How to Answer a Debt Collection Call

If you receive a call from a debt collection agency, you might be unsure of whether or not you should answer. The Fair Debt Collection Practices Act (FDCPA) requires debt collectors to adhere to a strict set of requirements when reaching out to consumers about a debt in collection.

Knowing your consumer rights and what to expect from a debt collector can help you navigate a debt collection call more smoothly and with confidence. From student loan collections to medical bill collections, debt collectors can call on behalf of a wide array of organizations and companies.

Before picking up the phone, make sure you have the knowledge to protect yourself.

Who are debt collectors?

Often lawyers or employees of a debt collection agency, debt collectors reach out to debtors on behalf of an organization that’s owed an unpaid debt. Debt buyers, entities that purchase debts and then facilitate the collection process, also engage in debt collection calls.

To put it simply, debt collectors are calling to notify you that a debt that’s allegedly under your name has been sent by the original creditor to collections. Debt collectors are then tasked with obtaining payment from consumers.

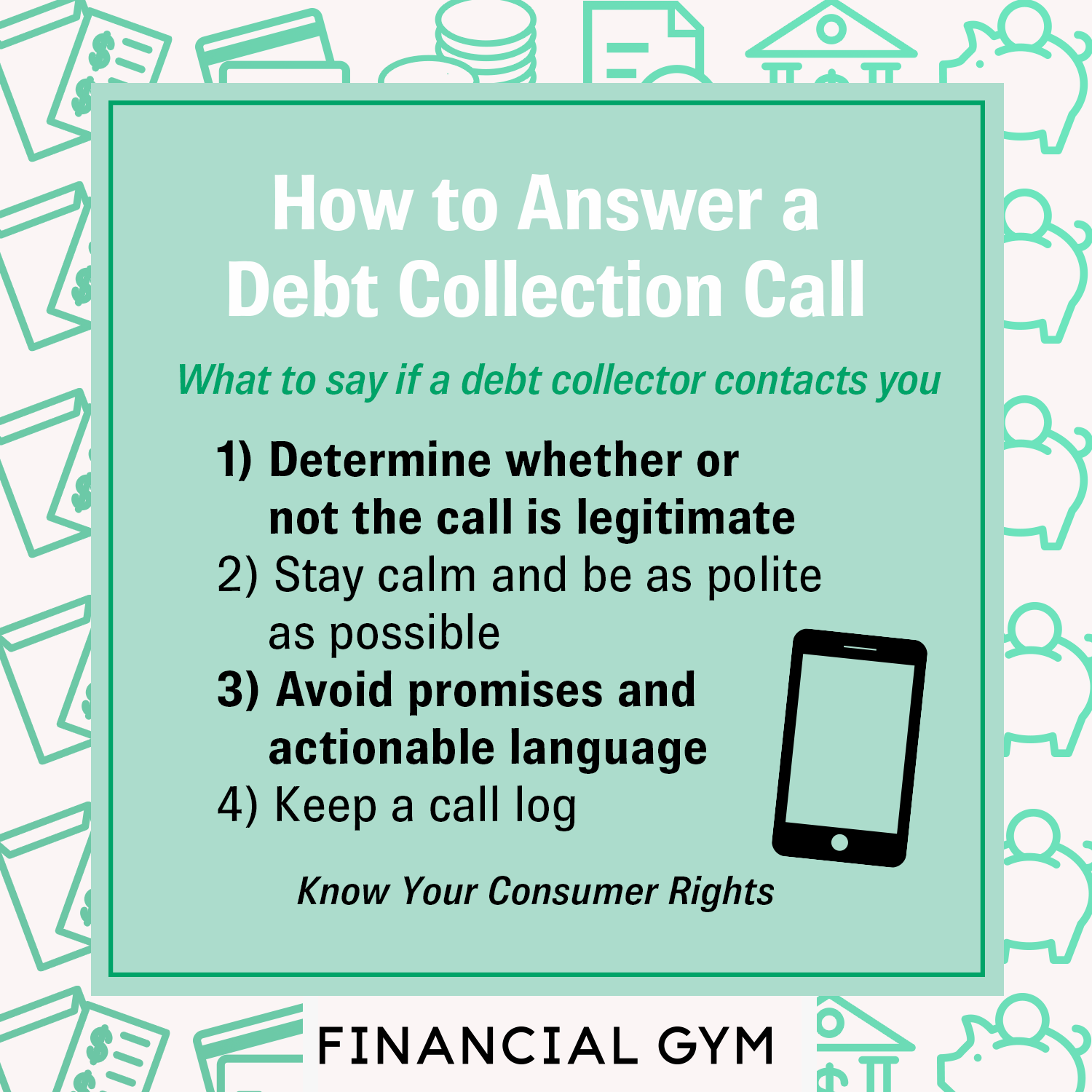

What to say if a debt collector contacts you

It can be unsettling to get a call from a debt collector, especially when you aren’t prepared to answer their questions. Here are four steps you can take to prepare yourself for your next call from a debt collector.

1. Determine whether or not the call is legitimate

Before you decide whether you’d like to talk to the debt collector, determine if the call is from a legitimate collection agency. Legitimate collectors are required to be truthful about the claims they make and must reveal the agency they represent.

The most important step at this stage is to avoid confirming that the debt is yours or relaying your personal information. Within five days of making first contact with you, collectors are required to provide you with information about the unpaid debt, such as:

The amount of the debt

The name of the creditor the debt is owed to

A statement noting that you have 30 days to dispute the collection

A statement noting that if you choose to dispute the debt, the collector must supply verification of the debt or a court judgment within 30 days (including the name of the original creditor if it’s different from the current creditor, upon written request)

Whether you believe the debt is yours or not, it’s in your best interest to withhold any personal information, and instead, request a debt validation letter from the debt collector containing all of the above information. This request also prevents the collector from legally contacting you again until they’ve supplied the debt verification you requested.

2. Stay calm and be as polite as possible

Although calls from a debt collector can feel “off the record”, they’re often not. If your case ends up in court and unpleasant recorded calls are referenced by a collection agency, you may be painted as uncooperative and belligerent.

Stay calm and have a go-to phrase for when you aren’t prepared to answer a question. A simple statement like, “I am not comfortable answering that at this time” will suffice.

3. Avoid promises and actionable language

Your verbal confirmation of your intended payment schedule could be legally binding. Avoid telling debt collectors a timeline for which you plan to pay if you’re uncertain whether the debt is even yours or if you’re not sure you have the means to pay.

With the pressure of discussing personal finances over the phone, committing to payments might seem like the right thing to do, but don’t give in. Avoid promises and actionable language until you’ve had time to review your case and potentially consult with a debt lawyer. Examples of language to avoid include confirming the debt is yours, promising repayment by a specific time, and apologizing for late payments.

4. Keep a call log

If you’ve been receiving calls from a debt collector, take a moment to write down the date, time, general purpose of the call and the name of the person with which you spoke. You can do this manually or type it out in the notes of your phone.

This record is for your personal files, allowing you to reference the frequency and content of past calls with debt collectors. The FDCPA restricts what times debt collectors can contact you, and sets strict rules about what they can and can’t say to you. Keeping a call (or text message) log, if a collector is bordering on harassment or making misleading statements, can help your case if the issue is brought to court.

Know your consumer rights

The Federal Trade Commission has a Bureau of Consumer Protection to help mitigate unfair business practices. Offering consumer information and additional resources to consumers, the FTC outlines your rights as a consumer — which are important to know when facing a debt collector.

From tips and advice for consumers and information on getting refunds to consumer advocate resources, the FTC has a number of valuable features for consumers. For more information regarding your consumer rights, check out the FTC website or talk to a debt lawyer.

If a debt collector crosses the line, you have the right to protect yourself. Consider seeking legal counsel, if you need help handling your debt collection situation.