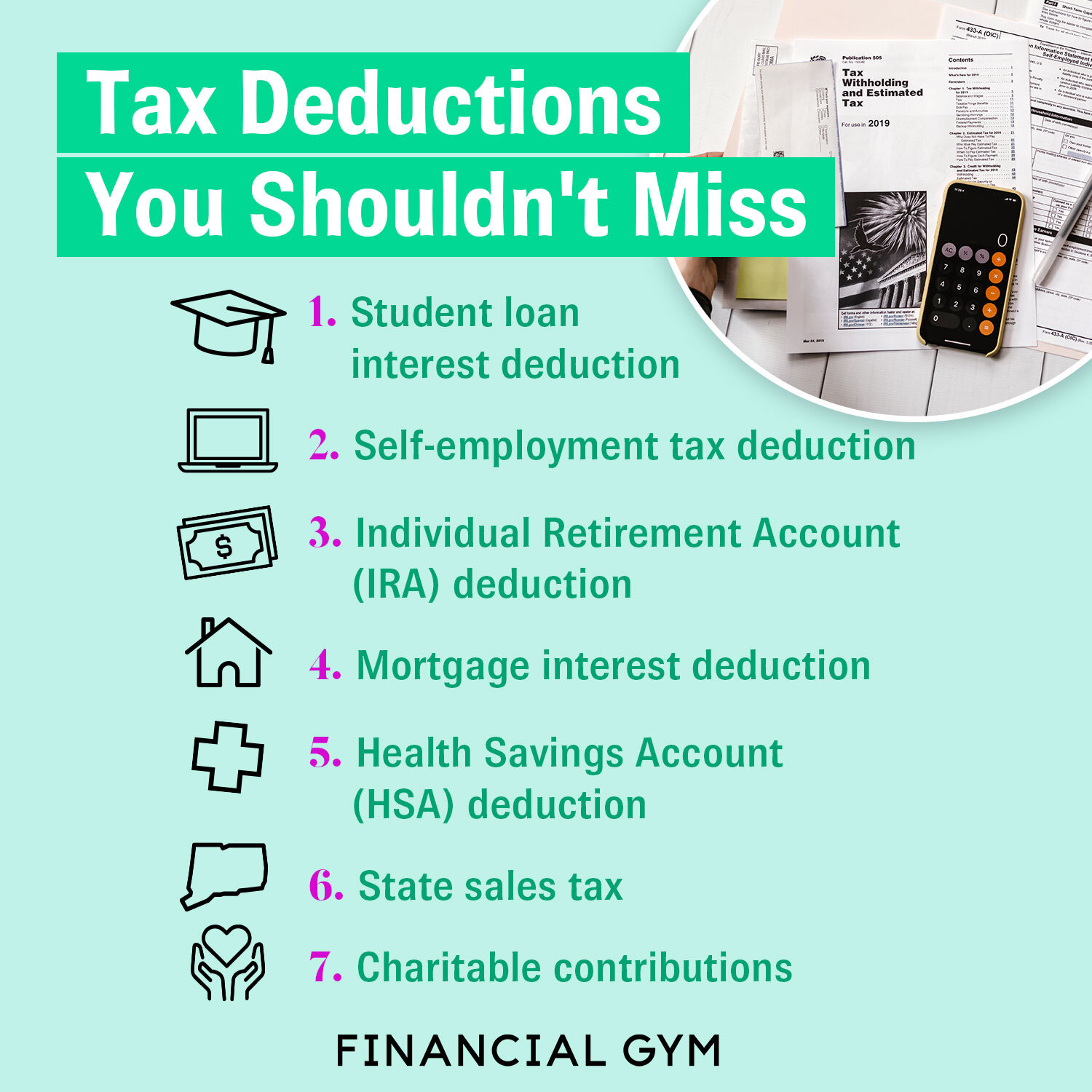

7 Tax Deductions & Write Offs That Save You Money

Filing your taxes can be complicated, which makes it easy to overlook tax deductions that could save you money. Whether you choose to claim the standard deduction or itemize your tax return, there are various tax deductions that are worth exploring.

Here’s a list of common tax deductions that many taxpayers often miss.

1. Student loan interest deduction

You may qualify for the student loan interest deduction if you or your spouse make payments for student loans. You can deduct the amount of interest you paid or $2,500, whichever is the lesser amount. Only the interest you pay during the current tax year will be eligible, meaning money paid toward your principal is not included.

The student loan interest deduction can be claimed without itemizing. You’ll receive a Form 1098-E from your loan servicer if you paid more than $600 to help complete your claim. You won’t be able to claim this deduction if you file as married, filing separately.

Get 1 on 1 Coaching

2. Self-employment tax deduction

Self-employed taxpayers are responsible for paying self-employment taxes, which include Medicare and Social Security taxes. With traditional employment, the employer splits the burden of paying these federal taxes. However, self-employed individuals have to cover the cost of both the employer and the employee, totaling 15.3%.

Fortunately, you can deduct half of your self-employment taxes — the employer-equivalent portion — from your net income since this is considered a business expense by the Internal Revenue Service (IRS).

Self-employment has many other benefits during tax season. You may be able to take advantage of deductions for business-related expenses like:

Home office expenses

Internet and phone bills

Health insurance premiums

Travel costs (e.g. meals and vehicle use)

To claim these deductions, you need to thoroughly track your expenses all year and save all receipts.

3. Individual Retirement Account (IRA) deduction

If you contribute to a traditional IRA throughout the year, you can take advantage of the IRA deduction. This allows you to decrease your taxable income dollar-for-dollar. The annual contribution limit for 2019 and 2020 is $6,000 but bumps up to $7,000 for those 50 or older.

However, the amount you can deduct may be limited if you’re covered by a workplace retirement plan and your income exceeds certain limits. Additionally, contributions made to a Roth IRA don’t qualify for a deduction.

4. Mortgage interest deduction

If you itemize, you can deduct the interest paid on your mortgage for your primary or second home. For the purposes of the mortgage interest deduction, the IRS also considers non-traditional property as a home if it has sleeping, cooking, and bathroom facilities. This includes mobile homes, boats, and recreational vehicles that are used as a residence.

You’ll need copies of your mortgage interest statement (Form 1098) that your lender issues to claim this deduction.

5. Health Savings Account (HSA) deduction

If you contribute to a qualifying HSA to help offset the cost of healthcare-related expenses, you may be able to use this deduction to your advantage. To be eligible, you must have health insurance coverage with a high-deductible plan and can’t be covered by any additional plans.

Your employer’s contributions to your HSA are not included in the deduction, and you don’t have to itemize in order to claim your own contributions.

6. State sales tax

If you choose to itemize your tax return, you can take advantage of the state sales tax deduction. This write-off is especially beneficial if you live in a state that doesn’t have an income tax. This is because you’ll need to decide whether to deduct state and local income taxes, or state and local sales taxes.

You can deduct up to $10,000 per year (or $5,000 per year, if you’re married, but filing separately) for all of your state and local taxes. Use the IRS Sales Tax Calculator to determine what you may be able to deduct or tally up all the sales tax you paid throughout the year using your saved receipts.

7. Charitable contributions

Although you may have made donations out of the goodness of your heart, you can deduct those donation costs on your taxes. Money or property given to a qualified organization can be deducted if you itemize your return.

For example, you can deduct charitable gifts made through payroll deduction or one-time donations. You can also include smaller costs, like the cost of ingredients used to make food for a soup kitchen. If you donate property, you should use the fair market value of the item — not the amount you purchased it for. Just be sure to keep receipts and other documentation of any items you are claiming.

Worried about missing out on these and other tax savings? The Financial Gym has Certified Public Accountants (CPAs) on staff who are ready to help you prepare your taxes, so you can maximize your deductions.