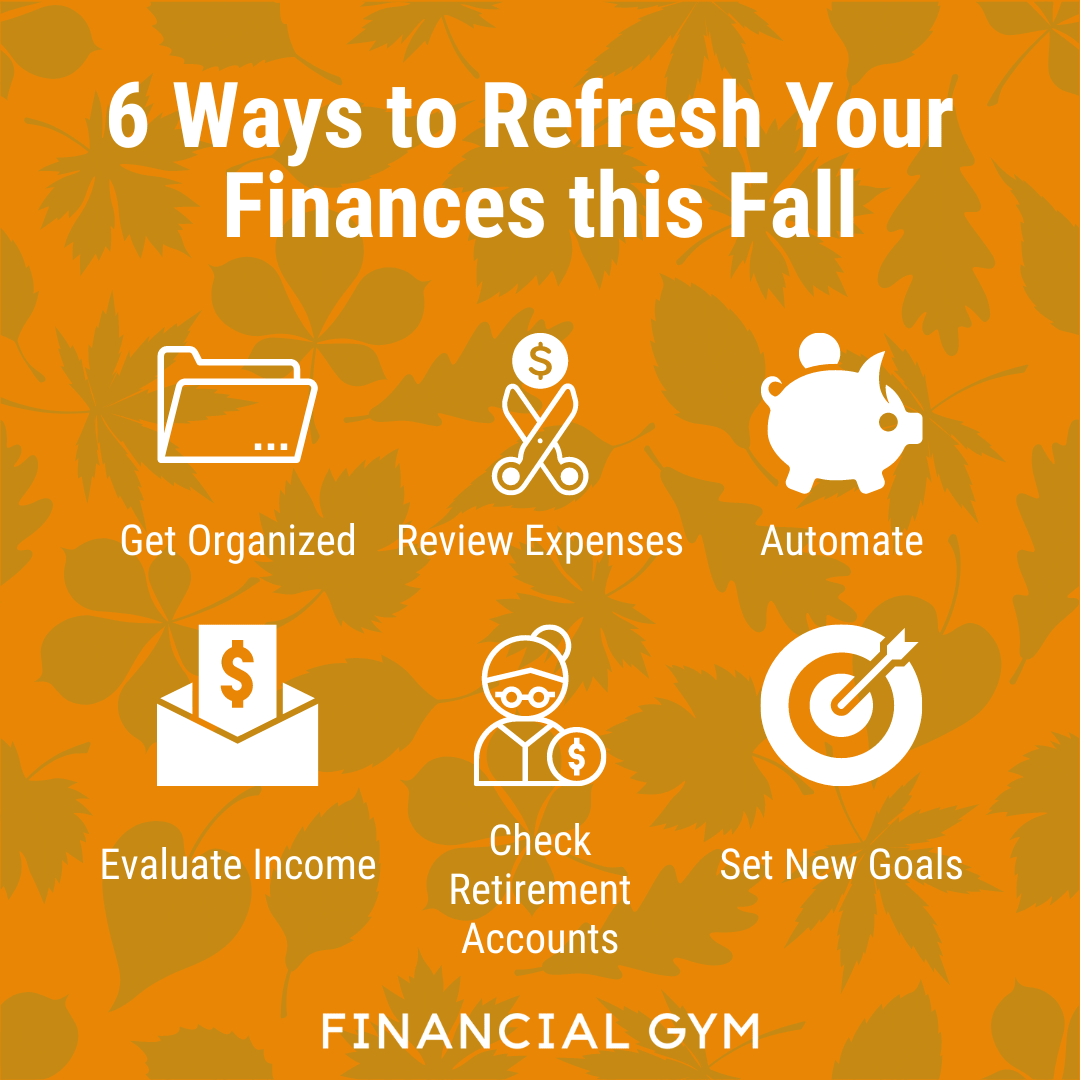

6 Ways to Refresh Your Finances this Fall

It is officially a new season and a new month which means it is the perfect time to conduct a financial refresh! It is easy to put your financial health to the side, especially given all that we have going on in our world right now, but checking in with your financial wellness is extremely important. Below are 6 ways you can take a few moments to review your overall financial health and make sure you’re setting yourself up for ultimate success!

Get Organized

Organizing your financial documents is an important foundation for optimal financial health. Start by going through all of your financial records and eliminating anything that isn’t essential. If a document can be easily accessed elsewhere, such as online banking statements, there’s no need to maintain a paper copy of the same information. However, if it’s something that’s difficult to replace or is legal in nature, it’s worth keeping.

You should also choose a storage system. For hard copies, use a filing cabinet or hard case storage box for organizing financial records. Label hanging file folders, so they are easily identifiable and tailored to your personal finances. It’s not necessary to keep hard copies of most financial records. You can free up a lot of desk and home office space by scanning documents and saving them to a cloud server that can be accessed from any of your devices.

The final step is to create a quick reference guide that can be used for yourself and in case a designated person, such as a surviving spouse, ever needs to navigate your finances during an emergency.

Review Expenses

It is always a good idea to review your fixed expenses every so often. Aiming to do this at the start of every season is a great cadence to put into place. You can first start by reviewing each expense and asking if you really need/want that product or service. Are you paying for cable when you really only watch shows and movies on Netflix? If the answer is yes you may want to ditch cable entirely.

You can also review each expense and note which ones may be negotiable. Does your internet bill seem to be increasing year after year? Sometimes all it takes is a quick phone call to lower that bill by asking what the best rate they can offer you is. It never hurts to ask and you may be surprised on how much you can actually negotiate!

Automate!

Automating is one of our favorite things to do here at The Financial Gym...especially when it comes to your savings. If you find saving money difficult we completely understand. Our brains are good at making excuses on why we may need to purchase something and avoid putting those funds into saving. We also all have A LOT going on in our brains right now and worrying about whether we remembered to put cash into our savings sometimes just isn't top of mind.

To take the hassle out of the process, set up automatic transfers from your checking account to your savings account. Set it up for a date after pay day so you know you have money in your account and won’t overdraft. It could be as small as $20 or up to $100 or more. Whatever you can afford each month on a regular basis, make it automatic.

Making it automatic helps build the habit without any effort and can ensure that you actually save!

Evaluate Income

We know with so many businesses struggling due to the pandemic right now, negotiating your salary may not be possible at the moment. It is still always a good idea to note where you are with your salary and where you want to go. If you are fortunate enough to still be employed, continue to keep a list of all of your accomplishments so when the right time comes to ask for a salary increase or bonus - you have all of the data to back it up.

If you’re a business owner or freelancer you can do the same for your service rates or product prices! At the moment you may need to discount your services or product to keep a steady income, but reflect and still work toward your goal income. Once businesses see an uptick in consumerism - that will be your time to ask for more!

And if your company is performing well despite the pandemic, check out our blog post here on how you can negotiate in a pandemic.

Check Retirement Accounts

Although we don’t suggest checking your retirement accounts daily or weekly since retirement is a marathon not a spring, it is a good idea to review them every so often.

You can make sure your asset allocation is set appropriately, double check that your contributions are not too little or too much based on your retirement goal date as well as your short and medium term goals, and also ensure any old accounts are rolled over to your current account. In addition it is always great to inquire about what fees are being taken out of your account.

Curious to learn more about which retirement vehicle is right for you? Check out our blog post about whether a 401k or Roth IRA is best for you.

Assess Old Goals and Set New Ones

Setting goals is an important part of measuring your success and financial health. Sure we like to look at how much money you have saved, how your investments performed, and how much money you made....but our life’s success is not dependent on how much money is in your bank account. It is determined by how your money has supported your life goals and overall happiness!

Take some time at the beginning of each season and reflect on your past goals. Have you achieved them? Past yourself on your back and celebrate! Have they changed? That’s fine, too! That just means the way you manage your money may need to change, too.

If you are ready to set some new goals this season we fully support that. Think about where you are right now and where you want to go in the short term, medium term, and long term. Does your current financial health and management support your road to these goals? If so keep going and don’t stop! If not it may be time to start with a Certified Financial Trainer™ so they can provide you with more expertise, accountability, and support. You can get started with one here by scheduling a free consultation call.