The Financially Free Blog

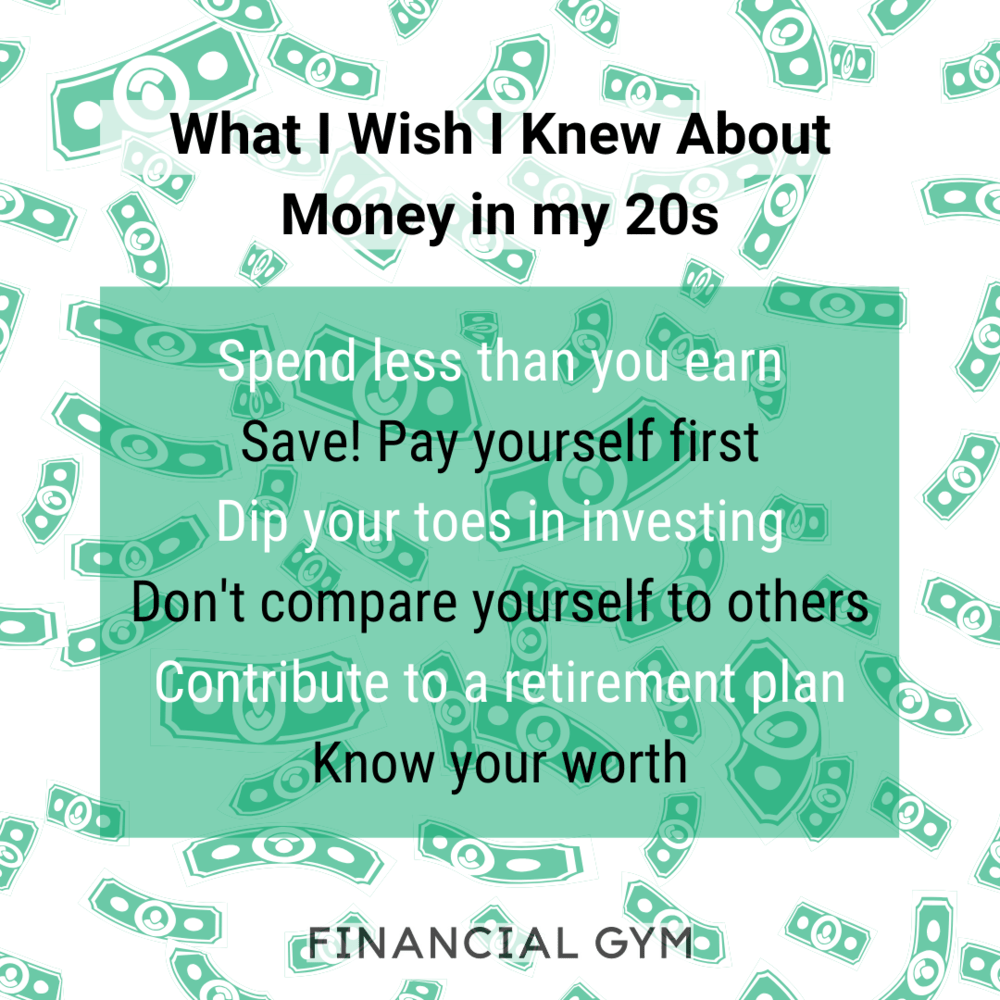

What I Wish I Knew About Money in my 20s

After the interest in Gus & Kadri’s podcast about overspending in their 20’s, we decided to put their advice into words. Kadri shares his story of overspending, followed by Gus’ advice for how to control your spending habits in your 20s.

A Day in The Life of a FinGym Trainer

When I meet new people, or I am catching up with friends or family and they ask “What do you do?” and I respond with “I’m a Financial Trainer” it’s usually met with a puzzled look or a follow up question sort of like “Is that like a Financial Advisor or….?” I explain that we aren’t a traditional financial company, we are set up a lot like a traditional gym, where you pay a monthly membership and you get complete access to your Best.Financial.Friend. (me) a lot like a personal trainer! I am extremely up front with my clients from day one: I don’t make commission, I am not here to sell you life insurance, my #1 goal is for you to be successful in your personal financial journey, your membership pays my salary!

How to Plan for Post College

First of all, congratulations! Your hard work HAS paid off. It may seem anti-climactic with the lack of formal celebration, but we are proud of you and we are cheering for you!

One of the more important things to remember as a new grad is that the transition into the “real world” (as many call it) can be challenging. It’s not easy to go from higher education to working a full-time job! It is also important to remember that your plans have likely changed, it may be challenging to get a job right now, and even if you are fortunate enough to have secured one, it probably doesn’t look the same as it did a few months ago. For these reasons and more, it can be hard to have a clear plan of what is next. College graduation can be a tough transition for many and is even tougher now, due to the impact COVID-19 has had on higher education and the global economy. This is why it is more important than ever to be easy on yourself. Remind yourself of why you got a degree, and of how proud of yourself you are for completing it. Be gentle with yourself.

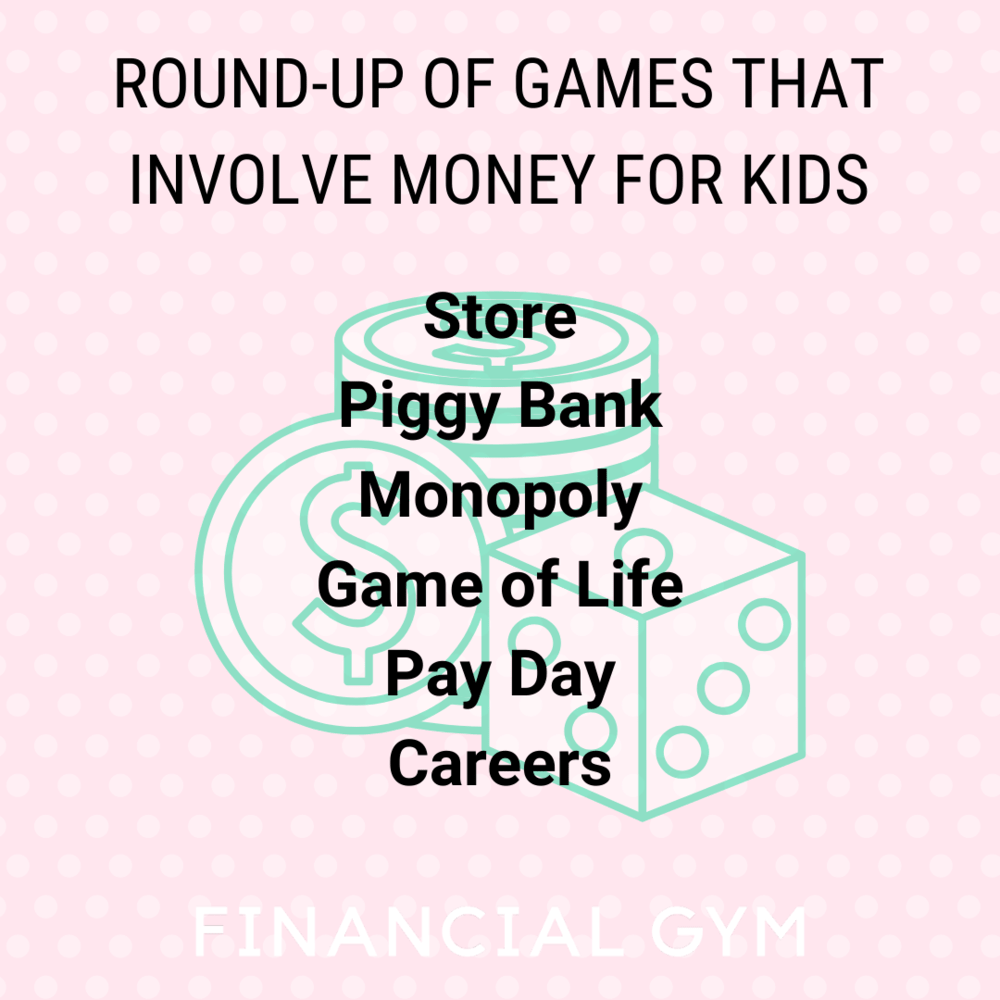

Round-up of Games That Involve Money for Kids

Teaching financial literacy to children can be a daunting task, but introducing fundamental financial concepts now can set them up for a stable future. Instilling the building blocks of saving, spending and making money early on can help prepare your children to be financially wise.

Not sure how to teach kids about money? Here are six games you can use to help teach your kids about money.

5 Tips for Couples With a Shared Credit Card

Sharing important areas of your life — including your finances — is a common part of building a deeper relationship with a long-term partner. Whether you’re newlyweds in need of a shared credit card, or in a committed relationship and want a shared card to cover date nights and communal household supplies, opening a credit card account together can be a useful financial tool.

Learning a few key credit card strategies for couples can help you and your spouse or partner manage expectations for the new card. Here are a few tips for a more positive shared credit card experience.

Round up of Companies Who are Hiring

We know many people are experiencing job loss, reduced hours, and uncertain employment right now. While many companies are downsizing their workforce, there are also many that are expanding and hiring!

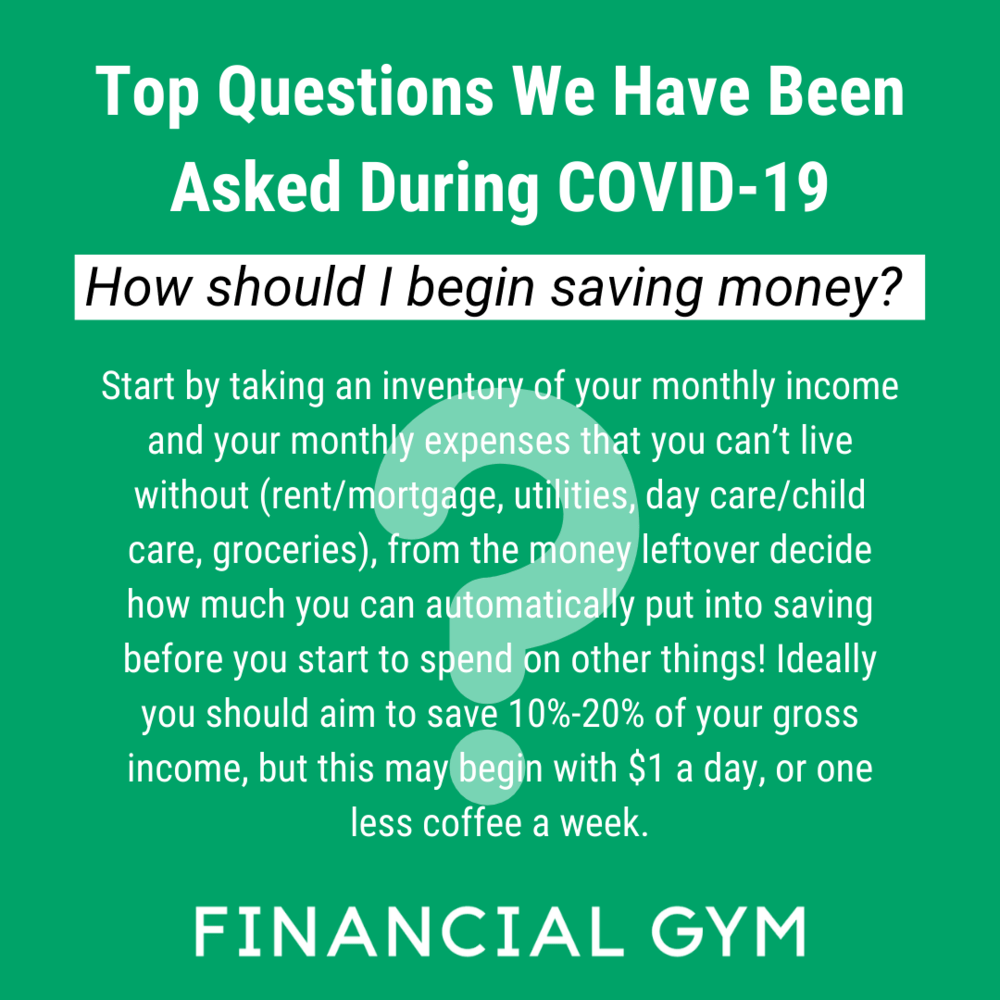

Top 5 Questions We Have Been Asked During COVID-19

We know that your finances are top of mind right now. You might be worried about your investments, income, or savings right now-- and we understand, finances can be frightening! We’re here to provide the answers you need when you need them. If you haven’t tuned in yet, be sure to turn to our Instagram page at 12pm EST every weekday, where you can chat live with one of our Financial Trainers! Here are five of the top questions we have been asked during this time of social distancing.

9 Ways to Avoid Online Shopping Overload While at Home

The temptation is real to spend more money online while most of us can’t go out and about during coronavirus. Let’s just accept that. You’re probably spending more time on the internet and therefore you’re the target of more ads. And let me tell you, retailers are trying to entice you with sales galore! But that doesn’t mean it’s inevitable that you’re going to overspend and make regrettable purchases.

Your Mental Health and COVID-19

As we enter May, we honor Mental Health Awareness Month. Here at The Financial Gym, we know tackling finances often comes with stress and anxiety. This year, May approaches as many of us are navigating a global pandemic and disruptions to our routines. It is so important, now and more than ever, to bring awareness to mental health. If you are struggling with uncertainty, here are some ways that you can take care of your mental health.

8 Tax Myths to Avoid This Filing Season

Even though tax season was extended, we still want to make sure you have all the information you need to file your 2019 taxes properly.

There are many misconceptions about taxes that can hurt taxpayers by adding to their uncertainty and by costing them money.

Here are some of the most common tax myths that often trip-up taxpayers during the income tax filing season.

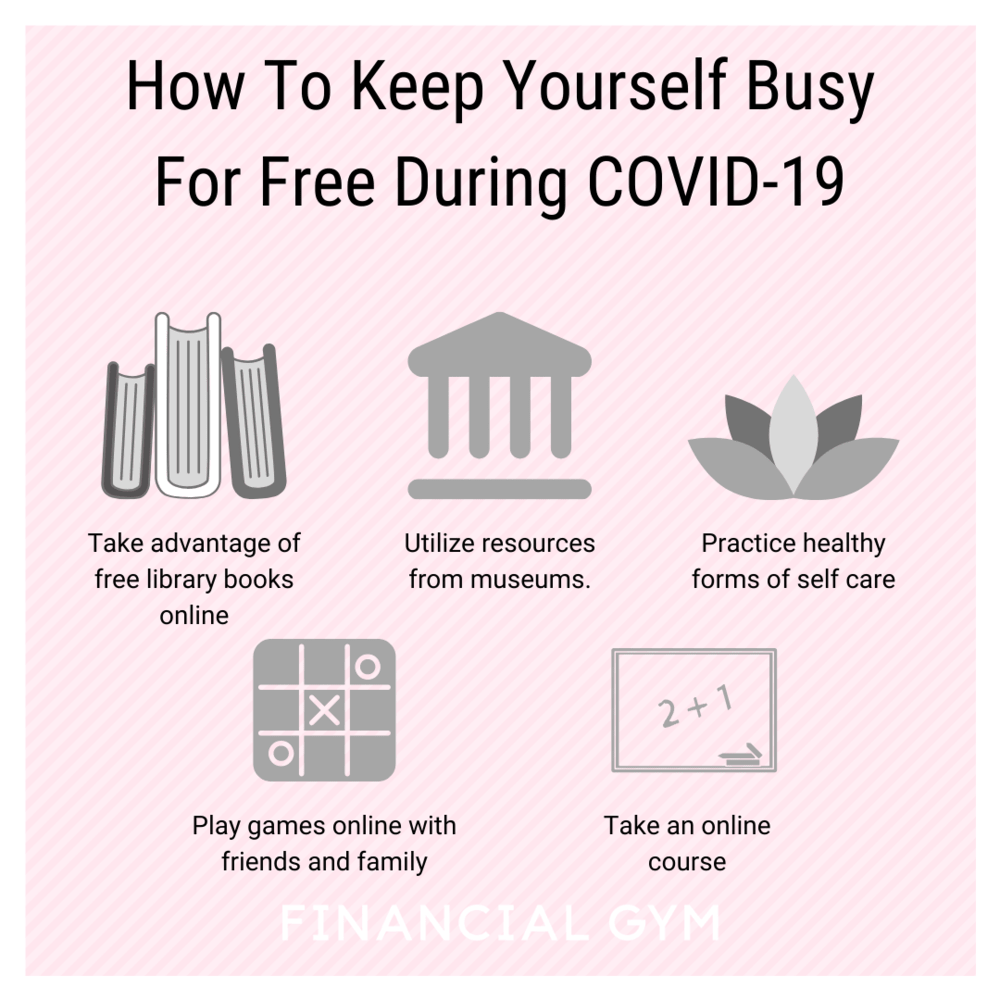

How To Keep Yourself Busy For Free During COVID-19

You might be getting to the point in social distancing where you want to introduce something new or different to your stay at home routine. We’ve rounded up some of our favorite low or no cost ways to pass the social distancing time.

We definitely don’t think everyone needs to come out of this pandemic with a new hobby or side hustle! That said-you might be ready to incorporate something new into your routine, so here’s some inspiration beyond free Instagram workouts and creative pantry cooking.

Tips for Finding Temporary Housing

We’ve partnered with Common to bring you this content. Common is the country's leading community based residential brand. With dozens of homes across 7 major cities, Common makes moving and city living easier than ever before for renters. Every Common co-living home comes fully furnished and move-in ready with household essentials, utilities, WiFi, and access to the Connect by Common App.

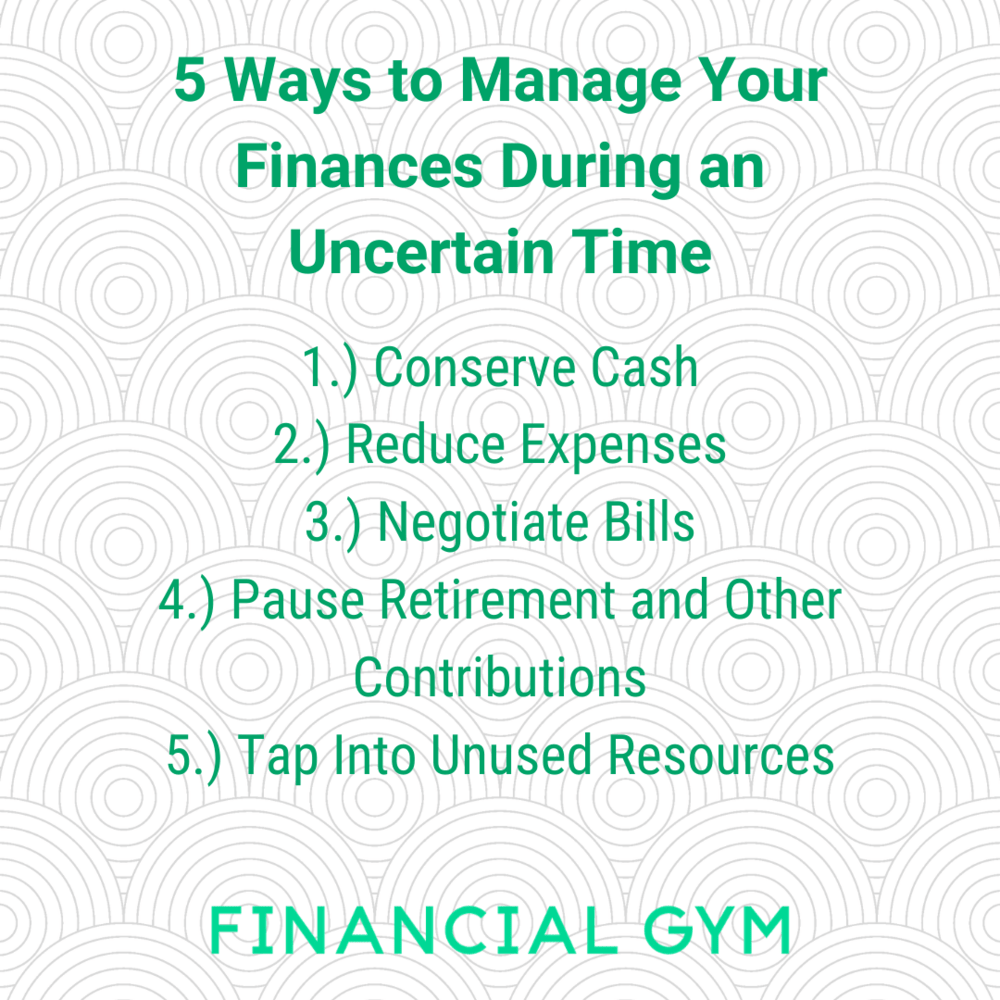

5 Ways to Manage Your Finances During an Uncertain Time

If you are looking to conserve cash during uncertain times, here are some tips you can follow!

5 Job Search Tips During COVID-19

Here are some job search tips to keep in mind during COVID-19.

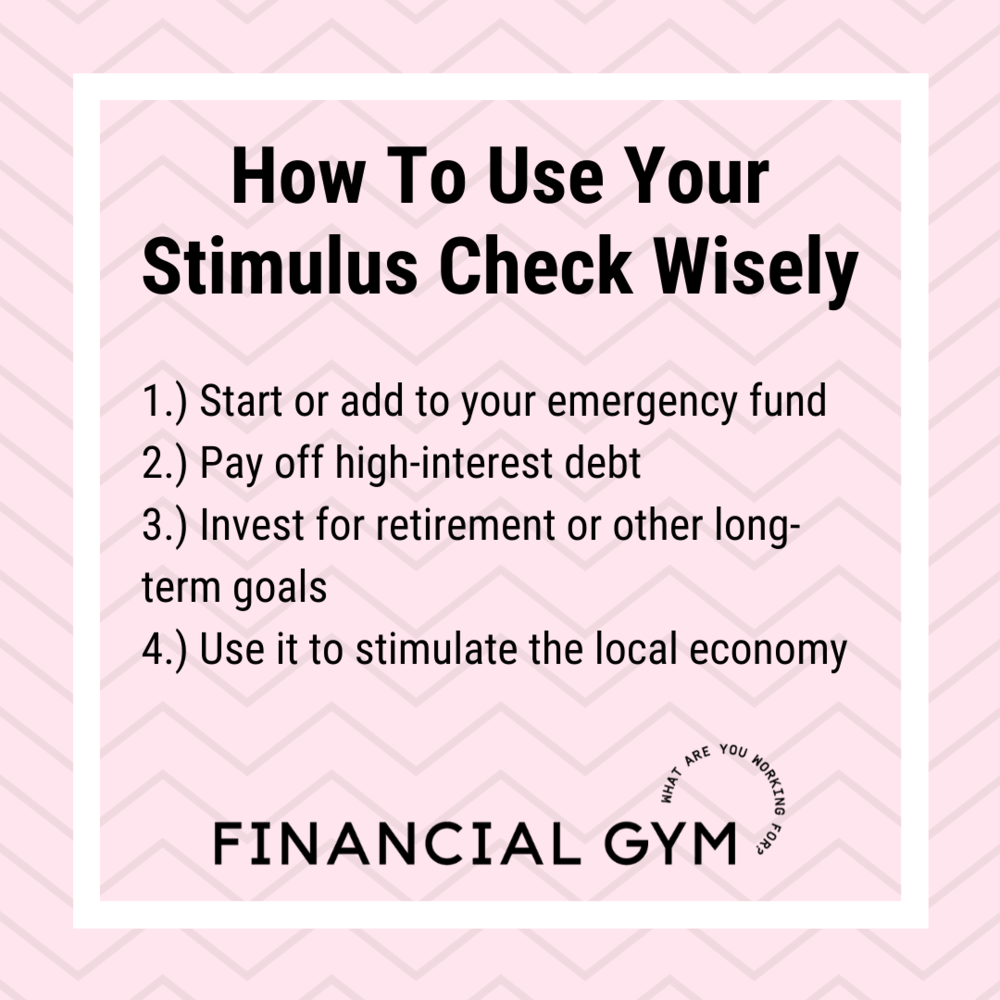

How To Use Your Stimulus Check Wisely

As many of you may know, over 80% of Americans will receive a check from the new government stimulus package. It is important to use this money wisely, so we have compiled a checklist to help guide your use of the money. Here are some guidelines to help you figure out the best use of the check for you.

How to Talk to Your Creditors When You’re Behind on Bills or Payments

Mike Poulin, a Level 2 Financial Trainer here at The Financial Gym uses his prior experience as a Debt Collector to describe how to talk to your creditors when you’re behind on bills or payments.

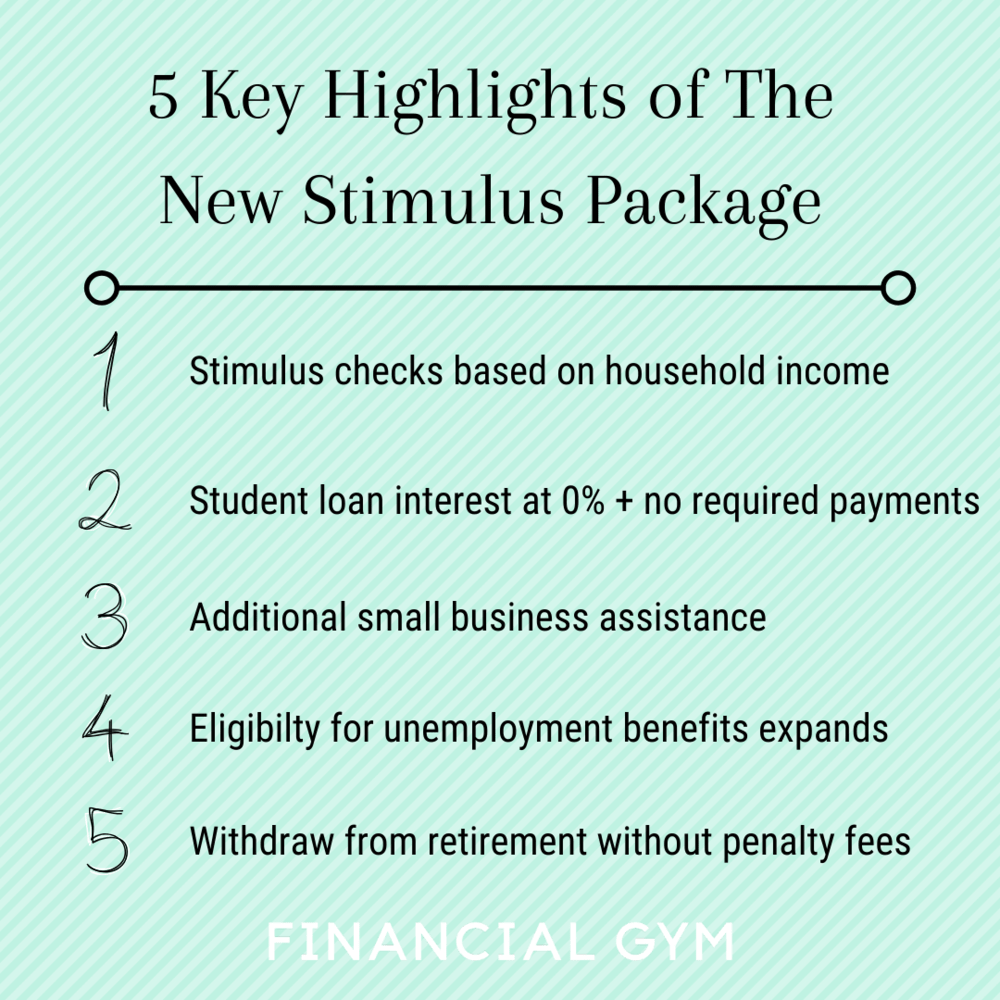

What Are The Highlights of The New Stimulus Package?

You’ve probably heard about the historic $2 trillion stimulus package that was passed last week. There has been a lot of talk about the government giving away free money, expanding unemployment benefits, changing the rules around student loans and retirement accounts, helping small business, and bailing out the airlines, but what does this all mean? How does this affect you and what can you actually expect to gain from this stimulus package? Here’s a quick breakdown of the essential pieces of package and how they affect you.

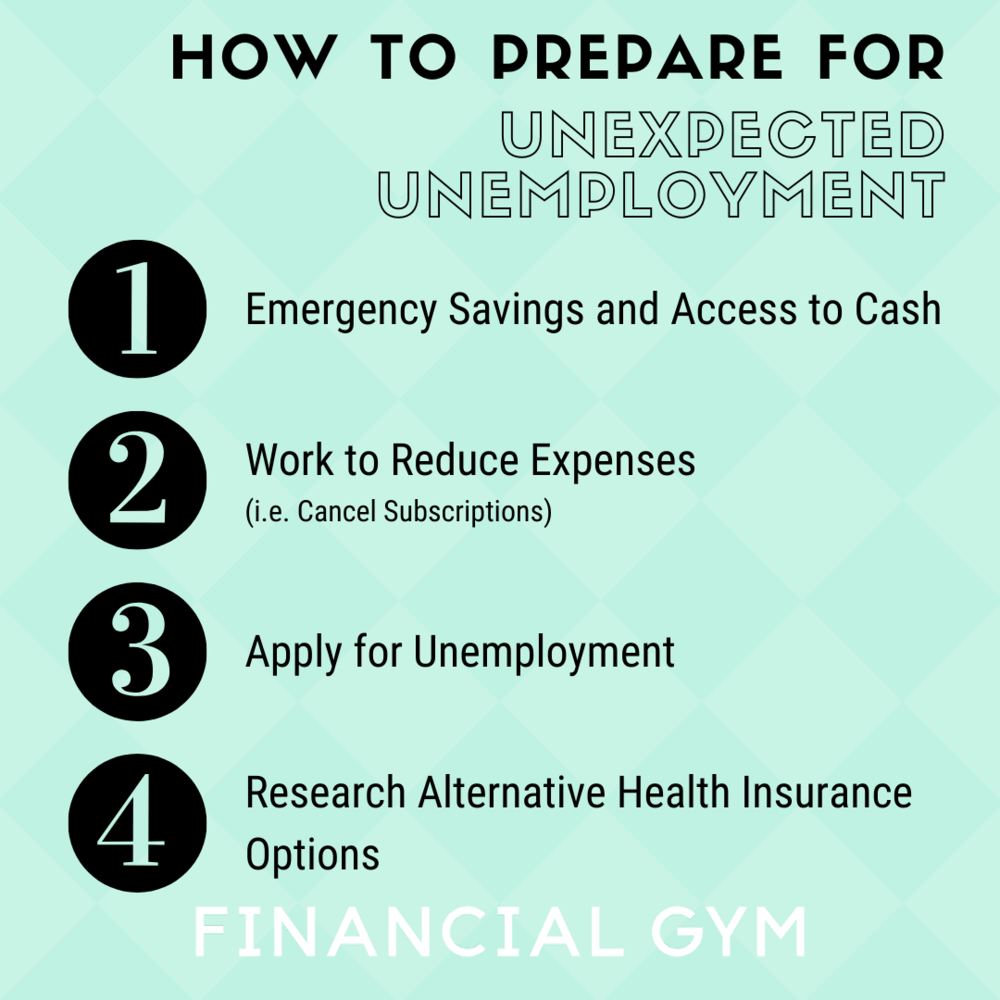

How To Prepare for Unexpected Unemployment

During these unprecedented times, many people have found themselves unexpectedly unemployed. Here are our tips for navigating unemployment.

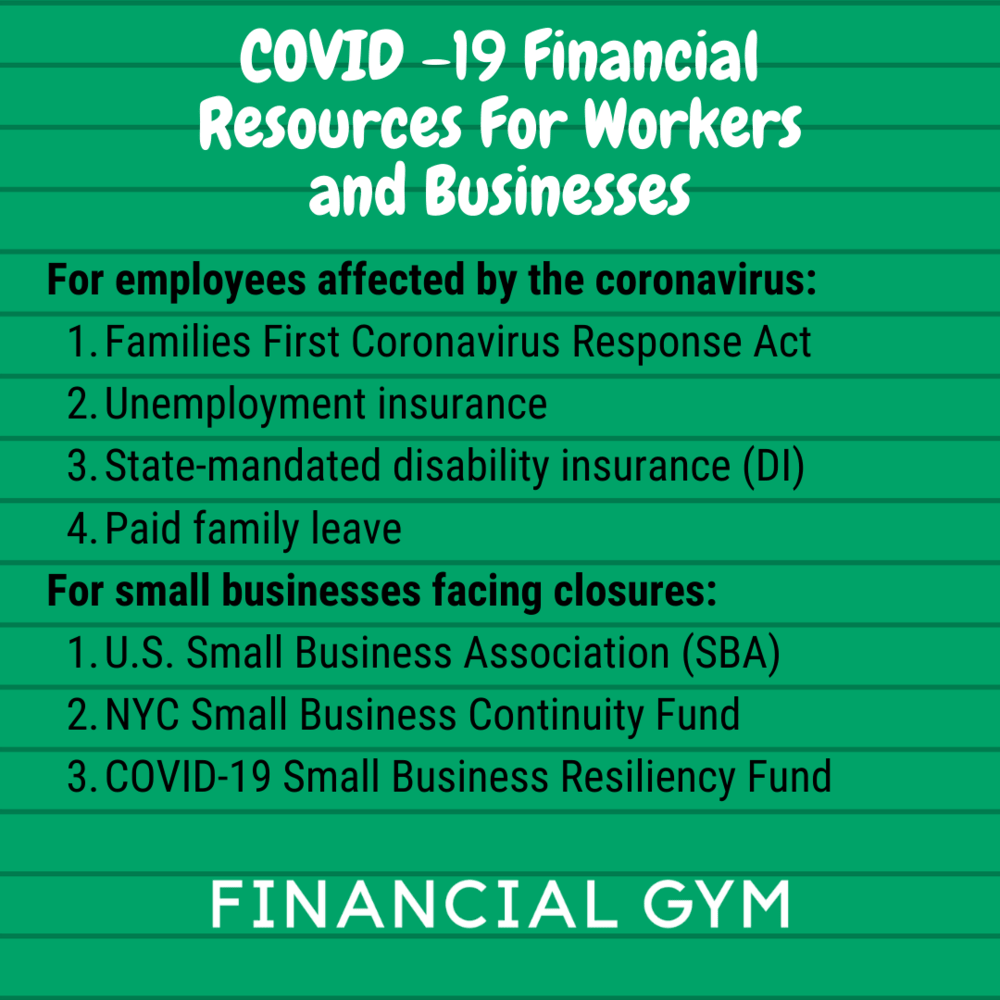

COVID -19 Financial Resources For Workers and Businesses

People all over the country are experiencing economic hardships due to the novel coronavirus, or COVID-19. Many states have mandated closures of restaurants, entertainment venues, and hotels. Leaving many service workers without income and other employment benefits.

The White House recently when it released new guidelines that included avoiding crowds of more than 10 people. In light of heath advisory recommendations, many business owners face uncertainty as Americans hunker down in their homes instead of frequenting local businesses.

As we wait to see what comes of this virus — from both a health and economic perspective — it’s important to know where to find factual information and get the resources and relief that’s desperately needed in some parts of the country.

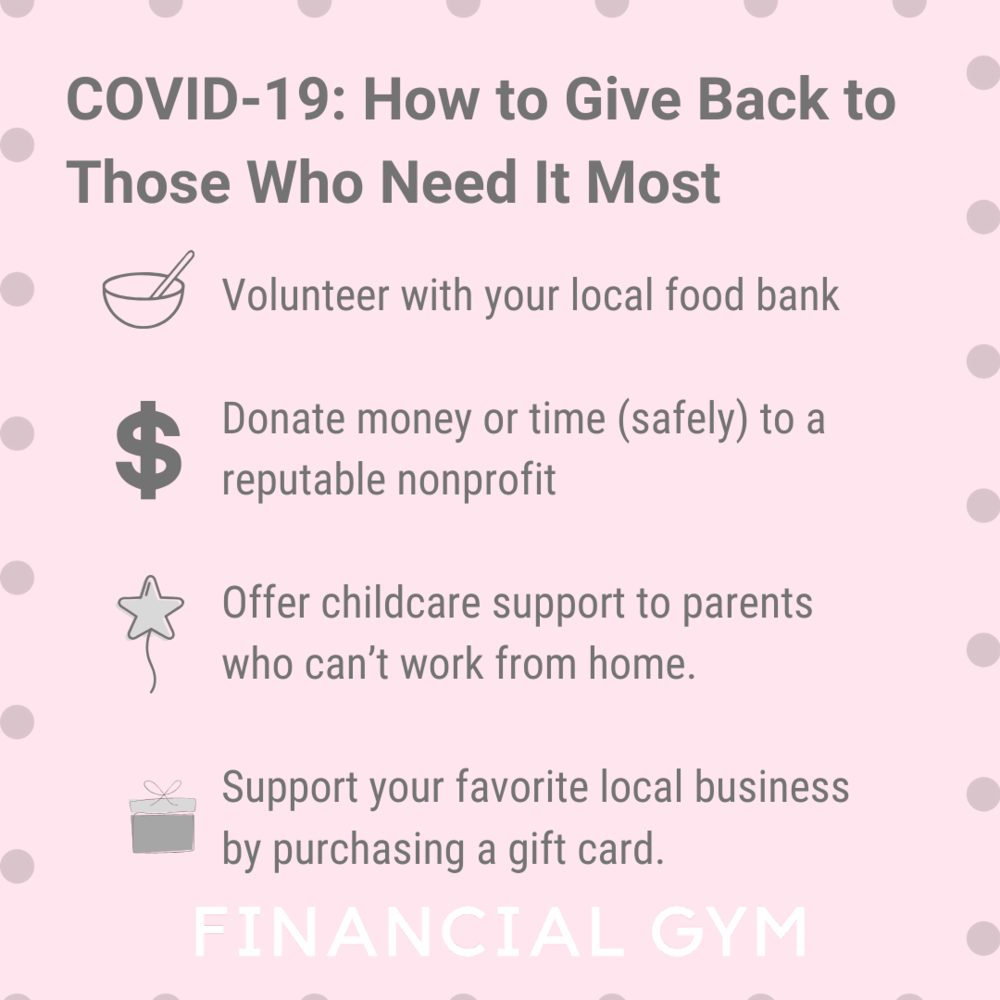

COVID-19: How to Give Back to Those Who Need It Most

The novel Coronavirus, known as COVID-19, is affecting communities worldwide at rapid speed. As of March 18, 2020, the Centers for Disease Control and Prevention (CDC) says there’s been 7,038 total reported cases of COVID-19 in the U.S. These numbers are expected to grow as access to testing becomes more available in the coming weeks.

For many Americans, local and state governments have enacted closure mandates to slow the spread of transmission within communities. The City of Los Angeles, for example, has temporarily closed schools, public buildings, gyms, entertainment venues, and bars, and also ordered a halt to dine-in restaurant service (take-out or delivery orders only).

In the wake of these necessary changes, you’re likely concerned for the well-being of others who lack access to food, medicine, and the financial resources to withstand this pandemic. There are a few ways you can help the people in need in your local community as well as on a larger scale. Here’s how.