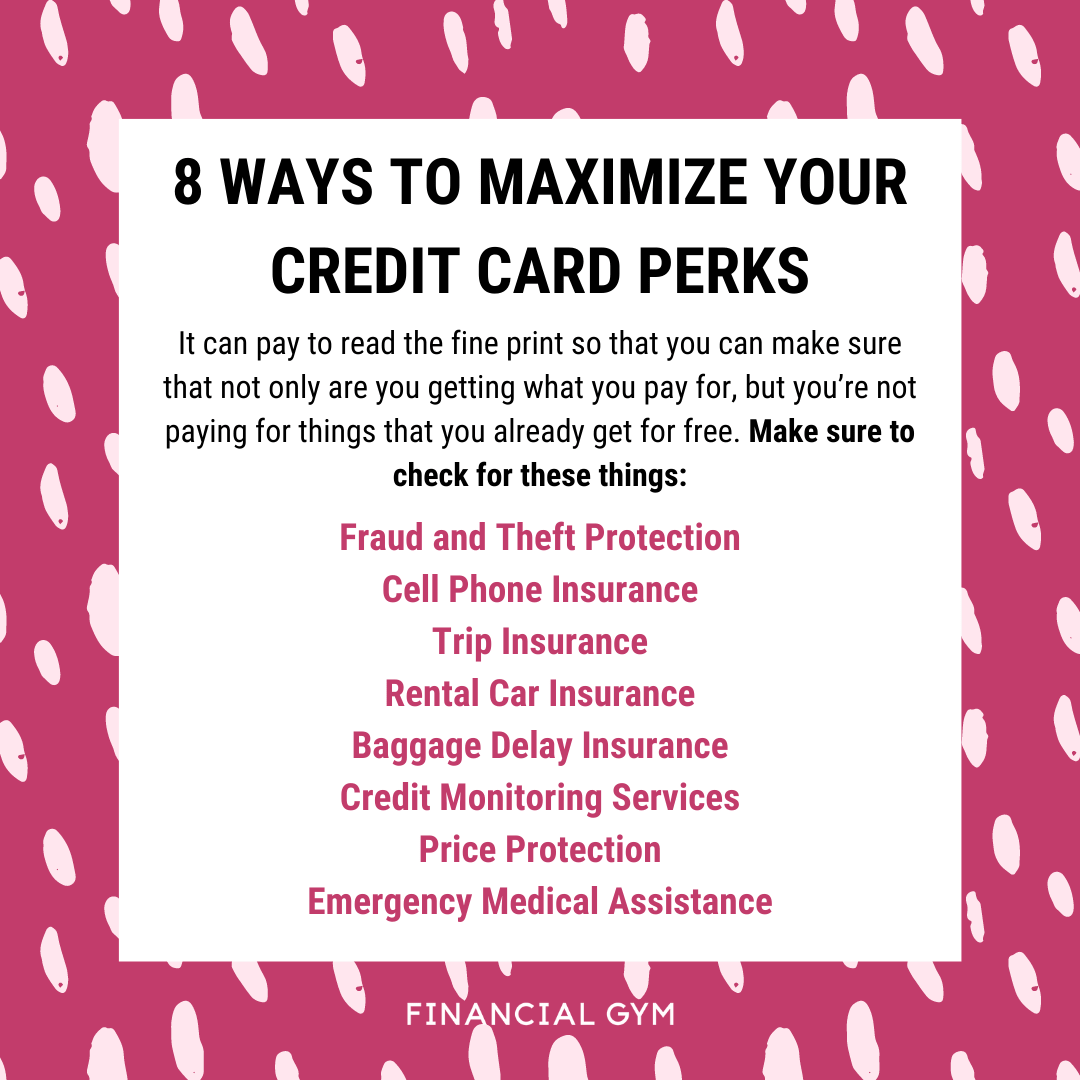

8 Ways to Maximize Your Credit Card Perks

This post contains affiliate links and The Financial Gym may earn a commission on products that you purchase or apply for through these links. To learn more about why TFG participates in affiliate programs, read this message from our CEO.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Credit cards are a few things. They’re a means to an end in a tough time, they’re a necessary tool for getting a job done (think renting cars or hotel rooms), and they can even help us travel more for way less when we use points and miles.

However, chances are those cards in your wallet carry perks you’re not using to their full advantage. It can pay to read the fine print so that you can make sure that not only are you getting what you pay for, but you’re not paying for things that you already get for free.

Fraud and Theft Protection

Unfortunately, many of us have dealt with unscrupulous companies, faulty merchandise, package theft, or bait and switch operations at some point or another. If you pay for a product or service with a debit card or cash, it is unlikely that you’ll get your money back if things go south. When you pay with a credit card, you have the ability to contact the card issuer and report unlawful or unjust behavior and get refunded. Almost all credit cards offer this perk, but a shockingly small number of people are aware that they are protected!

Cell Phone Insurance

Paying for cell phone insurance through your phone carrier can be costly, and depending on what credit cards you have, you may be paying for it twice. For instance, the Chase Ink Preferred card has a $95 per year annual fee, but as long as you pay your cell phone bill with the card, all of the phones on the plan are covered by insurance. Some other cards that offer this perk are US Bank, Wells Fargo Propel Amex, and Navy Federal Credit Union Rewards card. Switching to a card that carries insurance can save you hundreds of dollars per year.

Trip Insurance

Travel junkies tend to agree that if you are trying to maximize your points and miles game, a Chase Sapphire card is a must have. What many people don’t know, however, is that Chase Sapphire cards offer trip delay and interruption protection. This means that if you are prevented from traveling for a covered reason, or if your trip is cut short, you can get a refund. What’s more is that it isn’t just you who’s covered, but any immediate family members for whom travel was purchased on the card, even if you aren’t traveling with them.

Rental Car Insurance

Renting a car can be expensive, especially when you want to go the safest route and make sure you’re properly insured while driving. You may have coverage through your card as long as you pay for the rental with the card in question. Checking the fine print is important so that you can better understand the coverage options, but several cards offer secondary insurance and also provide an opportunity to opt in to primary insurance.

Baggage Delay Insurance

If you’ve ever had your bags delayed at the airport you know that temporarily replacing the items in your suitcase can cost you. Many credit cards offer baggage delay protection and help you save money by reimbursing you for qualified items like toiletries and even clothing while you wait.

Credit Monitoring Services

With so many free ways to track our credit scores these days paying for credit and identity monitoring services should be a thing of the past. Besides all of the free ways to track your credit, many credit cards also provide your FICO or Vantage scores so you can monitor your own score for free without disclosing personal information to yet another company.

Price Protection

There are few things more annoying than thinking you got a great deal and watching the price drop right after you spent your hard earned cash. This is why many card issuers offer price protection. If you make a purchase and the price drops within an allotted time, you can be issued the difference in a statement credit.

Emergency Medical Assistance

Amex Platinum has a hefty annual fee, but the perks it delivers can be well worth it. One particularly lucrative perk is one we hope you’ll never need: emergency medical assistance while traveling. Being a Platinum holder gives you access to Platinum Travel Assistance, which can pay for you to travel to a trusted medical facility, access needed prescriptions, or medevac you to a place where you can get the help you need if it is not available in your immediate location.

These are just a few of the ways that your credit card choices can lead to big savings. Our best advice is to read that fine print, search for information about your card perks on sites like Nerdwallet or Doctor of Credit, and make helpful credit card perks a bigger part of your overall banking strategies. You may have to put in a little extra work at the onset or manage your perk details in a spreadsheet, but you can get a great ROI for your time!

Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.