Changes to Look Out For with Your Student Loans

The Federal Student Loan system has seen some major changes over the last few months, with the announcement of the COVID relief program, which brought interest rates to 0% for 6 months, and put a halt on all payments.

While many people are calling for further assistance to be provided, in the form of forgiveness of loans or reduction of interest rates on a permanent basis, the Federal government has decided to go a different route and work towards consolidation of servicers.

Earlier this week, the Department of Education announced that it has entered into servicing contracts with several new companies in an effort to move all loans to a single platform. The five selected servicers are EdFinancial, FH Cann & Associates, Maximus, MOHELA, and Texas Guaranteed Student Loan Corp (Trellis Company).

So what does this mean for you? Some of the largest services, Nelnet, Navient, GreatLakes, and FedLoan have all been left off the list, despite being higher rated by consumers. If your federal student loans are with one of these providers (or any other provider), you should be receiving communication from one of these five servicers regarding the transfer of your loan(s) to their platform. The Federal Government has stated that this communication can come via phone, mail, email, or even through social media.

Traditionally, however, communication from loan providers about the transfer of loans has been extremely poor and has ultimately led to confusion and sometimes missed payments, late fees, and processing problems for borrowers. Furthermore, account records have been lost in the transfer process. All of these things can force borrowers off track and have negative impacts on their credit scores, which makes it difficult to refinance or take out additional lines of credit when necessary.

Borrowers have some time to prepare for these changes, as the current contracts don’t expire until December of this year, and existing servicers may have the potential to extend for up to 12 months. So what can you do to prepare for these changes?

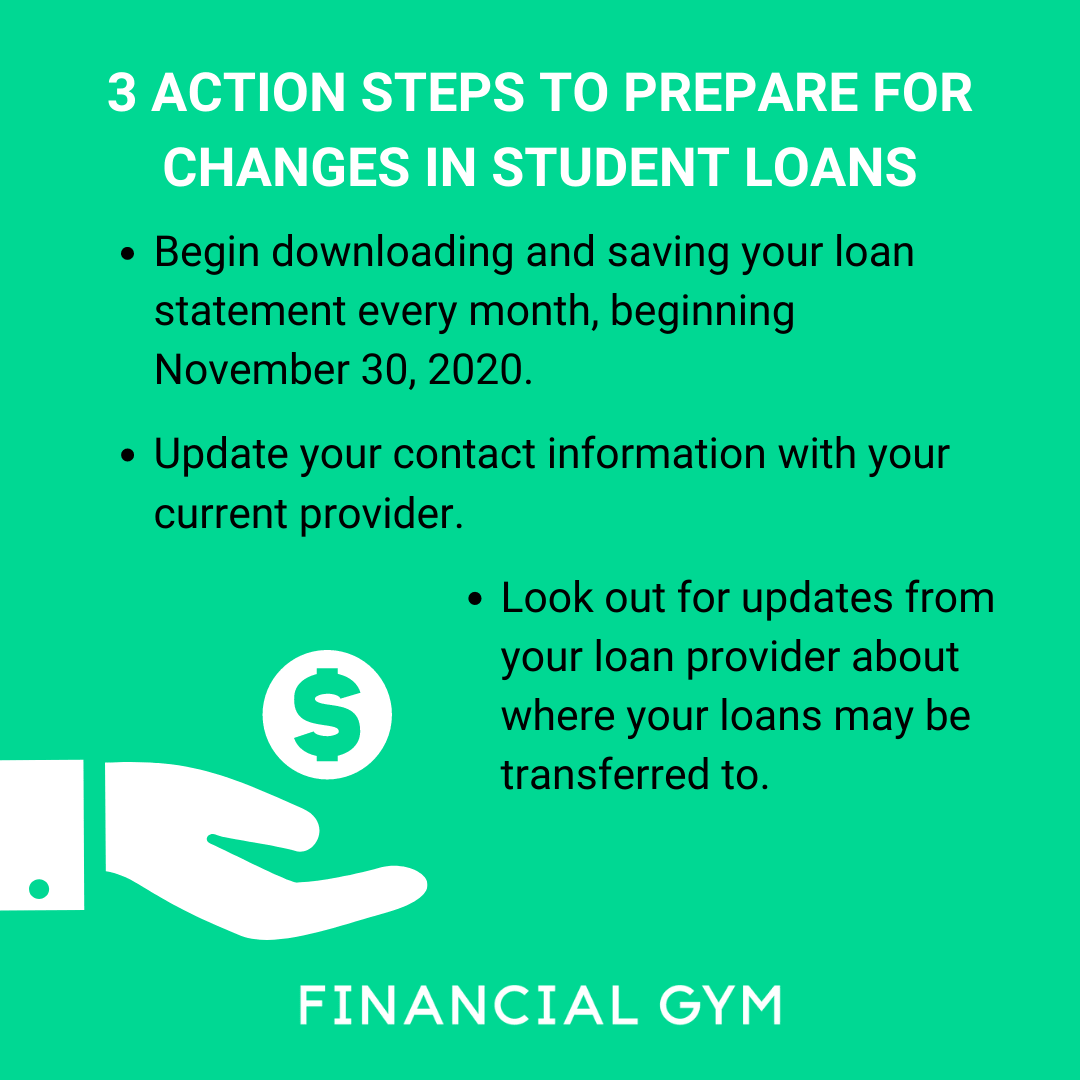

Begin downloading and saving your loan statement every month, beginning November 30, 2020.

Update your contact information with your current provider. Making sure that your phone number, email address, street address, and other contact information are correct will help to eliminate problems caused by information being sent to the wrong location!

Look out for updates from your loan provider about where your loans may be transferred to. If you don’t begin receiving information by November, try calling the customer service line to get more information!

Ready to take your finances to the next level?

To get started schedule a free 20 minute consultation call to speak to a member of our team. We will ask you a few basic questions to get to know you more, walk you through our financial training program steps, and of course answer any questions you may have. No pressure to join!