Should You Get an Adjustable-Rate Mortgage?

With fixed mortgage rates at their highest level in decades, adjustable-rate mortgages (ARMs) are making a comeback. While an adjustable-rate mortgage can save you money in the short term, they come with a lot of uncertainty and can cost you in the long run. Anyone considering an ARM should carefully evaluate their current financial situation, their future plans, and the details of the loan.

What is an adjustable-rate mortgage?

An adjustable-rate mortgage is a type of home loan with an interest rate and monthly payment that can change during the life of the loan. They offer lower initial rates compared to fixed-rate mortgages because the lender assumes they will be able to raise rates later in the term.

What do you need to know about an adjustable-rate mortgage?

Adjustable-rate mortgages naturally have more variables than fixed-rate mortgages. It’s important to understand the details of how your loan is structured and when and how much your monthly payment could change.

How long is the initial fixed period? Adjustable rate mortgages offer a fixed rate for a particular amount of time (typically 3, 5, 7, or 10 years).

How often does the rate adjust after the initial fixed period? Many ARMs will change rates annually or every 6 months.

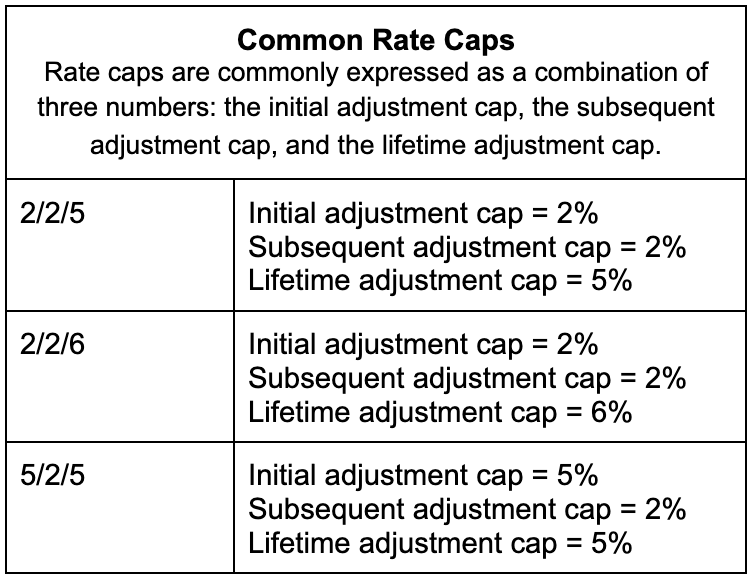

How much can your rate rise? Adjustable rate mortgages come with caps on how much your interest rate can rise.

Initial adjustment cap: This limits how much your first rate adjustment can be.

Subsequent adjustment cap: This limits how much each additional rate increase could be.

Lifetime adjustment cap: This limits the overall rate possible increase during the life of the loan. The rate during the initial fixed period plus the lifetime cap is the higher interest rate you could ever see under that loan. It’s a good idea to calculate what your monthly payment would be at that maximum interest rate.

When is an adjustable-rate mortgage right for you?

An adjustable-rate mortgage could make sense for you if:

You plan to sell before the first adjustment: Selling before the initial rate adjustment would allow you to take advantage of the lower initial fixed rate without risking an increase in your payment.

You plan to pay off the mortgage before the first adjustment: If aggressively paying down your mortgage is part of your financial plan, you could potentially pay off the balance before a rate adjustment.

You’re flexible: You anticipate being flexible enough to make a decision about whether to stay, sell, or refinance depending on the interest rate environment at the time of the first adjustment (and/or subsequent adjustments).

When is an adjustable-rate mortgage wrong for you?

An adjustable-rate mortgage could be wrong for you if:

You plan to live in the home for a long time: If this is your forever home, you’re committing to 30 years of payments. While we don’t know how interest rates will change over 30 years, there is a really good chance that they will change during that time.

You don’t have flexibility in your monthly budget: If you don’t have wiggle room in your budget or savings you could use to cover a higher mortgage payment, it’s risky to take on an adjustable-rate mortgage.

You like predictability: If the idea that one of your biggest expenses (your mortgage) could change every year after the initial fixed-rate period, stick with a fixed-rate mortgage.

Ready to take your finances to the next level?

To get started, schedule a free 20-minute consultation call to speak to a member of our team. We will ask you a few basic questions to get to know you more, walk you through our financial training program steps, and of course answer any questions you may have. No pressure to join! Need advice quickly? Talk to one of our Trainers on Demand.