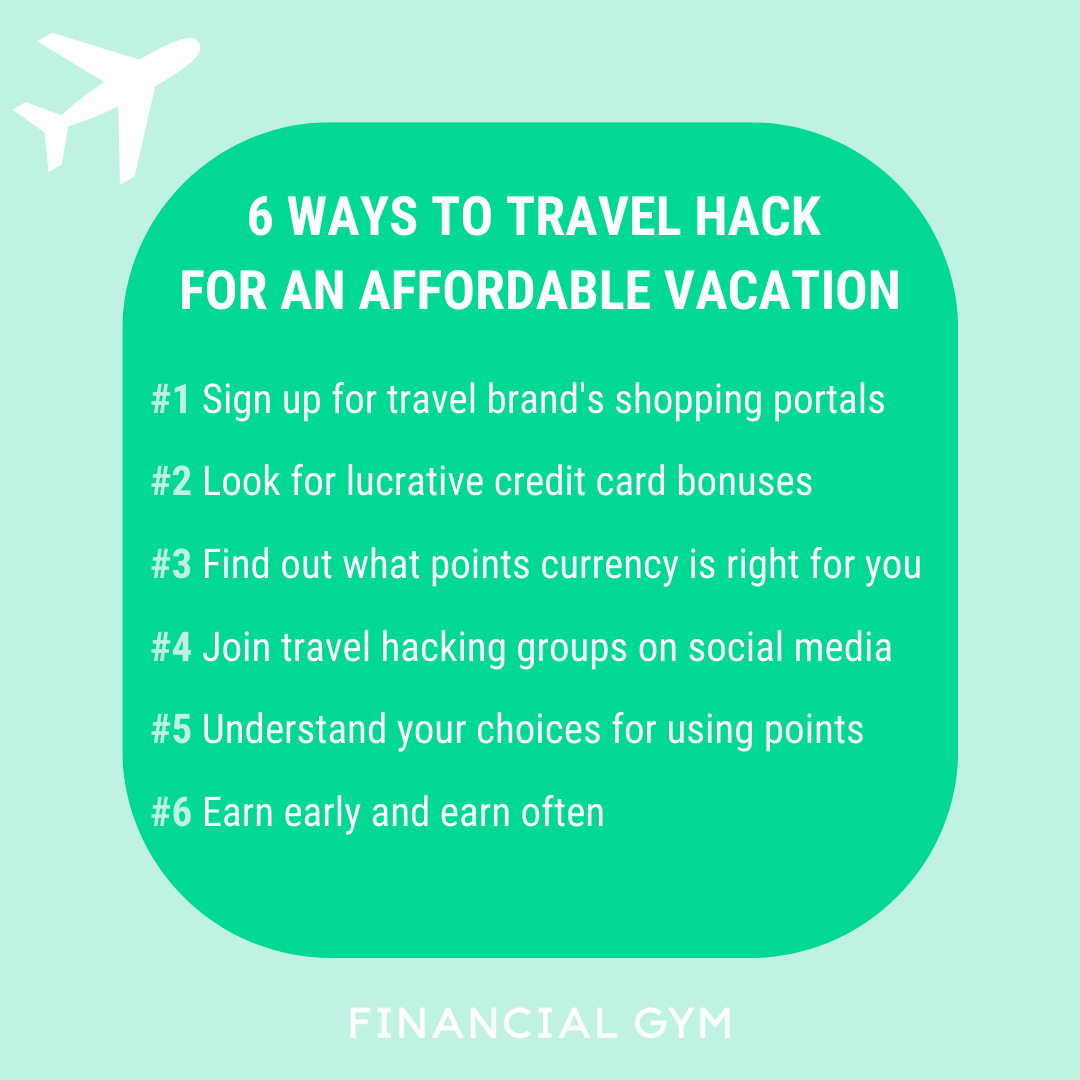

6 Ways to Travel Hack Your Way Into an Affordable Vacation

This post contains affiliate links and The Financial Gym may earn a commission on products that you purchase or apply for through these links. To learn more about why TFG participates in affiliate programs, read this message from our CEO.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

What is travel hacking?

Travel hacking is the art of maximizing credit card, airline, and hotel loyalty programs to get free travel, travel discounts, or travel perks that would otherwise be very costly.

Some of us are lucky enough to accrue points for business travel or travel so much for leisure that we’re able to organically grow our points and miles base with just those rewards from our trips.

But honestly, this is rare.

For the rest of us commoners the trick is to be strategic about how we use credit cards, learn about the sweet spots in loyalty programs, spend our money in ways that maximize our points and miles earnings, and stay up to date on offers that help us get the most of our points.

The people who make the most out of travel hacking are willing to put some time into learning about it, and then take the time to keep their knowledge base up to date. There’s also a learning curve involved, so give yourself a break if your first few big ideas don’t pan out exactly the way you’d hoped. Over time, your ROI is bound to increase and you’ll be flying the friendly skies with a fatter wallet.

One thing to note is that some of the best ways to earn points are through credit card sign on bonuses and optimizing how and where you spend. However, if you are not currently able to pay off your credit cards in full each month you shouldn’t be travel hacking! It could cost you more in interest than you make in travel and could potentially damage your credit score.

If this applies to you, don’t despair. Keep working on paying off your debt, growing your savings, and improving your credit score so that you can reward yourself with a foray into travel hacking further into your financial journey.

With that disclaimer out of the way, let’s get to the basics. There are a few steps that everyone should take to get started regardless of where they’re at and where they want to go.

Getting started

Join rewards programs for the airlines and hotels that you use.

Most (and the best) opportunities for free flights and hotel rooms involve being a rewards member of the airlines you want to fly and the hotels you want to stay at. I recommend joining any and all rewards programs of brands you’ve used in the past or want to use in the future. Certainly join the programs associated with any upcoming travel, and you can typically get credited for travel in the recent past (for some airlines up to 6 months or a year). If you’re not part of these programs, you’re not getting credit for your travel and basically leaving money on the table. Signing up for each brand’s newsletter is also a great way to stay up to date on specials and fare sales, and also to find opportunities to get higher status with various brands.

Sign up for travel brands’ shopping portals.

Many people don’t know that most airlines and some hotel brands have shopping portals that allow you to stack points you earn with the typical spending bonus you get on the credit cards you use. For instance, Alaska, Jet Blue, Delta, IHG, Wyndham, and American Airlines all have online shopping portals. You sign into the portal, search the place you want to shop, and get extra bonus points and miles for your purchases. You don’t even have to use a co branded card, so you can be earning the bonus while getting your everyday points offered by your credit card. On top of that, even a $1 purchase will stop your points from expiring, so it’s a great way to keep your current miles alive even when you’re grounded! You can use cashbackmonitor.com to find out who has the highest payout at any given time.

Look for lucrative credit card bonuses.

Credit card companies reward loyalty and to help get you loyal to their brand they offer generous sign on bonuses to new customers.

For instance, the Chase Sapphire family of cards has been known to offer bonuses of up to 100,000 points for signing up. Depending on how you use those points, that could be worth an average of $1250 in travel (and up to $3,600 in value, if used very strategically) all for paying an annual fee of $95. While many of us have long avoided annual fees, when the math is in your favor it can be a worthwhile investment.

These bonuses typically require a minimum spend. That means that in order to get that 1,000 in points, you need to spend (for example) $5,000 in the first 3 months. If you have a high income and a lot of expenses this might come easy to you, but if you are a fellow frugal, you might need to put some planning into how to make that spend in 90 days.

One way to do this is to time the card to align with any major purchases you are making. For example, if you’re replacing your kitchen cabinets, getting a new computer, buying a wedding dress, paying for daycare, or getting furniture for your next move, it might be a good time to apply. If you’re falling short of the minimum spends, you can also pay for monthly expenses in advance. You can buy yourself gift cards for your local grocery store, future Uber rides, or restaurants you frequent. Most cell phone, car insurance, and internet providers will let you pay for up to 12 months of service. These tricks can help you get that bonus without spending on anything you don’t need.

The highest value cards typically have a minimum spend of at least $3,000. If that sounds too high to you, you can start a little smaller until you have a big purchase to make. For instance, a Chase Freedom card will usually get you a $200 (or 20,000 point) bonus after spending $500 in 3 months. Most of us can accomplish this without breaking a sweat (or our budget). Start where you’re at and build from there, and you’ll see your strategy pay off in time.

Figure out what points currency is right for you.

When you get rewarded for your credit card spend it usually comes in the form of points or miles for a particular brand (like Delta miles or Hilton points) OR in the form of a more generic currency like Amex Membership Rewards (MR) points or Chase Ultimate Reward (UR) points. Experienced travel hackers agree that you should focus on generic points first because they are more flexible. With MR or UR points, you can purchase flights, pay for hotel rooms, rent cars, or get statement credits for train fare or Air BnBs, or non big brand hotels. Since you can often transfer these points to the specific brands as well, they are more valuable because they are more versatile than a single airline’s card that can only be used on their flights or with travel partners (like Delta and the Skyteam).

Once you have taken advantage of those opportunities you can start looking for good bonuses on cards for your favorite airlines or hotels. Doing so requires knowing what a good bonus looks like so you’ll need to check out a site like Doctor of Credit, Miles Talk, or 10x Travel to stay up to date. Those sites put in a lot of work following trends in travel rewards. They’ll let you know how a current bonus compares to bonuses they’ve seen in the past and give you an idea of when it's time to jump at an offer.

One more type of travel card is the cash back kind, like Capital One Venture, that pays you a 1:1 cash equivalent buy earning points that can be used as statement credits. While these are the easiest to use, they are not generally the most lucrative. Still, if you’re interested in reducing your travel costs but don’t have the bandwidth to do much research, these cards could save you a few bucks.

Get in the know.

The points and miles world changes rapidly and you’ll need to put some effort into staying up to date. Don’t worry! Lots of travel hackers put lots of effort in making this lots of fun! You can join Facebook Groups like Milestalk (which I consider the friendliest and most welcoming group out there) and follow niche sites aligned with your travel goals like Parks and Points. There you can find information about great deals and TON of inspiration for how to use those points once you get them.

Understand your choices for using points.

Different loyalty programs offer different ways to use your points. For instance, with Chase or Amex you can either use their points in their proprietary portals or you can transfer your points to their travel partners. Transferring is often the most profitable way to use your points.

Chase and Amex portals claim to have a 1:1 or even a 1:1.5 point to cash ratio, but often if you search the same flights or hotels independently, you’ll see the prices are higher in the portal. What’s more is that if you transfer the points directly to the airline or hotel you can access fare deals or sweet spots. For instance, Category 5 Hyatt rooms often rent for $500 or more per night while only costing 30,000 points. If you booked that through the Chase portal you’d have to use 100,000 for a 2 night stay, while if you transferred your Chase points to Hyatt you’d only be out 60,000 points for the same rooms, leaving your 40,000 points to play with.

Earn early and often.

People often ask how far in advance you need to start building up points and the answer is always NOW. Most people don’t spend the kind of money it takes to earn massive amounts of points in just a few weeks or months. Think about it: if a flight costs 30,000 points and you’re getting 3x points per dollar through a shopping portal, you’ll have to spend $10,000 to earn enough points for your flight, and you’ll have to book far enough in advance that there is still award travel available.

The sad news is that if a trip pops up in the next couple of months chances are unless you’ve already stockpiled points you won’t be able to build up points in time to reduce your costs much. The good news is is that under the current circumstances, you have a great opportunity to prepare for brighter times when travel is less dangerous, and when the skies are clearer you’ll have what it takes to say yes to new adventures.

The Takeaway

Travel hacking is an excellent way to save money, stretch your travel budget, or travel in style while not breaking the bank. It does take work, upfront effort, and is not free money, at least if you value your time.

If you want help learning more, tune into the next Travel Hacking webinar we host, check out a cool lady-owned travel hack coach like Julia at Geobreeze, and sign up for an account at Travel Freely, which helps you organize all of your points and sends you reminders when you have action items on your list for optimizing your travel hack strategy.

We’re also itching to start seeing the world beyond your own four walls. Until then, you can prepare ourselves to nurture our travel goals in the future!

Ready to take your finances to the next level?

To get started schedule a free 20 minute consultation call to speak to a member of our team. We will ask you a few basic questions to get to know you more, walk you through our financial training program steps, and of course answer any questions you may have. No pressure to join!