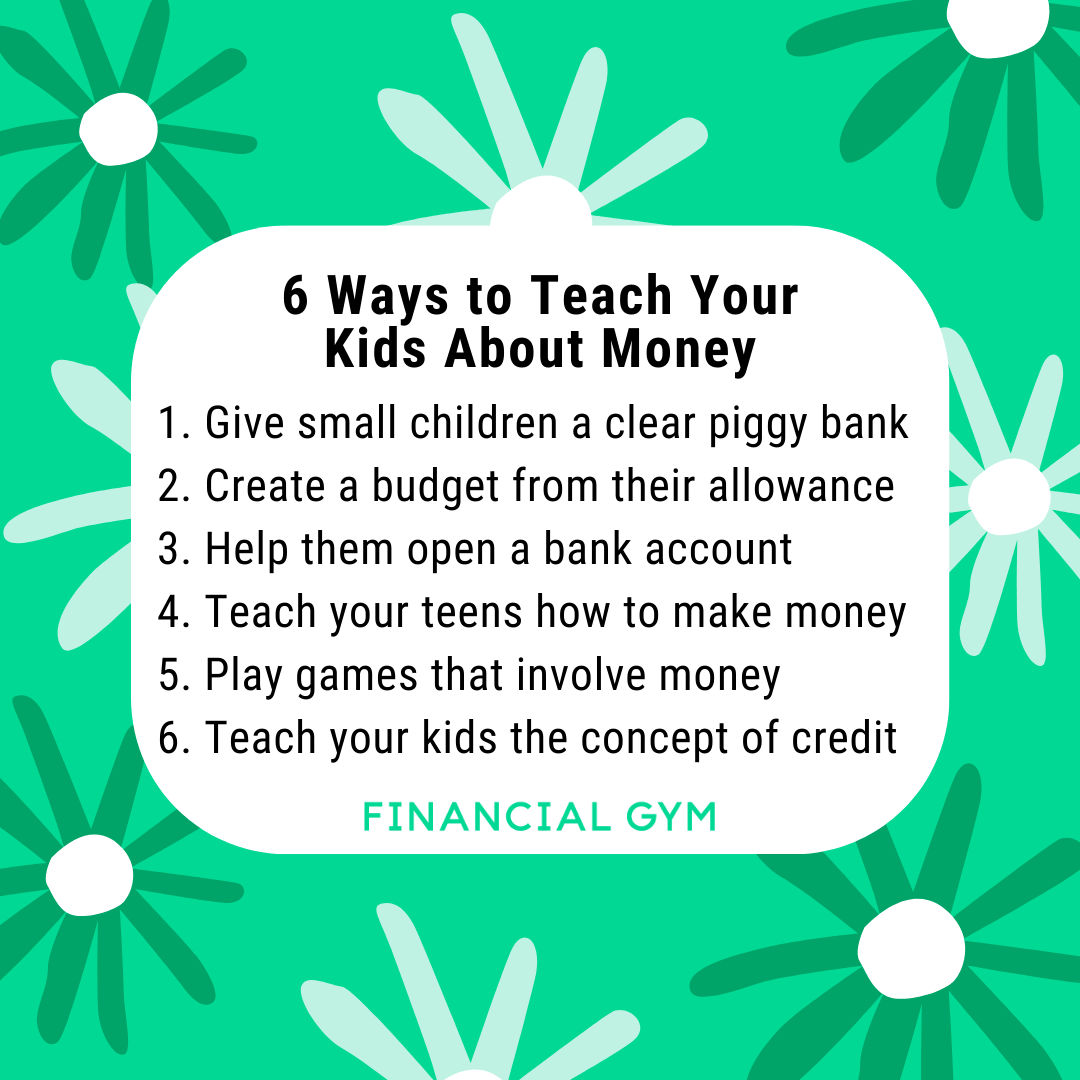

6 Ways to Teach Your Kids About Money

Teaching financial literacy to children can be a daunting task, but introducing fundamental financial concepts now can set them up for a stable future. Instilling the building blocks of saving, spending, and making money early on can help increase prepare your children to be financially wise.

Not sure how to teach kids about money? Here are six tools you can use to help teach your kids about money.

1. Give small children a clear piggy bank

Rather than using the traditional opaque piggy bank, use a see-through container to help young children see their savings visually. Money is an inherently abstract concept and the more concrete you can make it for children, the better.

Once your kids start learning math, it can be helpful for them to roll the loose change from their piggy bank so they can see how it adds up to form greater dollar amounts. Physically handling rolls of coins can help children conceptualize the building blocks of a dollar.

2. Create a budget from their allowance

Budgeting skills aren’t always taught at school, so it’s best to proactively guide your children as soon as they begin receiving an allowance.

There are various schools of thought on an allowance. Some people think it could either be earned based on a rate of pay done for household chores. Other parents provide spending money for their children as needed. Some parents opt for a hybrid approach where you only pay for chores that are outside what is considered “normal” everyday responsibilities.

There is no hard and fast rule on how much allowance to allot each week but whatever you land on, help your child create a budget to prepare them for bigger budgeting later in life.

Using the example of the clear jars, you could mark three jars as either savings, charity, and spending. Then, work with your child to decide how much of their weekly allowance to put into each jar. The visual of the jar creates accountability.

3. Help them open a bank account

As parents we must prepare our children to be successful in life and money management is a crucial step. One way to do this is to open a savings account. Children can see the interest rate earnings increase their savings over time and they’ll have access to real-life financial tools as they mature.

If your child is tech-savvy enough to go online, teach them how to navigate through a bank’s website and see how account statements are laid out. Similarly, having your child physically visit a bank teaches them bank etiquette and healthy financial habits, like keeping receipts and interacting with tellers. Plus, many banks have programs designed around children to make banking a fun and positive experience.

4. Teach your teens how to make money

By the time children reach their teens, they will need to have a checking account so they can spend money with a debit card on their own purchases. This places bigger importance on how to make money. There are many jobs done for cash so that teens can see immediate earnings. Cash jobs, which in turn also add job experience, might include:

Mowing lawns

Babysitting

Starting an online business

Shoveling snow

Getting a part-time job

Giving teens an opportunity to make their own money helps prepare them for adulthood and learn how to care about their finances.

5. Play games that involve money

Games that involve money are helpful for younger children to start understanding how money works and how it is used in daily living. For children and toddlers, try playing “store” by setting up a fake storefront and having them hand over play money in exchange for goods. With older children, playing games like Monopoly introduces them to how money works.

6. Teach your kids the concept of credit

Good credit is important for many aspects of adult life such as renting an apartment or buying a car or house. Understanding the concept of credit at a young age can help your children avoid bad debt when they become of the age that they qualify for credit cards.

Start teaching them how credit works. You can do so by showing them your credit report or discussing your mortgage or personal loans with them, if appropriate. As your teens mature into adults, start helping them prepare to build a credit score early.

If you’re interested in learning more about teaching children about money, make sure to sign up for our Wine & Learn this Wednesday. During this Virtual Wine & Learn, our Certified Financial Trainer, Randi, will give tips for instilling a healthy understanding of money at any stage in a kid's life! We'll give age appropriate skills that will help the kids in your life develop mindful money habits. Register here.