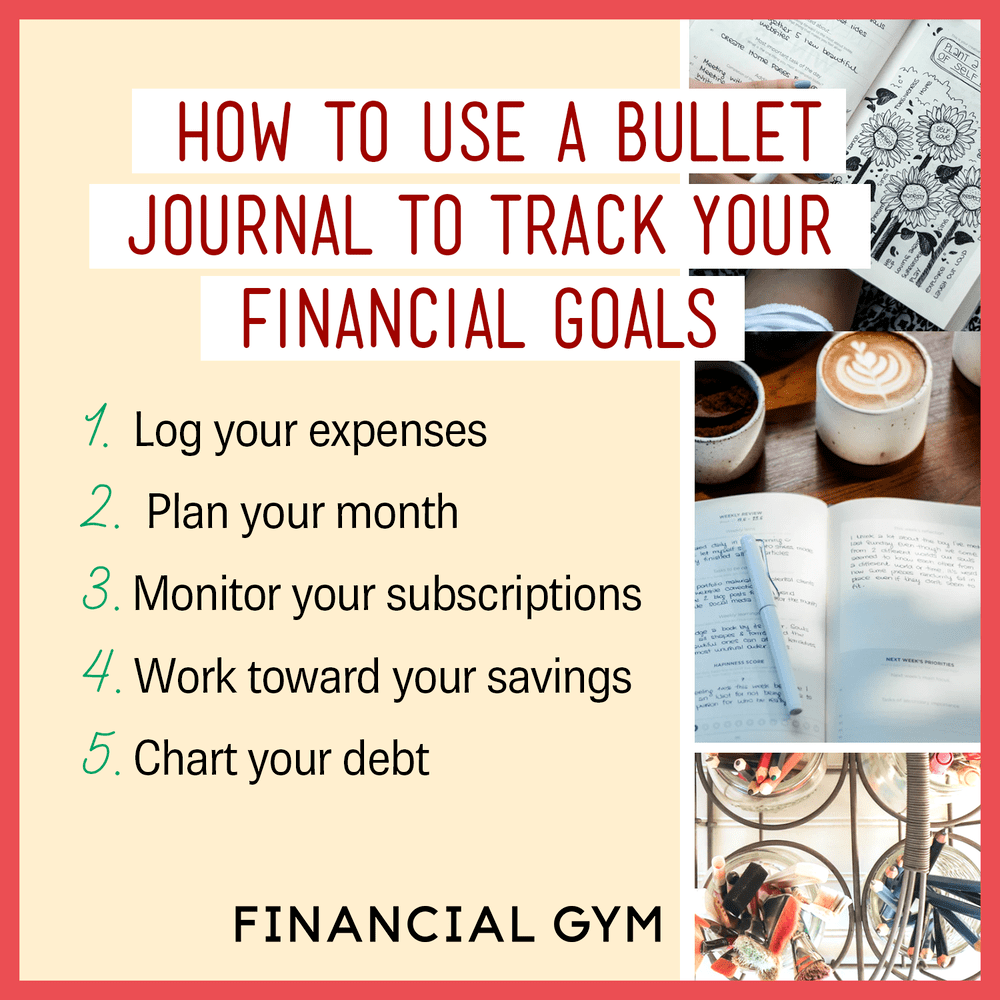

How to Use a Bullet Journal to Track Your Financial Goals

Are you looking for ways to track your financial goals? A bullet journal is a useful strategy some people use to organize and reach their financial achievements. Not quite sure how a bullet journal works? Here’s how you how to use a bullet journal to help you track your financial goals.

What is a bullet journal?

The bullet journaling system increased in popularity since 2013 as a strategy for organizing different aspects of life including school, work, and mental health. The name comes from the use of abbreviated bullet points to list information.

The goal of a “Bujo” is to introduce greater organization that can increase productivity. Originally developed by Ryder Carroll, the notebook generally includes daily and monthly scheduling, daily reminders and brainstorming. To make goal tracking easier, these notebooks come in many different styles and mediums which can be customized to match your creativity and writing style.

How to use a bullet journal as a financial goal tracker

There are a lot of strategies for using a bujo as a goal tracker. Here are some of the common ones.

1. Log your expenses

The way to effectively use a bullet journal to track expenses is by planning daily, weekly, and monthly goals, and writing in all of your purchases. You’ll want to create a system where you’re logging what you purchased, when, how much it costs, and any other relevant information like the payment method you used. You could also color-code important information so that you can easily identify expenses.

How this can help you:

You can track expenses so that you know how much you’re spending in each category.

Visually seeing your expenses color-coded can easily help you understand your finances, especially if you are a visual learner.

Staying on top of your organization can help ease the amount of work you will have to do come tax season.

2. Plan your month

Keep yourself accountable and your finances in check by planning ahead. Section off your bullet journal by categorizing your finances into sections such as income, bills, subscriptions, savings, budget, and expenses.

Related: How to Negotiate Your Bills

This makes it easy to plan ahead so that you can easily track expenses at a glance, although sticking to it can be difficult. Make it a habit to check-in daily so that you control how your finances work for you.

How this can help you:

Seeing each category will help you easily identify if you are off track with your spending and be able to make changes.

Going back to your budget page every day can help with goal tracking towards big life purchases.

Saving money isn’t always exciting, so this is a chance to be creative by using different colored pens, fonts, and layouts to make it visually appealing.

3. Monitor your subscriptions

Subscriptions that make auto-withdrawals can be anywhere from daily, monthly and yearly. Keeping track of subscription-based payments is important because they’re easy to lose track of and can eat away at your budget without you noticing. Use bill or expense layouts in your Bujo to keep these important dates in mind.

How this can help you:

You can color-code each subscription to make it easy to see at a glance.

Create charts next to each expense so that you can easily compare it to your budget.

Review your subscriptions and block of a day to make cancellations if necessary.

4. Work toward your savings

In your bullet journal, you can illustrate your savings by drawing different pictures. One fun idea is to fill up a whole page with a goal-based pyramid. After reaching each level, you get to color in the lines of the pyramid. This tracker is a helpful visual for small and large goals.

Maybe you’re saving for a new phone or computer and have several financial steps along the way. Or, you can even use it for bigger life goals like a car, a trip or a house. You can see the progress you are making, which is motivating when it comes to saving those dollar bills.

How this can help you:

Filling in a savings planner this way is a creative and rewarding experience to help reinforce positive saving habits.

Coloring in an achieved savings goal is satisfying and helps reduce stress around saving.

You can see where you might need to make changes to stay on track.

5. Chart your debt

It's totally healthy to realize you're in over your head with debt or have bad spending habits. You need to ask yourself the tough questions before anything can change: What do your spending habits look like? Do you overspend on your credit card without immediately paying it off?

As you get started with repaying your debt it helps to find someone with good habits that you’d like to emulate. Something you’ll notice about their strategy is that it’s organized — repaying debt requires you to look at the debt you owe, even if that’s a scary concept. You can do this with a bullet journal by making a running tally chart. After each payment mark off the amount left.

How this can help you:

A debt chart keeps your debts in one place and helps eliminate the stress that comes from being unorganized.

Stay on top of your different types of debt and which one will be financially smartest to reduce first.

A bullet journal is a handy way to organize your finances in a way that’s unique, fun and creative. It can be as simple or elaborate as you need in order to stay on track with your financial goals.