The Financially Free Blog

Getting Financially Naked: How My Biggest Fear Changed My Life

I remember my first call to The Financial Gym like it was yesterday. In 2016, I had just moved to Dayton, OH to start my doctoral degree at The Ohio State University. My bi-weekly two-hour round trip commute was comprised of listening non-stop to every single episode of the Martini’s and Your Money Podcast. Shannon, Melanie, Tonya, Liz and I were, of course, best friends...or at least I wished we were. Listening to Shannon’s podcasts was more than eye-opening. I had read all the books that most people read about financial well-being, but none of their advice ever stuck. I needed something more and The Financial Gym was where my life changed.

5 Essential Tips on Budgeting for Couples

Newlyweds meet many challenges when merging their lives, from living together for the first time to combining finances after marriage. New couples must decide how to manage their finances to work toward achieving joint goals.

Here are five budgeting strategies for newlyweds to set you and your spouse up for financial success.

The 5 Financial Benefits of Living with Roommates

Today, 25 million people in the US live with roommates. This is a dramatic shift from the decade prior when most adults between the ages of 18 and 34 were living independently. There are plenty of reasons why people are choosing to live together. First, there’s the obvious reason: the urban housing crisis. There’s a lack of homes, and housing costs are rising faster than income, so people are renting and sharing more. But that doesn’t explain the entire phenomenon.

We also have to consider the scientifically-proven mental, physical, and emotional benefits of living with roommates as well as the many lessons you learn by sharing space with others. The strongest argument behind living with roommates, however, is that it saves you a ton of money. From being able to split the cost of rent, to divvying up expenses you might not have thought of, living with roommates can save you a whole lot of cash.

Why Interest Rates are Dropping and What You Should Do About It

Interest rates today are lower than in the recent past. This could spell good news if you’re looking to borrow money but might not be as great for your savings. A lower interest rate could mean slower growth for your personal savings, which can negatively affect your financial planning timeline.

When navigating changes in interest rates, many people look for new and different ways to save. You’ve worked hard for your money, so don’t let dropping interest rates stop you from making the most of it. Not sure how to save money with interest rates today? You’ve got options.

Before we get started, let’s clear up what exactly federal interest rates are and how they affect high-yield savings accounts.

4 Ways to Overcome Imposter Syndrome

Have you heard of imposter syndrome? If you haven’t yet, there’s a good chance you have experienced it. It’s the scientific name for that dreaded feeling of not being good enough when you are about to achieve a goal or do something great for yourself. It’s the doubt that a person has on their capabilities, oftentimes feeling like they are a fake and that at any given time someone will expose them as a fraud.

The International Journal of Behavioral Science reported that 70% of people experience at least one episode of imposter syndrome in their lifetime. The pattern occurs among high-achievers and women. The condition can get serious, and the self-doubt that can occur due to the condition can really affect a person amid crucial moments in their life.

Given that you’re reading this post and are learning how to be financially fit, you’re likely already making some big financial decisions. Overcoming Imposter Syndrome is essential in reaching your money goals — here’s how.

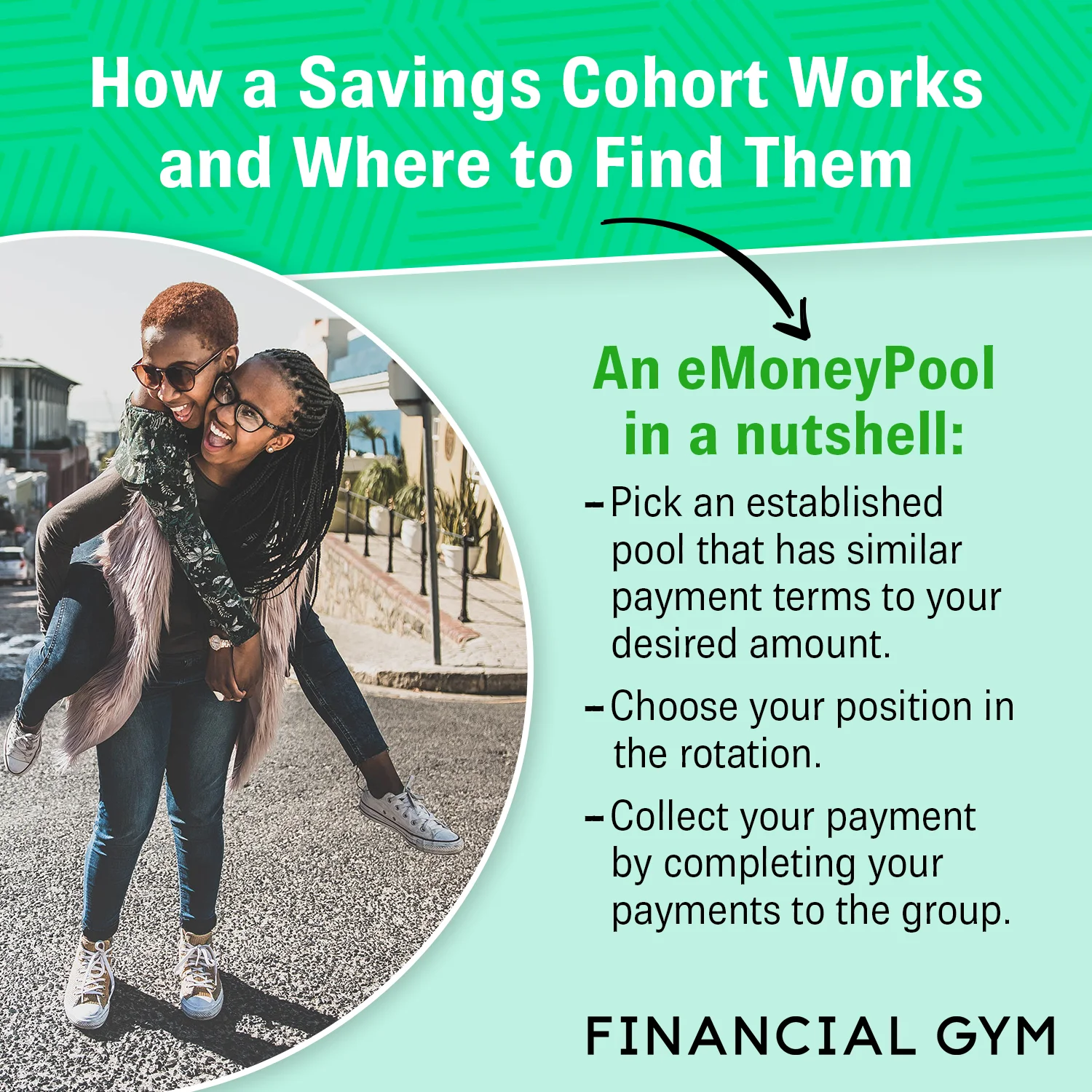

Tanda and eMoneyPool: How a Savings Cohort Works and Where to Find Them

We all have big expenses that our personal savings won’t cover. Between occasions like saving for a friend’s wedding, vacations, new cars, and home renovations life can get expensive. What if you could pool your personal savings with a group of people and take turns spending the larger pot of money?

With a savings cohort, or app like eMoneyPool, you can. Also known as a “Tanda” or “Susu”, group rotating savings funds make otherwise impossible expenses doable. It’s easy to get started if you understand how a savings cohort works and how to join.

Are Self Credit Builder Accounts Worth It?

Are you looking to improve your credit? You’re in good company, though many people aren’t sure how to start. One legitimate way to kickstart your credit is a Self account (formerly known as Self Lender), which are available in the form of a credit-building loan, secured credit card or secured loan.

Before getting started with your Self account, make sure you understand the pros, cons, and specifics of the different kinds of accounts.

How This FinGym Client Regained Her Financial Confidence Despite Setbacks

Jessica Bee has lived in New York City for the past three years and joined the Financial Gym at the start of 2019. She loves photography, live music and life's small pleasures - like new socks and good coffee!

7 Reasons You Might be Denied a High-Yield Savings Account

You work hard for your money, but what if your money could work for you? This idea is what motivates people to pursue investment options with their savings, one of the most secure being a high-yield savings account.

Selecting a high-yield savings account allows investors the chance to earn some interest with very little risk. If you’re denied a high-yield savings account, the reason could be anything from a problem in your ChexSystems report to a bank’s inability to verify your identity.

Have you been denied from opening a high-yield savings account? Find out the most common reasons for rejection below.

6 Best High-Yield Savings Accounts to Open

Interest rates have been very low so the past few years which isn’t ideal for deposit accounts. Slowly, interest rates have increased to a modest level. Although investing your money in a savings account won’t yield you the more competitive returns, it’s a good way to help your money grow while still maintaining your cash liquidity.

But not just any savings account will do. According to the FDIC, savings account rates averaged 0.09% as of the week of August 29, 2019. With savings rates at less than 0.1%, you might think twice about opening a new savings account. There’s a better alternative, however; the best high-yield savings account rates are often provided by online banks.

Here are the best high-yield savings account products to compare, before depositing your savings.

How to File a Health Insurance Claim

Health insurance can be confusing. When talking about your health insurance, the conversation usually involves whether or not you have it, or if your plan has good benefits. But how do you actually file a health insurance claim if you need to? Beginning the process of filing a claim can be daunting, but there are four easy steps to get the job done.

7 Ways to Save Money on Dining Out

The common mantra when it comes to overspending at restaurants is brown-bagging your lunch. But let’s face it — meal prepping isn’t always a feasible solution. Whether you’re headed to a new restaurant hotspot to network with coworkers or simply meet up with friends, you might worry about blowing your budget. Here are a few money-saving tips to keep in mind that can help you curb spending when dining out.

6 Ways to Avoid Debit Card Fraud

You’ve heard of debit card fraud, but are you familiar with how it works and how to protect yourself from experiencing this financial headache? Debit card fraud represents a huge challenge to consumers because it means your money literally goes missing from your bank account.

While banks do work to protect their customers when it comes to this kind of theft, protecting your own account is of the utmost importance.

7 Expert Tips to Book Cheap Holiday Flights

Peak travel season is just around the corner which means may be among the millions of Americans planning domestic flights for the holidays. With the high demand for plane seats this time of year, you’ll need to be extra vigilant about keeping airfare expenses within budget.

Top travel experts have a few secrets up their sleeves that help keep holiday fight costs down. Here are six ways to secure cheap flight tickets starting next week.

9 Easy Ways to Make Money Fast This Labor Day

Every year on the first Monday of September, the United States Department of Labor celebrates the American worker by giving them the day off. Often celebrated with barbecues and weekend trips, Labor Day is a national holiday designed to give the public a chance to breathe and enjoy the fleeting days of summer.

That being said, when businesses close their doors on Labor Day, their workers can be left in need of some extra cash. If you’re looking for easy ways to make money this Labor Day, we’ve got you covered. Check out the ideas below to catch up on your finances while observing the national holiday.

How to Find the Best Car Loan This Labor Day

Labor Day is right around the corner and if you’re like most people, you might be looking for holiday sales. If you need a new set of wheels, this is a popular time to find Labor Day car sales. We’ve compiled tips on how to find the best car loans and lowest auto loan rates this long weekend.

4 Side Hustles You Can Do From Your Phone

Nowadays, starting a side hustle is easier than most people expect. You don’t even have to babysit the neighbor's kid, or create an Upwork account in the hopes that out of the thousands of freelancers on the platform, an employer will notice you.

Here are some of the best side hustle ideas you can do straight through your phone while you’re out and about.

Women's Equality Day: How to Negotiate for the Pay You Deserve

A century ago, women still didn’t have the right to vote. But 99 years ago that all changed with the 19th amendment. The 19th amendment, which gave women the right to vote was signed into law on August 26, 1920, allowing women to use their voice and vote. As of 1973, in honor of this, Congress marked August 26th as Women’s Equality Day.

Though on this day, women achieved equality through having the right to vote, we know that there is still inequality that women face, especially when it comes to earning.

According to Payscale’s report, The State of the Gender Pay Gap 2019, women make 79 cents to every dollar a man makes. That number is worse for women of color. Systemic changes need to happen to achieve equality but what can you do now to move the needle forward?

Charge what you’re worth and ask for more. Read on to learn how to negotiate a salary and get salary negotiation tips.

How to Calculate Your Business' Quarterly Taxes

If you’re self-employed, there’s one major issue that can be a pain: taxes. You get to pay taxes not just once each year, but quarterly! This can be stressful whether you’re just starting out or just trying to stay on top of your taxes.

How do you know how much to pay? How do you ensure you aren’t overpaying or underpaying? It can be a confusing process, to say the least. But we’ve compiled a quick guide on how to calculate business taxes and how to get started with filing business taxes.

9 Insider Secrets to Book an Affordable Hotel Stay

You might be wrapping up your summer travel, but before you know it you’ll be knee-deep in holiday travel planning. A 2018 Holiday Travel Report by Nerdwallet found that nearly half of Americans expected to put an average $1,456 on a credit card to cover holiday season travel.

This year, save money on travel expenses by cutting costs on your hotel stay. Here are a few tips to help you find cheap hotel rooms and have an affordable stay.