Pros and Cons to Borrowing Against Your 401(k)

It is always best to consult a Financial Trainer before making a financial decision such as borrowing from your 401k, as everyone’s situation is different.

You can think of your financial journey to retirement as a road trip. If you start in New York and plan to retire in California, you have two choices: make the trip as direct as possible or allow some stops along the way to make the journey a little more comfortable.

A 401(k) allows workers to save part of their paycheck before taxes are taken out. Sponsored by a given individual’s employer, the purpose of a 401(k) is to provide a savings plan that workers can access once they have retired.

When borrowing against your own 401(k), it’s a stop on your trip to retirement that enables you to afford some of life’s pricier moments. Under normal circumstances, you can borrow up to 50% or $50,000 of your own savings. The CARES Act bumps the loan limit up to 100% of the vested balance or $100,000, whichever is less.

People who borrow against 401(k) savings accounts are usually looking for a large sum of cash to finance an expensive purchase, like a home renovation or repair, or to consolidate credit card debt. The benefits of borrowing money from your 401(k) include quick turnaround, flexible repayment options, and lack of fees. That said, some financial advisors urge you to seek out alternatives to borrowing against your 401(k), as you’re basically taking money from your own retirement fund that you’ll need to eventually repay.

Basics of borrowing against your 401(k)

Depending on your financial history and current situation, borrowing against your 401(k) could be an option for you. Unlike most traditional loans, borrowing against your 401(k) does not require a third party lender or credit history evaluation. Basically, borrowing money from your 401(k) is borrowing your own savings without having to pay taxes on the transaction.

If you repay the loan according to the terms and conditions of your 401(k) plan, this form of borrowing money can be ideal. Watch out though, failure to repay the balance of your 401(k) can result in a devastating blow to your own retirement funds.

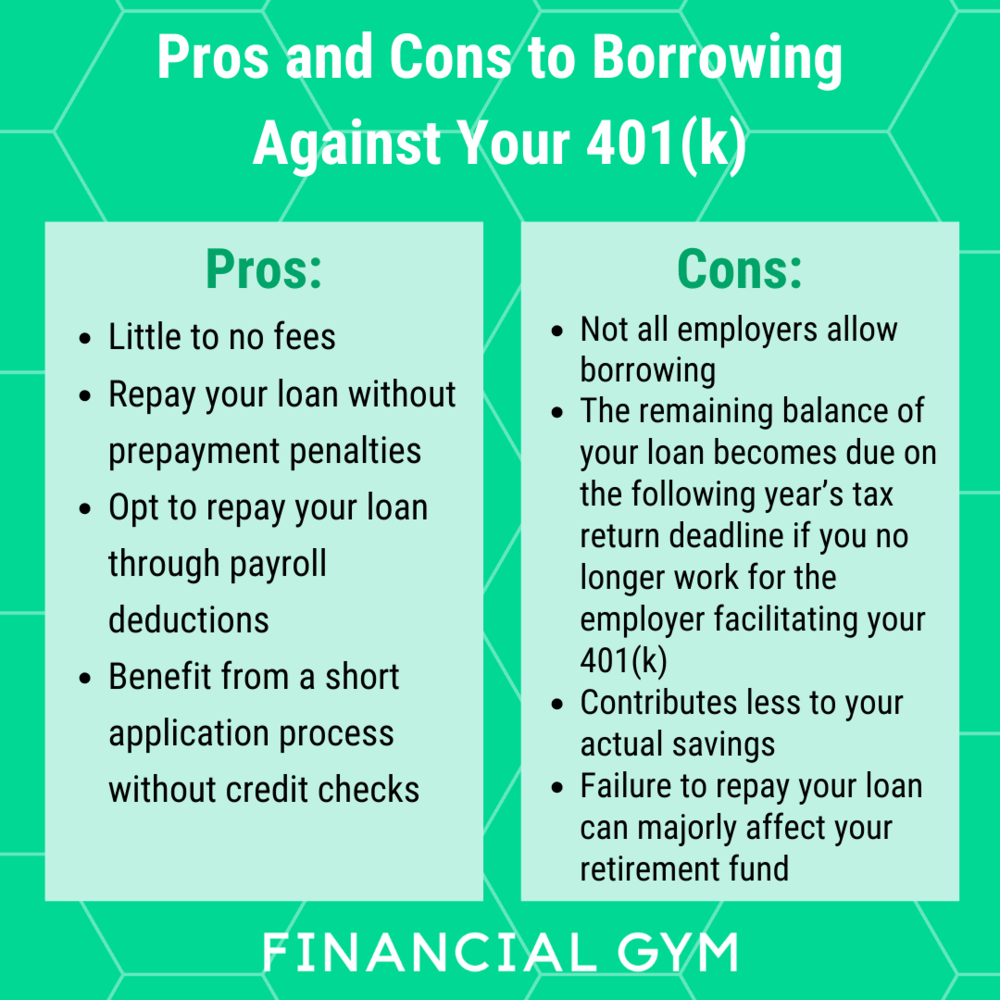

Let’s weigh the pros and cons of borrowing against your 401(k), in addition to considering alternative options.

Pros of borrowing against your 401(k)

There are many benefits to borrowing against your 401(k), especially when compared to other methods of obtaining money for large purchases.

There are little to no fees for taking out money against your 401(k)

Repay your loan without prepayment penalties, unlike many standard loans

Opt to repay your loan through payroll deductions

Benefit from a short application process without credit checks

In addition to these pros, the interest you’ll pay on your 401(k) loan eventually gets transferred back into your own 401(k) savings account. While you do have to pay interest on your loan, you’re basically paying yourself. In most cases, this interest rate will also be lower than that of a traditional bank loan.

Cons of borrowing against your 401(k)

The money in your 401(k) plan is invested in the stock market, which means you’re losing out on potential gains when you take it out. There are other cons to borrowing against your 401(k) that might make you think twice.

Not all employers with 401(k) plans allow borrowing. If yours doesn’t, you won’t be able to take out money against your 401(k).

Consider your job security, because the remaining balance of your loan becomes due on the date of the following year’s tax return deadline if you no longer work for the employer facilitating your 401(k) plan or if you lose your job, you have until the day your federal taxes are due that calendar year. In contrast to the usual five-year repayment schedule for 401(k) loans, this can be an alarming shift in the timeline of your financial obligation.

At the end of the day, you will contribute less to your actual savings as your payments will be going to pay off the balance of your loan.

Failure to repay your loan can majorly affect your retirement fund, in some cases extending the time you’ll need to work. If you don’t end up paying your 401(k) loan back in time, it will be considered an early distribution and you’ll be taxed on that plus you can face a 10% penalty on the unpaid balance (note: this applies only if you’re under age 59 ½).

Long-term consequences to Borrowing Against Your 401(k)

On your road trip to retirement, making stops can prolong your journey but improve the overall quality of the trip. Short-term, this decision can dramatically enhance your quality of life. But the long-term effect is equally dramatic.

In reality, however, being forced to borrow against your 401(k) likely means you didn’t properly map out all of the pit stops — like budgeting for a home expense, managing credit card debt, or building an emergency fund — before your road trip. Don’t get stuck in Nebraska without a gas station in sight and forget that your final destination is California.

The long term consequences of borrowing against your 401(k) include losing out on investment gains, paying interest you won’t be able to access for decades and overall difficulty retiring due to the balance of your account.

3 Alternatives to borrowing against retirement funds

If you stop to refuel on your journey to retirement, you’ll have choices of what kind of gas to get. Some gas is more expensive than others, and some gas stations have perks that others do not. You can think of gas stations as loan lenders, which you’ll need to carefully compare before selecting the best one for you. Consider these alternatives to taking out money against your retirement funds.

Personal loan

If you’re determined not to touch your retirement funds, taking out a personal loan could be a good solution. The fine print of personal loans differs depending on your lender and credit history, but personal loans aren’t contingent on your current employer—which can be the case with 401(k) loans.

Taking out a personal loan allows you to invest in your current self without affecting your 401(k) retirement savings down the line. Beware of high interest rates and repayment terms and conditions, as taking out a personal loan above your pay grade can be devastating to your credit score.

If you’re a homeowner and have grown the equity in your home, you may want to consider taking out a Home Equity Line of Credit (HELOC) or Home Equity Loan. Both types of loans use your home’s equity as collateral for the loan.

Since these options are a form of secured loan, they offer competitive interest rates and lower fees, compared to other lines of credit, like a credit card. The risk, however, is that if you’re unable to repay the loan, you may lose your home.

Emergency savings

If you have emergency savings set aside, consider accessing those funds before borrowing against your 401(k). Using your nest egg might feel risky, but can ultimately save you money as you won’t have to pay interest. Additionally, repaying yourself the money in your savings account has the ultimate flexibility.

Keep in mind, it can be easy to never restore your emergency savings balance without a third party pressuring you to make payments. If you choose to use your personal savings, you’ll want to make sure to hold yourself accountable for repayment.

Reallocate budget

Perhaps the simplest way to make extra cash, reallocating your budget allows you to set aside money for large costs down the line. Though reallocating your budget will take time and planning, it can be a great alternative to taking out a loan—especially if you foresee a large expense coming your way in the next few years. If budgeting isn’t your thing, try a personal budgeting app like Mint or PocketGuard.