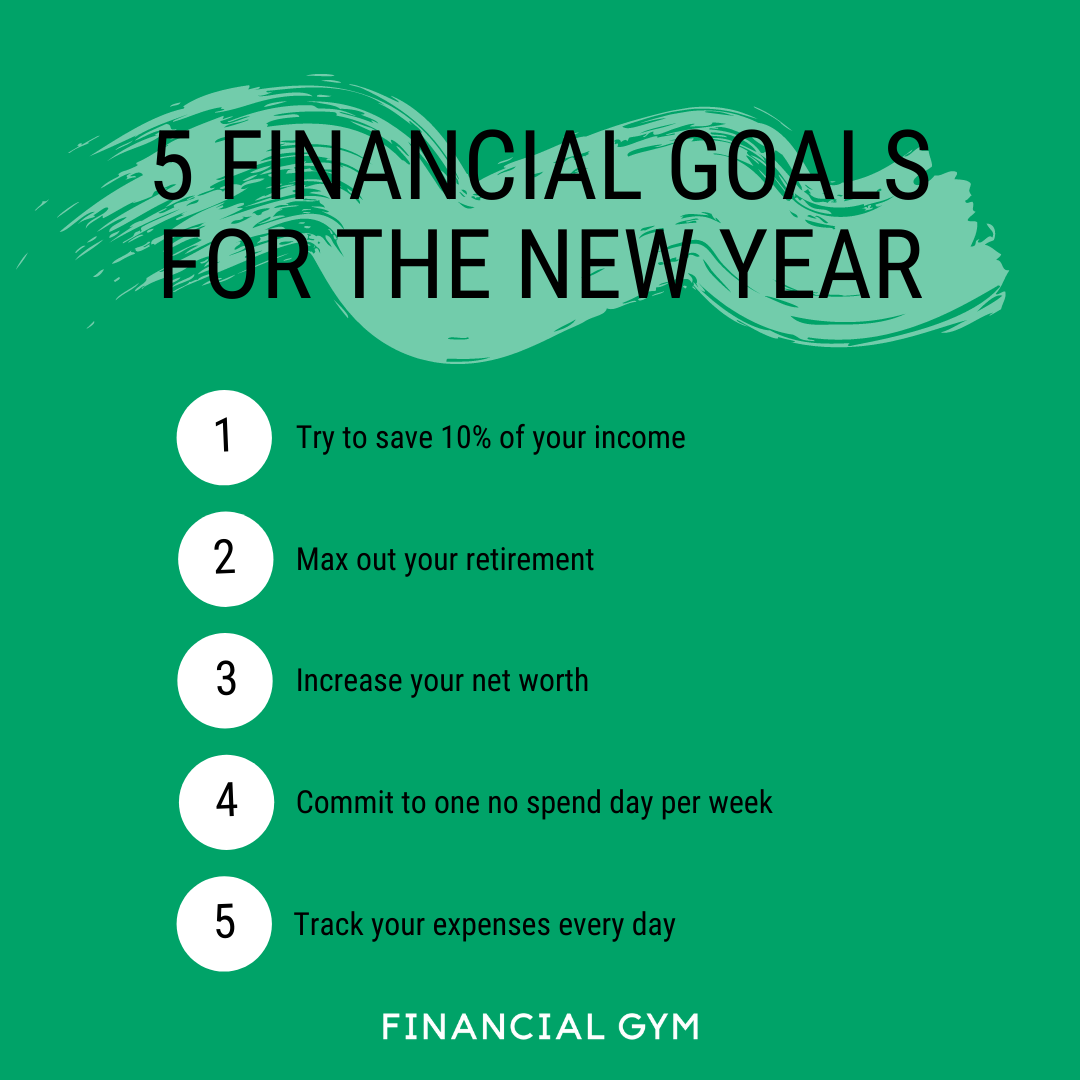

5 Financial Goals for the New Year

2022 is here! While making a resolution is not a requirement, many people feel that it is a good way to start off the new year, and financial resolutions are often among the most popular. You might be thinking…

“I want to make more money!”

“I want to pay off debt”

“I want to stop spending so much!”

These financial goals are well and good — but they’re not specific enough to keep you motivated and accountable. We’re going to share with you five specific financial goals for the new year that you can actually work toward-- and maybe even see results!

Financial goals

1. Save 10 percent of your income

You might have heard the saying “pay yourself first.” But no, really, you should pay yourself first if you want to meet your financial goals. What that means, is that instead of setting aside money for bills and other expenses first, you will flip the script. You will save FIRST, then pay your bills. Set your goal to save 10 percent of your gross income this year. So if you make $3,000 per month before taxes are deducted, that means you need to save $300 per month.

Depending on where you are at, this can seem tough at first. But look at your unnecessary expenses and see which ones need to be up on the chopping block in order to meet your financial goal. If you’re already meeting this goal, double or triple it. The key to getting started is through automatic withdrawals. You don’t have to think about it. You can schedule it so that money just transfers from your checking to your savings after every pay day.

2. Max out your retirement

Planning for the future is not something to sleep on! Maxing out your retirement is a great way to prepare for the future, but it shouldn’t be done at the expense of other, shorter-term goals. If you have already hit your emergency fund goals, repaid your consumer debts, and are regularly contributing to your medium term goals, then you can up your game by contribution extra money to your retirement, either through an employer sponsored plan (like a 401k or 403b) or by opening an IRA.

In 2022, you will be able to contribute up to $20,500 to your employer sponsored plan, and an additional $6,500 if you are over 50. In addition, you may be eligible to contribute $6,000 into a traditional or Roth IRA, plus an additional $1,000 if you are over 50. You can learn more about how to get started and the best retirement account for your specific situation, here.

3. Increase your net worth

For 2022, your goal could be to increase your net worth by a certain amount. Let’s take $12,000 for example. Say what? That might seem crazy-- but it’s actually more achievable than you may think.

First, a crash course in what ‘net worth’ actually means. Your net worth is your total financial value -- assets minus liabilities. So you would take the sum of your cash accounts, investments, retirement, etc. and subtract your debts (credit cards, car loans, mortgages, student loans, etc.) That’s your net worth.

Increasing your net worth by $12,000 doesn’t necessarily have to come just from saving more cash. It can be paying down debt, or earning interest on your investments too. Let’s say you paid down $6,000 in debt, added $3,000 to cash savings and $3,000 to retirement, that would make for a $12,000 increase in your net worth!

Whatever way you do it — whether through paying down debt, saving, investing, all of the above — strive for a set number that you think is achievable. Of course, more is always better when trying to improve your financial fitness!.

4. Commit to one no spend day a week

Spending is where all of our financial goals can go haywire. Too many unexpected Seamless orders, and too many spontaneous online shopping orders often cause us to borrow from savings and/or miss an automated transfer here and there. But, hey, it happens! Don’t beat yourself up about it. The key for the new year is to become more mindful of your spending habits. You want to commit to one no spend day per week.

That means spending no money at all. No coffee, no food, no clothing. Of course, your food and transportation needs will need to be covered during this time, but generally speaking you can go one day without spending any money.

When you spend no money, you can be more cognizant of your spending habits and your financial goals will become easier to achieve. On top of that, you can build momentum and continue to not spend. So many of us are used to spending as a default, this exercise can truly be eye opening.

5. Track your expenses every day

You’ve created a budget for the new year (RIGHT?!). You’ve committed to a no spend day each week and to saving 10 percent of your income. You’re all set right? Wrong. You need to track your expenses.

Every.

Single.

Day.

Yes, every single day. How can you actually know if your financial goal is on track if you don’t track? How can you know your spending triggers if you don’t track? You can’t. That’s why it’s key to track your expenses every day. You can try pen and paper. Excel spreadsheet. Financial apps. Whatever works. But find something that works and keep tracking until you feel confident that you are meeting all your goals!

Bottom line

There’s a lot of buzz around the new year about changing your life and your finances. And we totally believe you can do it, but you need to do it the smart way. Start with actionable, specific steps. Brainstorm and set financial goals for the new year now. If you need a little extra help, no shame. Get in touch and we’ll hook you up with your new Best. Financial. Friend. (B.F.F.).