The Financially Free Blog

6 Items to Avoid at Warehouse Stores

When looking to save money, many shoppers buy in bulk at a warehouse store like Costco or Sam’s Club. The main idea behind buying in bulk is that you’ll get a wholesale price for committing to a larger purchase of a given item. Especially in situations where you require a large volume of goods, warehouse stores can be lifesavers. Despite that, not every item offers benefits when bought in bulk.

How to Switch Banks in 5 Easy Steps

If you’ve been banking with the same financial institution since you were in high school, you might be curious about your other banking options. Whether you’re looking for a new high-interest savings account or are fed-up with your current bank’s costly fees, here’s how to switch banks in just a few steps.

How to Protect Yourself After a Bank Data Breach

In recent years, data breaches across various retailers, credit bureau Equifax, and the most recent, the Capital One data breach, have made data breaches seemingly inescapable. Since consumers rely heavily on the security measures these companies use, there’s not much you can do to prevent a data breach.

This can be especially troubling if the financial institutions that you bank with fall victim to a breach. If you believe your personal information was stolen during a bank data breach, there are a few steps you can take to protect yourself.

How an Emergency Fund Saved This New York City Bride-to-Be

After being with my then-boyfriend of 10 years, he finally got down on one knee and asked me to be his wife. Our engagement lasted longer than most (*cough, cough three years*) for many reasons such as moving, new careers, and the birth of our beautiful daughter.

However, the biggest reason we delayed solidifying our union was the huge ticket price that comes with a wedding. We had many conversations about the most cost-effective ways to get married but deep down we wanted a wedding. It was important for us to be able to celebrate our love in New York City, surrounded by our family and closest friends.

5 Top Companies Offering Seasonal Part-Time Jobs

Taking on a side gig is a practical way to make money on the side ahead of the big shopping season, or simply accelerate your earnings to start off your 2020 savings fund, strong.

As soon as you know it, pumpkin spice lattes will be replaced by eggnog and hot chocolate. But along with all the great things that come in a holiday season, there’s also the part about increased spending. You will need money for travel, buying gifts, and to set aside cash to continue hitting your financial goals.

But don’t fret — although there are many strategies to help control your holiday spending, you also can capitalize on seasonal part-time jobs that many companies offer this time of year!

We took a look at five companies that can help you earn a little more cash leading up to the holidays.

How to Rebuild Your Credit Over Time

Having a strong credit score can open doors to more affordable financial products, like loans, and can even help position yourself as a prime candidate for a new apartment. If your credit is poor or you’ve just undergone bankruptcy, however, these opportunities might be harder to come by.

Learning how to rebuild credit after bankruptcy or increase your credit score is possible, but there’s no instant solution to get you there. It takes time, but implementing a few strategies to improve your credit, can go a long way.

4 Financial Stress Triggers and How to Manage Them

Money can help catapult you closer to larger life goals, making rewarding milestones, like buying your first home or retiring early a reality. On the flipside, the lack of money can also feel like a setback keeping those very goals away from arms reach.

6 Holiday Expenses to Budget for (Aside From Gifts)

The holidays are packed with opportunities to celebrate life, family, friends, and traditions. With increased family gatherings and celebratory occasions, the holidays tend to cost a little more than the rest of the year.

Aside from holiday shopping for gifts, this time of year tends to bring unexpected expenses like travel costs and special meals. While you can keep your fingers crossed for a holiday miracle, it might be a better use of your time to budget for unexpected expenses.

With the holiday season around the corner, you can get ahead by anticipating costly purchases. Check out the holiday spending tips below.

What I Learned From My “No Shopping on Amazon” Quarter

My challenge also forced me out into the world to explore different avenues of making purchases that were sometimes even cheaper than Amazon’s prices.

I used to rush to Amazon Prime to buy books, office supplies, clothes, and anything that I thought I needed. But, when the challenge began in July and I needed a few things, it pushed me to go to physical stores, and not only find more affordable options, but also discover my community.

Pros and Cons to Borrowing Against Your 401(k)

You can think of your financial journey to retirement as a road trip. If you start in New York and plan to retire in California, you have two choices: make the trip as direct as possible or allow some stops along the way to make the journey a little more comfortable.

A 401(k) allows workers to save part of their paycheck before taxes are taken out. Sponsored by a given individual’s employer, the purpose of a 401(k) is to provide a savings plan that workers can access once they have retired.

Getting Financially Naked: How My Biggest Fear Changed My Life

I remember my first call to The Financial Gym like it was yesterday. In 2016, I had just moved to Dayton, OH to start my doctoral degree at The Ohio State University. My bi-weekly two-hour round trip commute was comprised of listening non-stop to every single episode of the Martini’s and Your Money Podcast. Shannon, Melanie, Tonya, Liz and I were, of course, best friends...or at least I wished we were. Listening to Shannon’s podcasts was more than eye-opening. I had read all the books that most people read about financial well-being, but none of their advice ever stuck. I needed something more and The Financial Gym was where my life changed.

5 Essential Tips on Budgeting for Couples

Newlyweds meet many challenges when merging their lives, from living together for the first time to combining finances after marriage. New couples must decide how to manage their finances to work toward achieving joint goals.

Here are five budgeting strategies for newlyweds to set you and your spouse up for financial success.

The 5 Financial Benefits of Living with Roommates

Today, 25 million people in the US live with roommates. This is a dramatic shift from the decade prior when most adults between the ages of 18 and 34 were living independently. There are plenty of reasons why people are choosing to live together. First, there’s the obvious reason: the urban housing crisis. There’s a lack of homes, and housing costs are rising faster than income, so people are renting and sharing more. But that doesn’t explain the entire phenomenon.

We also have to consider the scientifically-proven mental, physical, and emotional benefits of living with roommates as well as the many lessons you learn by sharing space with others. The strongest argument behind living with roommates, however, is that it saves you a ton of money. From being able to split the cost of rent, to divvying up expenses you might not have thought of, living with roommates can save you a whole lot of cash.

Why Interest Rates are Dropping and What You Should Do About It

Interest rates today are lower than in the recent past. This could spell good news if you’re looking to borrow money but might not be as great for your savings. A lower interest rate could mean slower growth for your personal savings, which can negatively affect your financial planning timeline.

When navigating changes in interest rates, many people look for new and different ways to save. You’ve worked hard for your money, so don’t let dropping interest rates stop you from making the most of it. Not sure how to save money with interest rates today? You’ve got options.

Before we get started, let’s clear up what exactly federal interest rates are and how they affect high-yield savings accounts.

4 Ways to Overcome Imposter Syndrome

Have you heard of imposter syndrome? If you haven’t yet, there’s a good chance you have experienced it. It’s the scientific name for that dreaded feeling of not being good enough when you are about to achieve a goal or do something great for yourself. It’s the doubt that a person has on their capabilities, oftentimes feeling like they are a fake and that at any given time someone will expose them as a fraud.

The International Journal of Behavioral Science reported that 70% of people experience at least one episode of imposter syndrome in their lifetime. The pattern occurs among high-achievers and women. The condition can get serious, and the self-doubt that can occur due to the condition can really affect a person amid crucial moments in their life.

Given that you’re reading this post and are learning how to be financially fit, you’re likely already making some big financial decisions. Overcoming Imposter Syndrome is essential in reaching your money goals — here’s how.

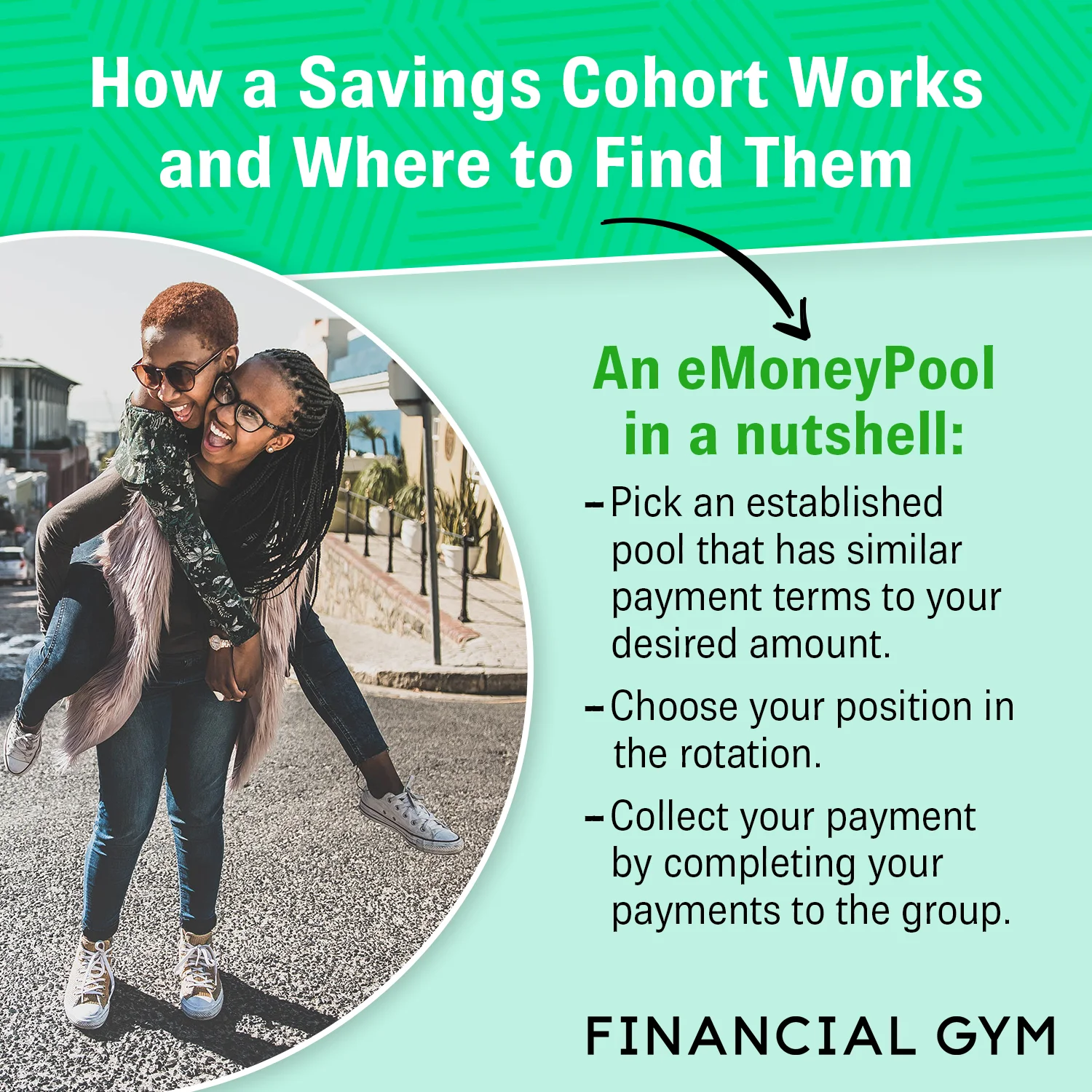

Tanda and eMoneyPool: How a Savings Cohort Works and Where to Find Them

We all have big expenses that our personal savings won’t cover. Between occasions like saving for a friend’s wedding, vacations, new cars, and home renovations life can get expensive. What if you could pool your personal savings with a group of people and take turns spending the larger pot of money?

With a savings cohort, or app like eMoneyPool, you can. Also known as a “Tanda” or “Susu”, group rotating savings funds make otherwise impossible expenses doable. It’s easy to get started if you understand how a savings cohort works and how to join.

Are Self Credit Builder Accounts Worth It?

Are you looking to improve your credit? You’re in good company, though many people aren’t sure how to start. One legitimate way to kickstart your credit is a Self account (formerly known as Self Lender), which are available in the form of a credit-building loan, secured credit card or secured loan.

Before getting started with your Self account, make sure you understand the pros, cons, and specifics of the different kinds of accounts.

How This FinGym Client Regained Her Financial Confidence Despite Setbacks

Jessica Bee has lived in New York City for the past three years and joined the Financial Gym at the start of 2019. She loves photography, live music and life's small pleasures - like new socks and good coffee!

7 Reasons You Might be Denied a High-Yield Savings Account

You work hard for your money, but what if your money could work for you? This idea is what motivates people to pursue investment options with their savings, one of the most secure being a high-yield savings account.

Selecting a high-yield savings account allows investors the chance to earn some interest with very little risk. If you’re denied a high-yield savings account, the reason could be anything from a problem in your ChexSystems report to a bank’s inability to verify your identity.

Have you been denied from opening a high-yield savings account? Find out the most common reasons for rejection below.

6 Best High-Yield Savings Accounts to Open

Interest rates have been very low so the past few years which isn’t ideal for deposit accounts. Slowly, interest rates have increased to a modest level. Although investing your money in a savings account won’t yield you the more competitive returns, it’s a good way to help your money grow while still maintaining your cash liquidity.

But not just any savings account will do. According to the FDIC, savings account rates averaged 0.09% as of the week of August 29, 2019. With savings rates at less than 0.1%, you might think twice about opening a new savings account. There’s a better alternative, however; the best high-yield savings account rates are often provided by online banks.

Here are the best high-yield savings account products to compare, before depositing your savings.