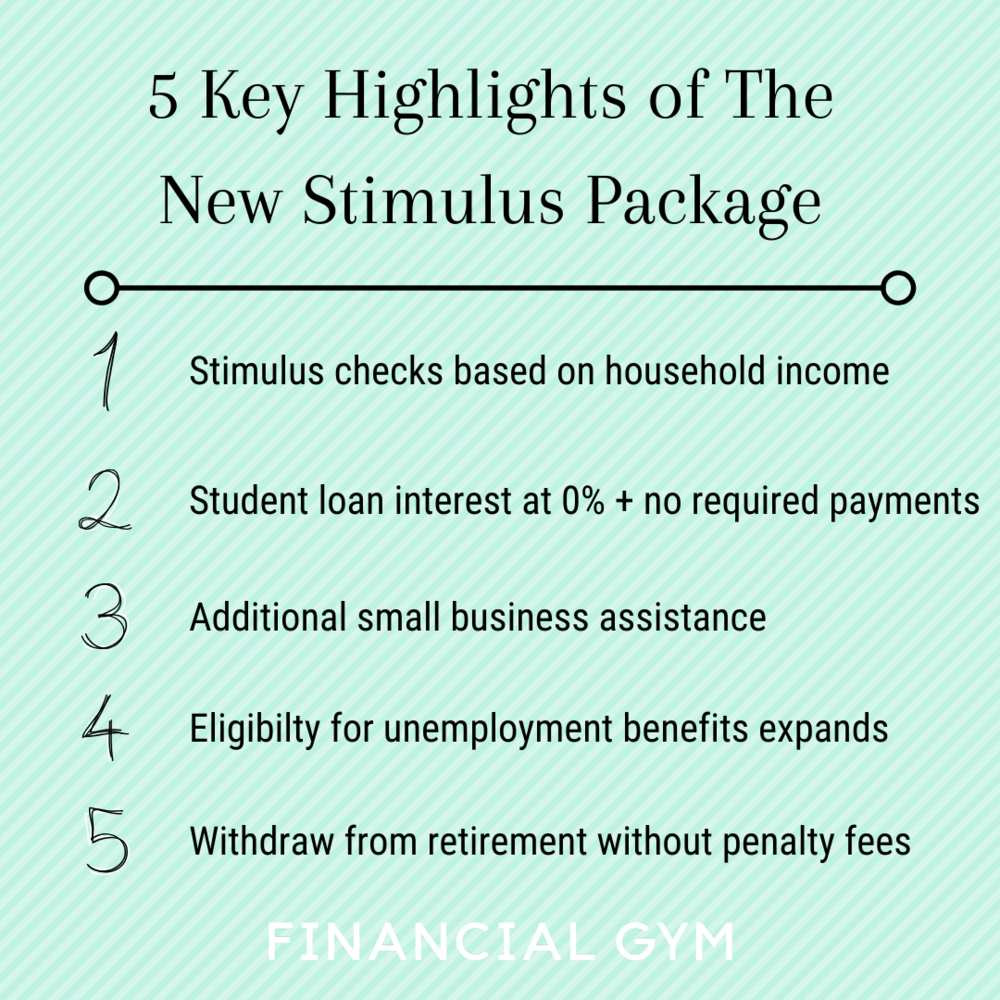

What Are The Highlights of The New Stimulus Package?

You’ve probably heard about the historic $2 trillion stimulus package that was passed last week. There has been a lot of talk about the government giving away free money, expanding unemployment benefits, changing the rules around student loans and retirement accounts, helping small business, and bailing out the airlines, but what does this all mean? How does this affect you and what can you actually expect to gain from this stimulus package? Here’s a quick breakdown of the essential pieces of the package and how they affect you.

Stimulus Checks (AKA Free Money)

The government is going to send a check for $1,200 to all single Americans who make $75,000 or less annually. Couples who make $150,000 or less annually, will receive $2,400. Taxpayers who file as head of household, must make $112,500 or less to receive the full benefit. In addition, anyone who has children will receive an additional $500 for every child in their household who is 16 or younger.

If you make between $75,000 and $99,000 (or between $150,000 and $198,000 for couples) you will receive a lesser amount. You can use this calculator from CNN to determine the total benefit you will be receiving.

How will I get my money? And when?

If you used the direct deposit function the last time you filed your taxes, the IRS will deposit the money directly into your bank account. And what if you didn’t utilize the direct deposit function? The US Treasury Department plans to launch a web portal for you to provide your banking information so they can send payments directly without having to mail checks. Right now, estimates are that people will begin receiving their payouts around April 17th.

Who is not getting money?

Any individual who makes more than $99,000 as of their last filed tax return is ineligible to receive the cash payout, as are couples who make more than $198,000 annually. Additionally, families with 2 or less children, who earn more than $218,000 annually are not eligible.

Is there anything else I need to know?

Yes! You must have a valid social security number to receive the benefit and the amount you receive will be based on your most recently filed tax return. That means if you haven’t submitted your 2019 tax return, the government will use your 2018 return to decide how much you will receive.

Student Loans

By now, most people are aware that the interest rate of federal student loans has been reduced to 0%. But for how long? What other benefits come along with this change?

Here’s the lowdown:

Interest rates to remain at 0% until September 30, 2020

No required payments until September 30, 2020

No garnishment of wages, tax refunds, or social security for student loan debt

There is also one additional perk for people who qualify for the Public Service Loan Forgiveness Program or PSLF. Although payments are paused for the next 6 months, the $0 payment WILL still count as part of the 120 qualified payments, so you will not lose any time if you are working towards loan forgiveness.

Small Business Benefits

A core aspect of the stimulus package is providing assistance to small businesses so that they can continue to operate and continue to pay employees while keeping their doors closed and adopting social distancing measures. Here is a breakdown of the provisions laid out in the stimulus plan:

A $350 billion forgivable loan program

Essentially, if small businesses maintain their current employees and use their stimulus loan to pay those wages, the principal of the loan will be forgiven and the business will only be required to pay back the accrued interest.

Businesses can receive a loan up to $10 million, depending on the size of their payroll from January 1-February 29 of this year. There is an expedited origination process and all loans will carry an interest rate of 4%.

A 50% refundable payroll tax credit on worker wages

A delay in employer-side payroll taxes for Social Security

A portion of the $425 billion designated for the Fed’s credit facilities will target small businesses directly

Rules around net operating loss-reduction will be relaxed so the business can offset losses more

How these measures will impact your business depends on a variety of factors and is unique to each individual business. Here’s a link from the Small Business Administration (SBA) to help you get started with the loan application process.

Expansion of Unemployment Benefits

An added benefit of the new stimulus package is a revamp of unemployment benefits and who can receive them. Those who were previously not allowed to file for unemployment, including part-time workers and self-employed individuals, can now receive benefits!

How much you receive will vary state to state, but overall, the goal is to increase the total amount being paid out. Typically, state unemployment benefits replace 40-45% of your income, but the total maximum weekly payout varies state to state and that number will not change. However, under the new plan, eligible workers will get an additional $600 per week on top of their state benefits.

Self-employed individuals and part-time workers are eligible for the additional $600 weekly benefit, but the total amount depends on other factors.

For self-employed individuals the amount you receive will be calculated based on the income you previously reported to the IRS, using a formula from the Disaster Unemployment Assistance program.

For part-time workers, the amount and length of time the benefits last will vary state to state.

Withdrawals From Retirement Plans

In addition to the benefits outlined above, the stimulus package allows you to withdraw money from your retirement accounts (401k, IRAs) without incurring the usual taxes and penalties. Normally, doing this would trigger a 10% penalty and you would be required to pay all applicable taxes during this year. The new benefit allows you to withdraw up to $100,000 without penalty and defer the taxes for 3 years. The amount you can borrow against your 401k has also been doubled from $50,000 to $100,000. While this should be a last resort, as we don’t want you robbing your future self of income, in times of great need this can be a huge relief.

Ready to take your finances to the next level?

To get started schedule a free 20 minute consultation call to speak to a member of our team. We will ask you a few basic questions to get to know you more, walk you through our financial training program steps, and of course answer any questions you may have. No pressure to join!