Giving My Son His First Money Memory

My 5-year-old son saved up enough money for a Nintendo Switch this year. Weirdly enough, my first money memory is also of saving up enough to buy a Nintendo system (a purple Gameboy at the time) with my own money. I saw the opportunity to give him his first money memory and I ran with it.

So how did I talk him through saving up for it?

He had received a Target gift card for Christmas and wanted to go spend it immediately. We walked through each aisle about 4-5 times. He picked up toys in each aisle, all of which he already had. Each time he picked up something I asked him the following questions:

Do you really want it?

Do you already have it?

Do you need it?

Do you love it?

What makes you excited about it?

Will you miss it if you don’t get it?

Will you use this item a lot?

Where do you want to keep it? Is there a specific place in mind to put it?

These are questions you should ask yourself when you are impulse shopping as well (they work for adults, too!).

Each time I asked him these questions, he stared at the toy and put it back (I will make a disclaimer that for a 5-year-old he’s pretty sensible and has two parents who are already talking about money with him).

I could tell nothing was really sparking his interest. We wandered the store a little more and I asked him if there was something he really wanted and he told me that he wanted a Nintendo Switch. As we continued to wander through Target, I asked him some basic questions about why he wanted it. His answer: his cousins have one and he knew he could play with them even if they weren’t together. As much as I wanted to buy one right then and there, I knew he’d value it more if he bought it for himself. I asked him if he knew how much they cost, which he didn’t, and when I told him they were $300 his eyes got really big (in “kid money” this is like $3,000).

I explained to him that since he was 5 now, we could start giving him an allowance for continuing to help us with his family chores, and I told him I’d give him $5 a week for it. This was before I really learned the importance of the “Give, Invest, Save, Spend” method, so I let him put it all towards buying his Switch.

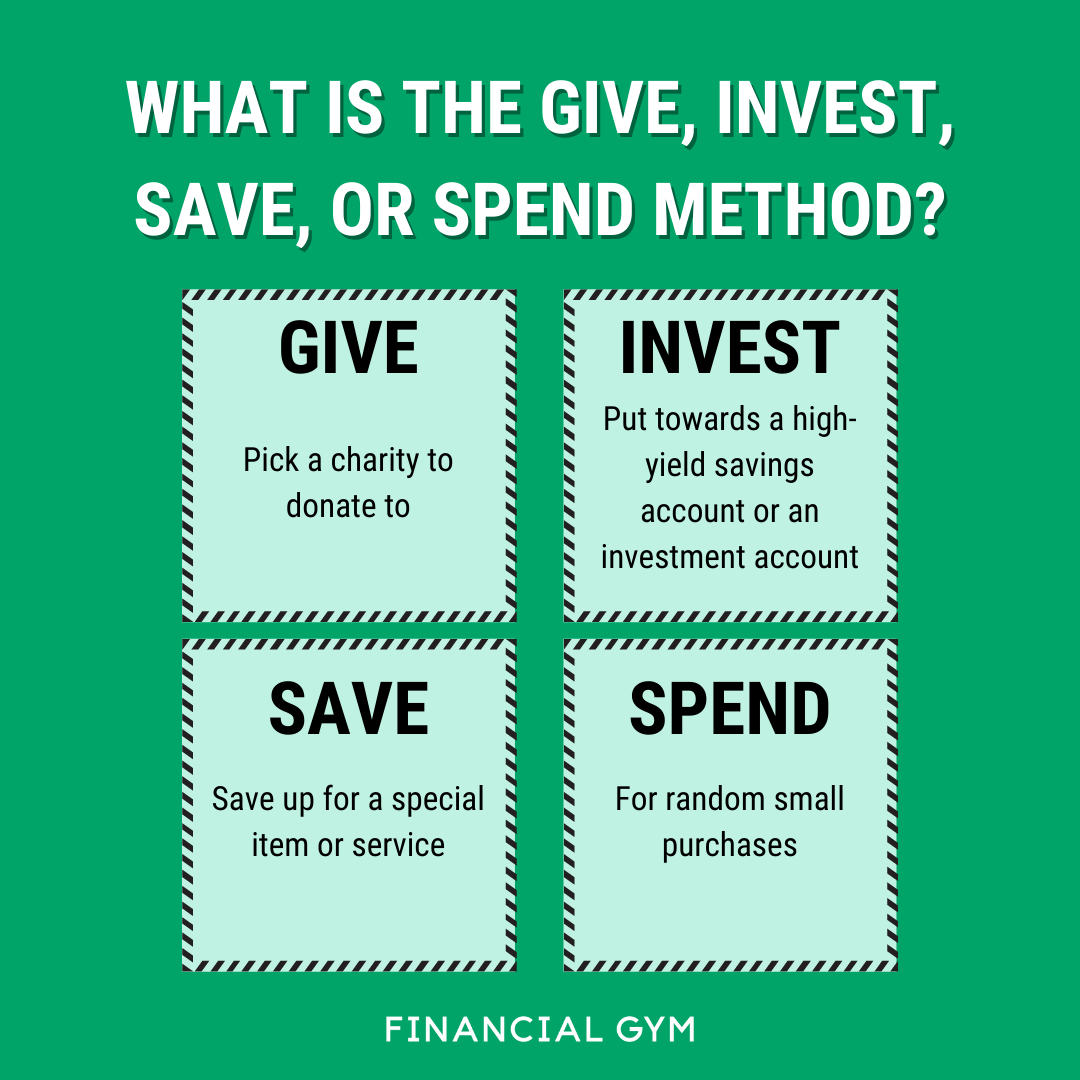

The Give, Invest, Save, Spend (or G.I.S.S.) method is a tool to help anyone from kids to young adults learn how to manage their money. With younger kids, 4 clear jars are best and you can label them with each category. Each time they earn money, work with them on how they want to disperse their dollars into each jar. For the “Give” jar, have them pick a charity they want to donate to. For the “Invest” jar, the money goes towards investing. This teaches them early on the power of having their money work for them. For the “Save” jar, have your child choose something that costs a bit more that they have to save up to buy on their own. Finally, the “Spend” jar, is how they can buy the random knick-knacks they usually ask you for that are less expensive (think candy, Pokémon cards, Barbies, etc.)

He already had some money saved from his birthday plus all the coins in his piggy bank. Once his grandparents, aunts, and uncles heard about his plan to save, they’d throw him some money here and there. There was also one occasion over Thanksgiving where he won $30 in our “Left/Right/Center” game. He raked my in-laws’ yard (with our help) and assisted my mother with some chores to earn a couple of bucks. The big thing that put him over was my mother-in-law entered him in a Super Bowl Box pool and he won $100 (I swear we don’t have a gambling problem).

The next day, we counted up his money and took his change to the bank to exchange for dollars. He had exactly $369 dollars to buy his Nintendo Switch and 2 (used, thanks to Facebook Marketplace) games. While I wish there was a store that had it in stock so he could pay for it himself, that wasn’t the case. We had to purchase it online, but I let him help me with that process and explained what I was doing throughout.

Now, had he not won money, he would have just kept earning his $5 a week, and would have been able to buy it in about 6-7 months compared to the 2 months it took.

But during this time he learned that you have to work for money, learned about impulse control, and navigated his wants and needs. It’s important to start instilling these values early so kids have the financial muscle memory as they get older.

Now we use the G.I.S.S. method so his allowance, gift money, and “winnings” have to be divided into these categories. He will have to work a little longer and harder for the big-ticket items he really wants, but he’ll be learning how to manage money at an earlier age than most.