The Financially Free Blog

3 Myths About The Current Housing Market

We have partnered with Ardley to bring you the latest information regarding the current housing market. Check out this post to explore these three myths about the current market and steps you can take to ensure a safe and healthy home buying experience.

Negotiating Your Worth in a Pandemic

At The Financial Gym, we’re often telling our clients to “Know Your Worth”-and yes, even in a pandemic you should know and advocate for what you are worth! Negotiations can be scary, especially in these unprecedented times when there isn’t a roadmap or guarantee on what the next few months will look like. The good news is that you CAN negotiate in a pandemic, and the secret is that a lot of the pre-pandemic advice still applies! Whether you’re looking for more money in your current job or hitting the job market, read on for tips on negotiating right now.

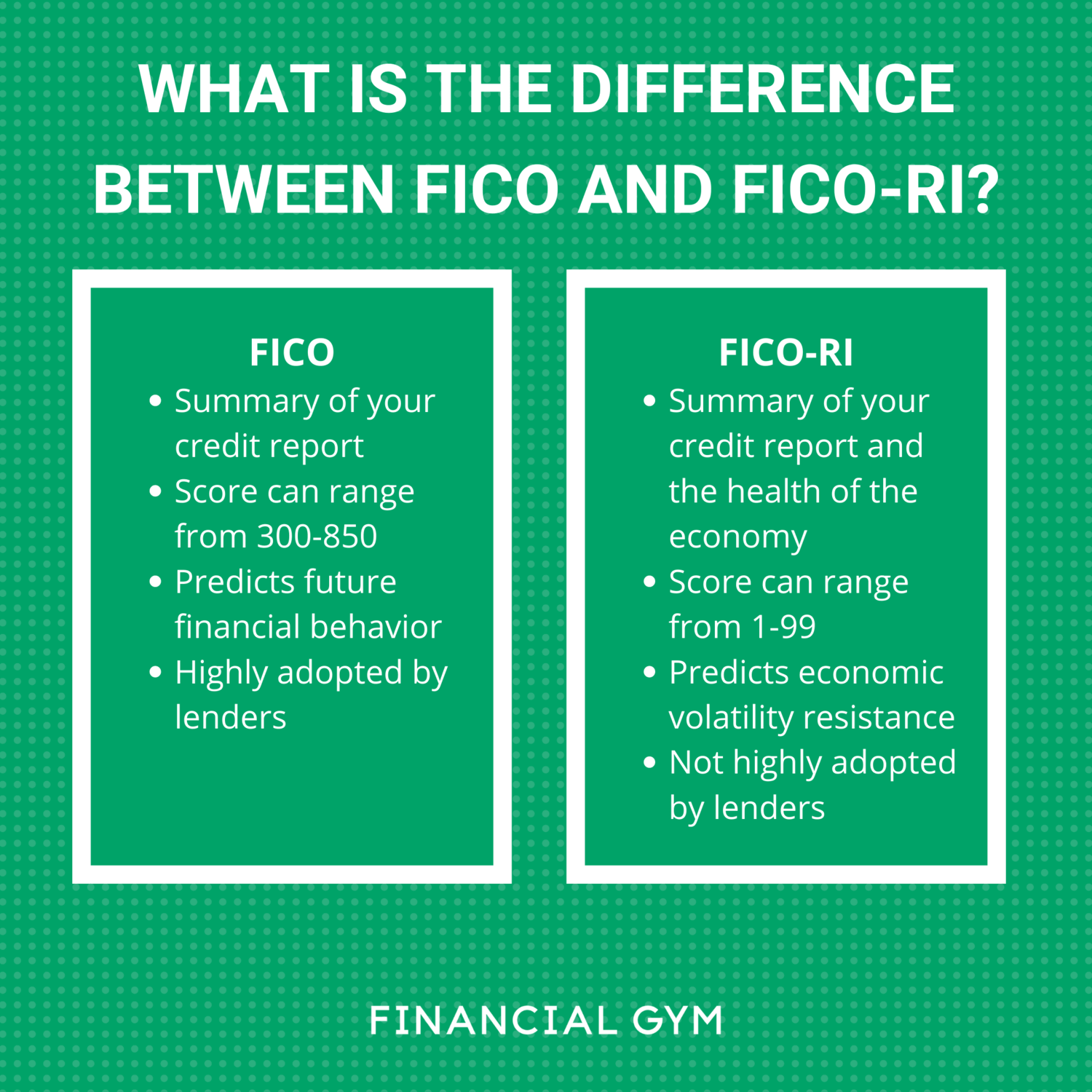

FICO-RI: What You Need to Know

One of the most common concerns of clients at the Financial Gym is maintaining a healthy credit score. Healthy credit scores can get you a lower interest rate on a mortgage, assure a landlord that you’ll be a good tenant, and help you secure favorable rates on debt consolidation loans or student loan refinancing.

Benefits of Using a Black-Owned Bank

Black-owned banks used to be and continue to be a safe place for Black Americans to bank without any discrimination. These banks often help stimulate the economy in under-served communities.

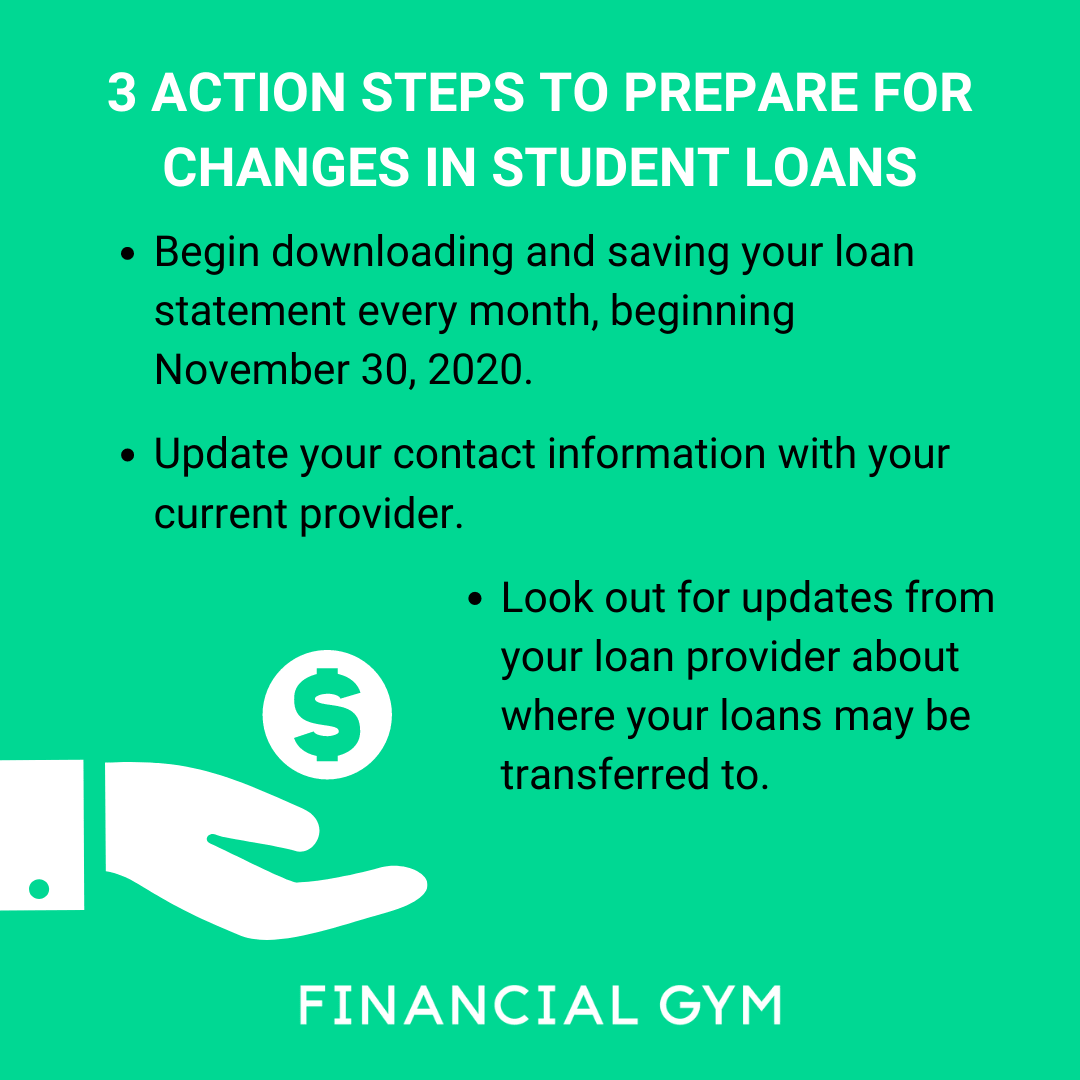

Changes to Look Out For with Your Student Loans

The Federal Student Loan system has seen some major changes over the last few months, with the announcement of the COVID relief program, which brought interest rates to 0% for 6 months, and put a halt on all payments.

How to Make an Impact with Your Money

As Financial Trainers, we’ve had the privilege of witnessing the amazing generosity of our clients throughout the pandemic. An increasingly common question is how to donate and support charities when you’re paying off debt? So, we wanted to compile a list of ways that you can be thoughtfully generous and make your dollar stretch as far as possible!

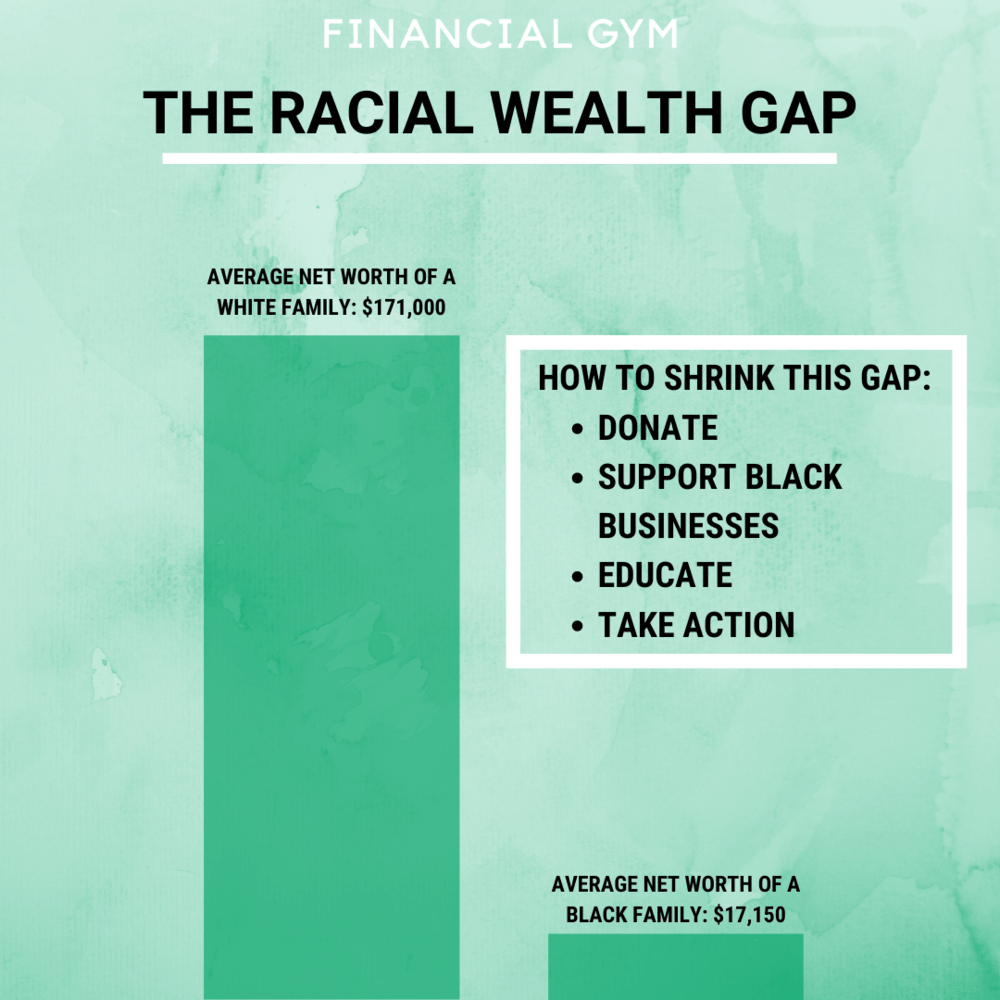

Understanding the Racial Wealth Gap

Ever since the abolition of slavery in 1865, there has been a prevalent racial wealth gap in America. The abolition of slavery was supposed to begin an era of Black wealth in America, but systematic discrimination has made it challenging for Blacks in America to create wealth. There are three main factors driving the racial wealth gap in America, homeownership, household income, and education disparities.

5 Ways to Stay Active in Your Job Search During Covid-19

Your goal is to achieve a job and to be prepared for the expectations that it may come with. All this goes to say, don’t give up! Follow through with these steps to not only achieve your goal, but to be mentally ready! Take breaks, manifest, and think positive! Everything starts with your mind. You got this!

How to Support the Black Community with Your Dollar and Action

It’s no question that the U.S. faces a huge racial wealth gap. The average white family has 10x more wealth than the average Black family. Bringing financial freedom to families all over the nation has always been a priority of ours, and with this goal in mind, we aim to help close this wealth gap.

That being said, there are plenty of ways to help build Black wealth. As a society it is our duty to close this wealth gap. This means supporting Black businesses, donating to charities that help Black Americans, supporting Black creatives, and educating ourselves and our white friends.

Message from the CEO - Trying to Find the Words

Like many people right now, I haven’t been sleeping well. In fact, I’m writing this from my bed at 1:30am and all I can think is that I need to say something but it’s been tough to find the words. Only a week has passed since George Floyd gasped for breath and yet it seems like ages. Probably because George Floyd represents what I hope is the final straw on hundreds of years of racial oppression in the United States. I have been at a loss for words; but there are words for what happened to George Floyd and the unnecessary police brutality against him and the growing number of persons of color and they are: wrong, horrifying, scary, abominable.

Investing 101: What Are Investment Markets?

We originally shared this post a few months ago, but in light of all the questions we have gotten surrounding investing as a beginner, we felt like it was a good time to re-share.

How My “Sober October” Has Shaped My Quarantine Spending Habits

Back in October of 2019, I set a lofty goal for myself to abstain from drinking for an entire month. I was in the final weeks of training for the NYC marathon and I thought my body would be better off if I were to cut alcohol out. After *mostly* taking the month off from drinking, I learned a few key things about mindfulness that are very applicable to “Quarantimes” as we like to call it here at the Gym.

When Doing Your Own Taxes Makes Sense vs. Hiring a Tax Preparer

Whether you're taking advantage of the extended deadline to file your 2019 tax return or are thinking ahead to your 2020 return, here are some considerations..

Regardless of the outcome, each taxpayer must decide how they’ll file their taxes. Although online tax software can make doing your own taxes fairly simple, it’s not a one-size-fits-all solution.

Here are some scenarios to help you decide whether you should do your own taxes or hire a tax professional.

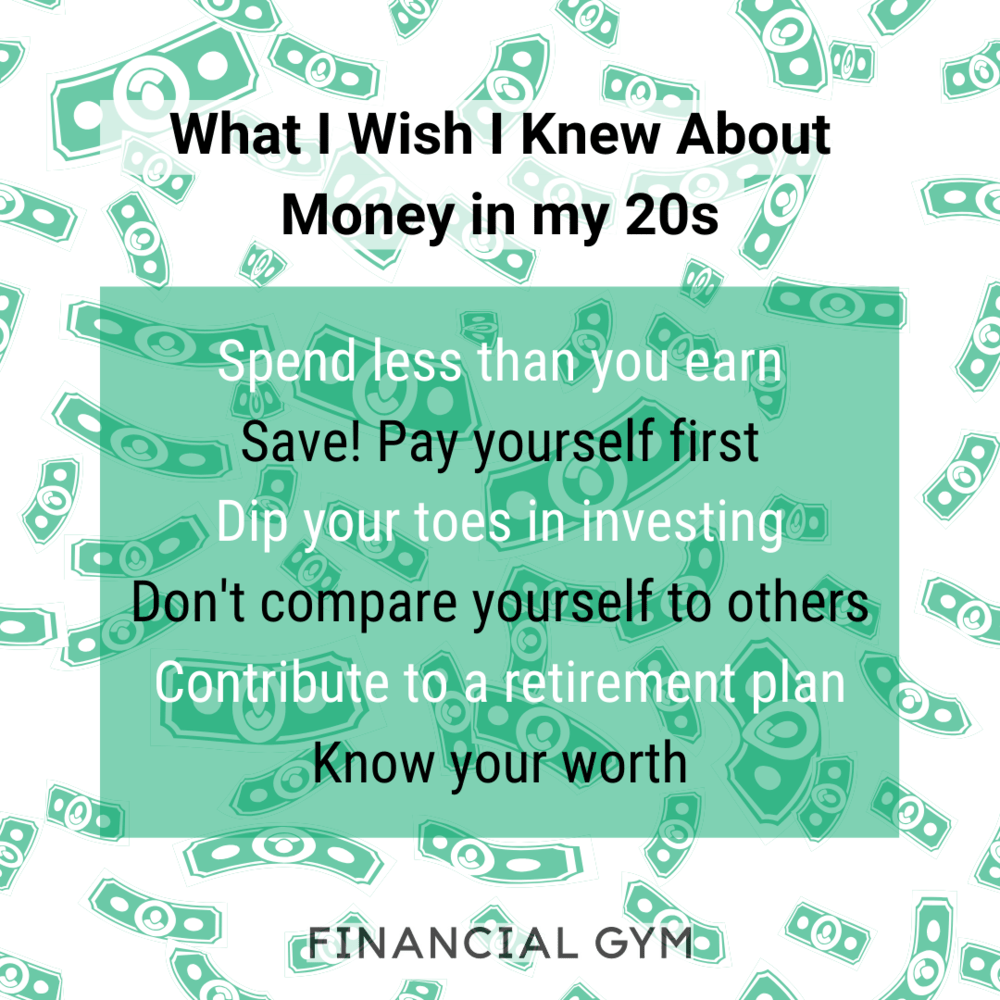

What I Wish I Knew About Money in my 20s

After the interest in Gus & Kadri’s podcast about overspending in their 20’s, we decided to put their advice into words. Kadri shares his story of overspending, followed by Gus’ advice for how to control your spending habits in your 20s.

A Day in The Life of a FinGym Trainer

When I meet new people, or I am catching up with friends or family and they ask “What do you do?” and I respond with “I’m a Financial Trainer” it’s usually met with a puzzled look or a follow up question sort of like “Is that like a Financial Advisor or….?” I explain that we aren’t a traditional financial company, we are set up a lot like a traditional gym, where you pay a monthly membership and you get complete access to your Best.Financial.Friend. (me) a lot like a personal trainer! I am extremely up front with my clients from day one: I don’t make commission, I am not here to sell you life insurance, my #1 goal is for you to be successful in your personal financial journey, your membership pays my salary!

How to Plan for Post College

First of all, congratulations! Your hard work HAS paid off. It may seem anti-climactic with the lack of formal celebration, but we are proud of you and we are cheering for you!

One of the more important things to remember as a new grad is that the transition into the “real world” (as many call it) can be challenging. It’s not easy to go from higher education to working a full-time job! It is also important to remember that your plans have likely changed, it may be challenging to get a job right now, and even if you are fortunate enough to have secured one, it probably doesn’t look the same as it did a few months ago. For these reasons and more, it can be hard to have a clear plan of what is next. College graduation can be a tough transition for many and is even tougher now, due to the impact COVID-19 has had on higher education and the global economy. This is why it is more important than ever to be easy on yourself. Remind yourself of why you got a degree, and of how proud of yourself you are for completing it. Be gentle with yourself.

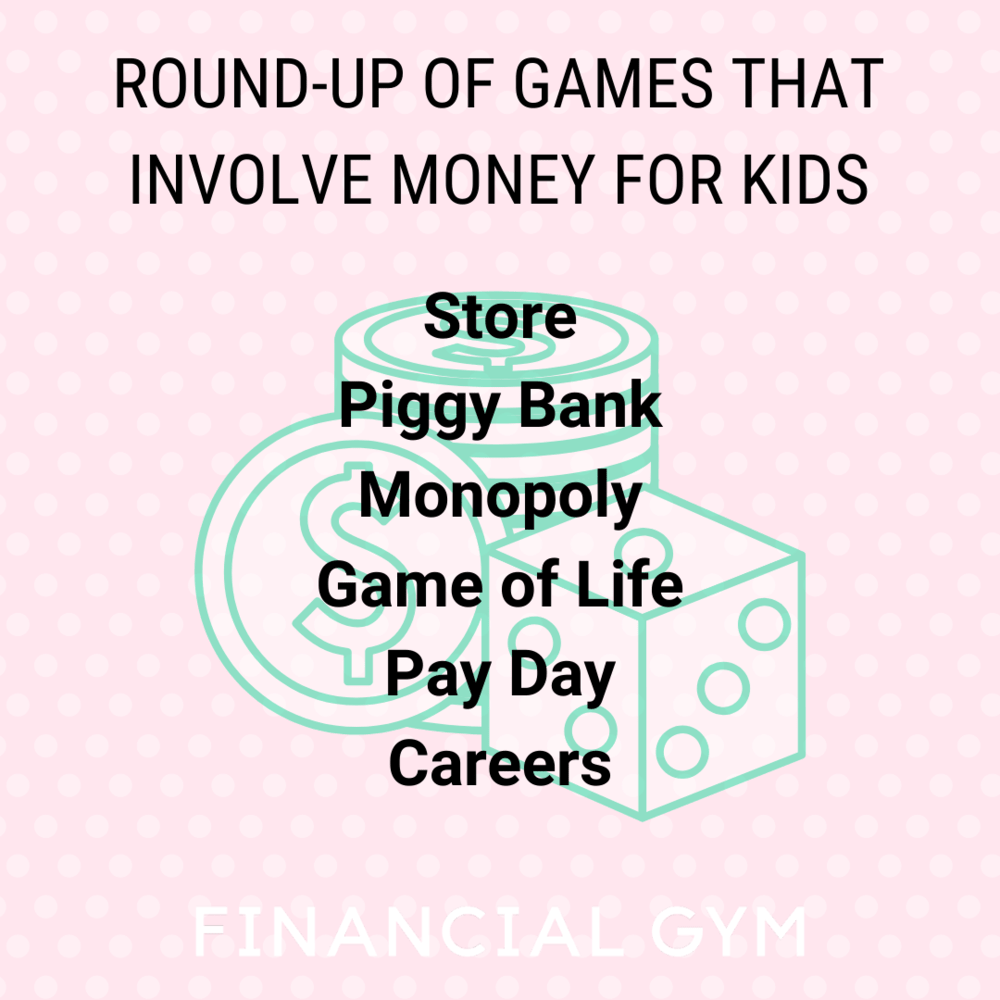

Round-up of Games That Involve Money for Kids

Teaching financial literacy to children can be a daunting task, but introducing fundamental financial concepts now can set them up for a stable future. Instilling the building blocks of saving, spending and making money early on can help prepare your children to be financially wise.

Not sure how to teach kids about money? Here are six games you can use to help teach your kids about money.

5 Tips for Couples With a Shared Credit Card

Sharing important areas of your life — including your finances — is a common part of building a deeper relationship with a long-term partner. Whether you’re newlyweds in need of a shared credit card, or in a committed relationship and want a shared card to cover date nights and communal household supplies, opening a credit card account together can be a useful financial tool.

Learning a few key credit card strategies for couples can help you and your spouse or partner manage expectations for the new card. Here are a few tips for a more positive shared credit card experience.