The Financially Free Blog

5 Little-Known Facts About Your HSA

A health savings account (HSA) can be a useful part of your financial toolbox. Like retirement accounts, HSAs come along with powerful benefits like tax-free spending on healthcare, but they also have some odd rules. Knowing the ins and outs of your HSA will help you get the greatest benefit from it depending on your own financial situation.

As you accumulate money in your HSA, you can actually invest those funds so they can grow for you over the years. As long as you spend that money on qualified health expenses, you never pay taxes on your contributions or your investment gains.

How to Save Money by Winterizing Your Car, Home & Health

Winter is coming and it will bring along challenging conditions for our cars, homes, and health. Luckily, a little preventive maintenance goes a long way toward averting costly problems this season. Try these winterizing tips to keep your car, home, and health running as smoothly as possible:

Although it’s never fun to break down on the side of the road, it’s a whole lot worse when it’s below freezing. The cold exacerbates the decline of car batteries so check that your car’s battery is in good health and consider replacing it if not.

4 Salary Negotiation Strategies to Use Right Now

Salary negotiation is a widely accepted practice during the job hunt process: about 70% of employers expect job candidates to negotiate. Despite that, a recent study from Fidelity found that 58% of young professionals accepted job offers without negotiating. Many people don’t negotiate because it’s uncomfortable or they fear how they will be perceived, but by not negotiating, you could be leaving money or other benefits on the table. The same study found that 87% of job seekers who negotiated received at least some of what they asked for.

Try these strategies to put yourself in the best position for a successful negotiation.

Six Fun Challenges to Jumpstart Your Savings

Finances can feel so serious, but they don’t always have to feel like that. Savings challenges are a great way to add a little “fun” into finance. They can help you save for a specific purchase, holiday gift money, or just to boost your overall savings. These challenges force you to step outside your day-to-day routine and get creative.

There are a few strategies to make you the most likely to succeed at your savings challenge. First, set the rules before you start and put them in writing so you are clear on what counts as success to you. You should also choose what you want to use the money for in advance and track your progress to keep up your motivation.

How to Budget: 5 Mistakes to Avoid

Sometimes, we get so caught up in the hamster wheel of life, we forget to ask ourselves what all of this hard work is even for. When you’re so busy reacting to the needs and demands of others, then of course, it would be hard to refuse the extra glass of wine at dinner, click “purchase” on Amazon, and order take out for dinner.

You’re much more likely to change your day-to-day budgeting habits when you have a specific goal that represents something you truly want for yourself.

Below are some examples of goals that I hear from clients. Guess who is reaching their goals faster? The ones with goals they feel obligated to have? Or the ones that match their personal values and desires?

8 Books to Help You Better Your Relationship with Money

Even in the best of times, our relationships with money is…complicated. While it sometimes feels like we are the only ones struggling to create new financial habits and overcome unhelpful money-related thinking patterns, we are not alone. Instead of succumbing to money mindset malaise, we recommend picking a good book to help expand your thinking and recognize new possibilities. Here are some of our recommendations.

Atomic Habits: This book gives you strategies and tools that you can implement to help with forming (and keeping!) good habits, which is a great skill to have when managing your money.

Ask a Trainer: What Can I Do to Raise My Credit Score?

Credit scores are important. They can be our ticket to getting a good rate on a mortgage, a car loan, or refinancing your home. Your credit score also can make or break a rental application, or prevent you from accessing affordable housing programs. And while I do think that a lot of people tend to freak out a little too much about their credit scores, having a healthy one is a reasonable concern.

So what can you do if you want to raise your credit score? First, you’ll need to to find your credit score, which you can do by using a site like Credit Karma. Then, you’ll want to know a little more about how they work.

How to Access Your Credit Reports (and What to Look For)

Everyone is worried about their credit score, but credit scores are calculated using the information on your credit reports. So, if you want to work on improving your score, your credit reports are a great place to start.

The three credit reporting agencies—Equifax, Experian, and TransUnion—gather information from creditors and create your reports, which they then sell when an inquiry is made. There are two types of inquiries: hard and soft. A hard inquiry is typically made by a lender when you apply for a line of credit. The institution is checking your history to help them make a decision on whether to lend, how much, and your interest rate.

6 Ways to Lower Your Cell Phone Bill

Cell phones: we all need them, but how much do we really have to pay for them? Depending on the number of lines and extras, the bill can easily cost between $150-$300 per month. That’s a solid chunk of change, especially if you are trying to find more room in your budget to save or pay down debt. Luckily, there are a number of ways to reduce your cell phone bill.

Cell phone providers change their offerings all of the time. If it’s been a while since you’ve looked into your provider’s current plans, take the time to review them online or speak to a customer service representative. You might be able to save on your monthly bill and keep your current level of service.

The Student Loan Debt Relief Application Is Open! Here's How to Apply

At long last, the federal student loan debt relief application is open! The application is still in beta (testing) mode and it will be available off and on until the official launch later this month, so if it’s not available when you first check, try again later.

The application requires basic information including your name, social security number, date of birth, phone number, and email address. It also requires you to certify that you are within the income limits required to receive the debt relief. To qualify, your adjusted gross income (AGI) must be less than $125,000 if you are a single tax filer or married filing separately.

Student Loan Payments Will Impact Your Employees. Here's How to Help.

For the past two and a half years, most borrowers with federal student loans have not needed to make any payments. And a lot has changed over that time: people have moved across the country, started families, bought houses, and changed careers. Resuming payments in January 2022 will be an unwelcome headache, especially for those who have not reserved space in their budgets for a student loan payment.

There is a good chance that at least some of your employees will be affected by this: about 20% of Americans have student loans.

Money as Life Energy: 3 Questions to Ask Yourself When Deciding What to Buy

A common refrain we trainers are hearing right now as we work with our clients on their financial goals is that the reopening of the world is expensive. With so many things off limits for so long, having the freedom to get out and resume something like a normal life has created a rupture in a lot of people’s financial plans and savings rates. We’re often asked for advice on how not to spend money, or how to stick to a budget when there is so much going on that just a few weeks ago seemed impossible.

Ask a Trainer: Should I Make Backdoor Contributions to a Roth IRA?

The Roth IRA began in 1998 as a way to encourage middle-class Americans to save for retirement without reducing revenue (i.e.taxes) to the federal government in the short term. Although Roth IRAs have income limits aimed at excluding higher-income people, major loopholes still allow just about anyone to stash cash now that they can withdraw tax-free in retirement. One of those loopholes is known as the “backdoor” Roth IRA contribution. Here are four signs that a backdoor Roth might be for you.

4 Things to Know About Financial Challenges in Native Communities

It’s appalling—but unsurprising—that after hundreds of years of stripping Native communities of their land and natural resources, Native Americans still face tough economic challenges. To recognize Indigenous Peoples’ Day, we rounded up news articles, reports, and stats to know about the current state of Native Americans’ financial outlook. A recent poll found that more than two-thirds of Native Americans have experienced “significant financial problems” due to inflation.

How to Improve Your Finances with Just One Tweak per Week

If you have ever struggled or are currently struggling with money, it can feel like you are alone. That could not be further from the truth. Many Americans are living paycheck to paycheck and no one is born financially literate. A 3-6 month emergency fund can look daunting when making ends meet is difficult enough.

Personal finance is personal and it is important to talk to a professional if you need help with your finances. The Financial Gym is a great place to start.

What is Bankruptcy? Debunking 3 Common Myths

Bankruptcy is often held up as the worst thing that can happen to us financially. We are taught to fear it. Creditors have an incentive to make us scared of bankruptcy because it’s the only way to legally wipe away our debts (and their potential profits). Unfortunately, this fear-mongering keeps us trapped in debt and prevents us from building the kind of financial life we want.

Myth # 1: I’ll lose my home or car if I file for bankruptcy

In most cases, people who file for bankruptcy are able to keep their home and vehicle.

4 Tips for a Fall Financial Refresh

There is something about fall that makes it feel like a good time for a refresh. Maybe it’s the changing of the leaves and that crisp fall air—or maybe it’s looking at your credit card statement after all of that summer fun. Either way, it’s worth taking every chance you can get for a reset. Here are four tips to make the most of the time we have left this year.

With only three months left in the year, you can more easily anticipate upcoming large financial expenses. Do you have any travel planned? What will the holiday season look like for you? Are you planning any major home updates?

How to Pay for Medical Intervention Needed to Start a Family

Starting a family can be an exciting—but also stressful. This is especially true for individuals and couples who have to deal with additional costs to conceive a child, including LGBTQIA+ couples, single parents by choice, and hetero couples facing fertility challenges. One of the frustrating aspects of starting a family when you’ll need medical intervention is that you have no way of knowing the final cost when you’re just starting out. The total depends on a number of factors including what medical interventions you need, what your insurance covers, and which clinic you use.

Message from the CEO - My Manifesto

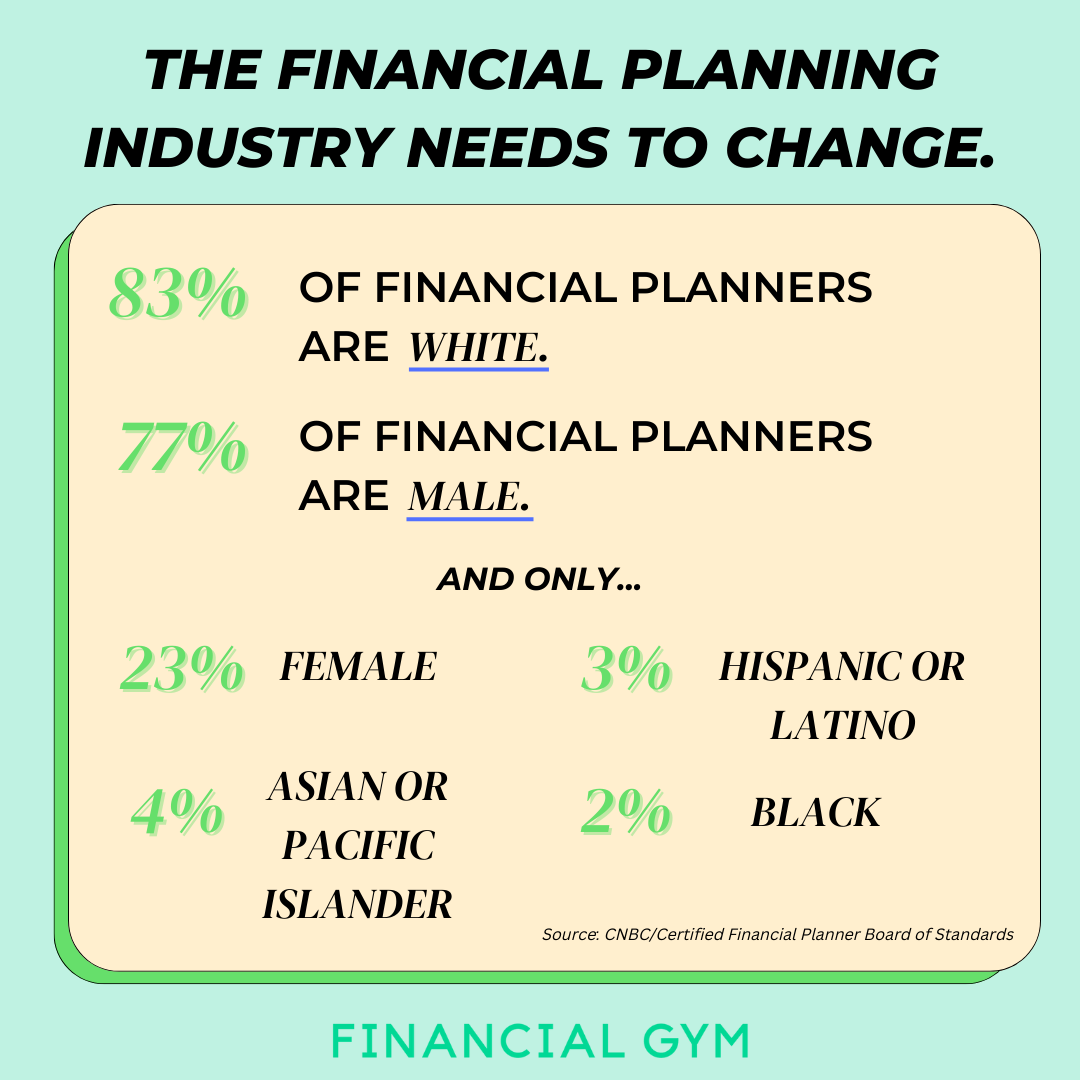

According to data released just last year, 83% of financial planners are white and 77% are male. Financial advisory firms will argue that this is where the wealth is held in the U.S., so they’re hiring to serve this population. I argue that a paradigm shift needs to happen in the wealth management industry. Instead of continuing to help white men and their families grow and preserve wealth, why not coach people and help them to build wealth?

Financial Gym has coached thousands of people from negative net worths to positive net worths in a relatively short period of time.

Could You Benefit from the Limited PSLF Waiver?

With all of the excitement around federal student loan cancellation, we don’t want other federal student loan benefits to be overlooked. In particular, the deadline for the limited Public Service Loan Forgiveness (PSLF) waiver is quickly approaching. Borrowers who believe they may qualify under the waiver have until October 31, 2022 to consolidate their loans (if necessary) and submit their employment for certification. The limited PSLF waiver offers a temporary path to counting certain payments towards PSLF that previously did not count.