The Financially Free Blog

What to Know About Sales Tax Holidays

We’ve all heard the saying, “Nothing is certain except death and taxes,” but millions of people can avoid taxes for at least a few days each year through a sales tax holiday. Read about what a sales tax holiday is and how to get the most out of it.

6 Tips On How to Reposition Yourself After a Job Loss

Maybe you saw it coming, maybe it blindsided you, but it happened: you lost your job. Whether it’s from a change in the industry, a layoff due to company finances, or even something specific to you and your role, the end result is the same: you’re looking for work.

Best Credit Card Perks for the Summer

Summer is a time for fun, but between travel, activities, and cookouts, it can be hard on your bank account. Luckily, you probably already have something in your wallet that can help reduce costs and make your summer more enjoyable: a credit card with perks. Here are the best credit card perks to take advantage of this summer.

What to Know About Paused Payments For SAVE Plan Borrowers

Federal student loan borrowers have been experiencing whiplash as legal challenges to the SAVE plan move throughout the courts. In late June, district court judges in Missouri and Kansas paused parts of the SAVE plan, but an appeals court ruled that parts of it could continue. On July 18th, another appeals court ruling of the Missouri case blocked implementation of the SAVE plan entirely until that case is resolved.

5 Ways to Keep Your Summer Spending in Check

Happy hours…weekend trips…BBQs….weddings….Do you find yourself spending extra during the summer months? Here’s how to keep your summer spending in check.

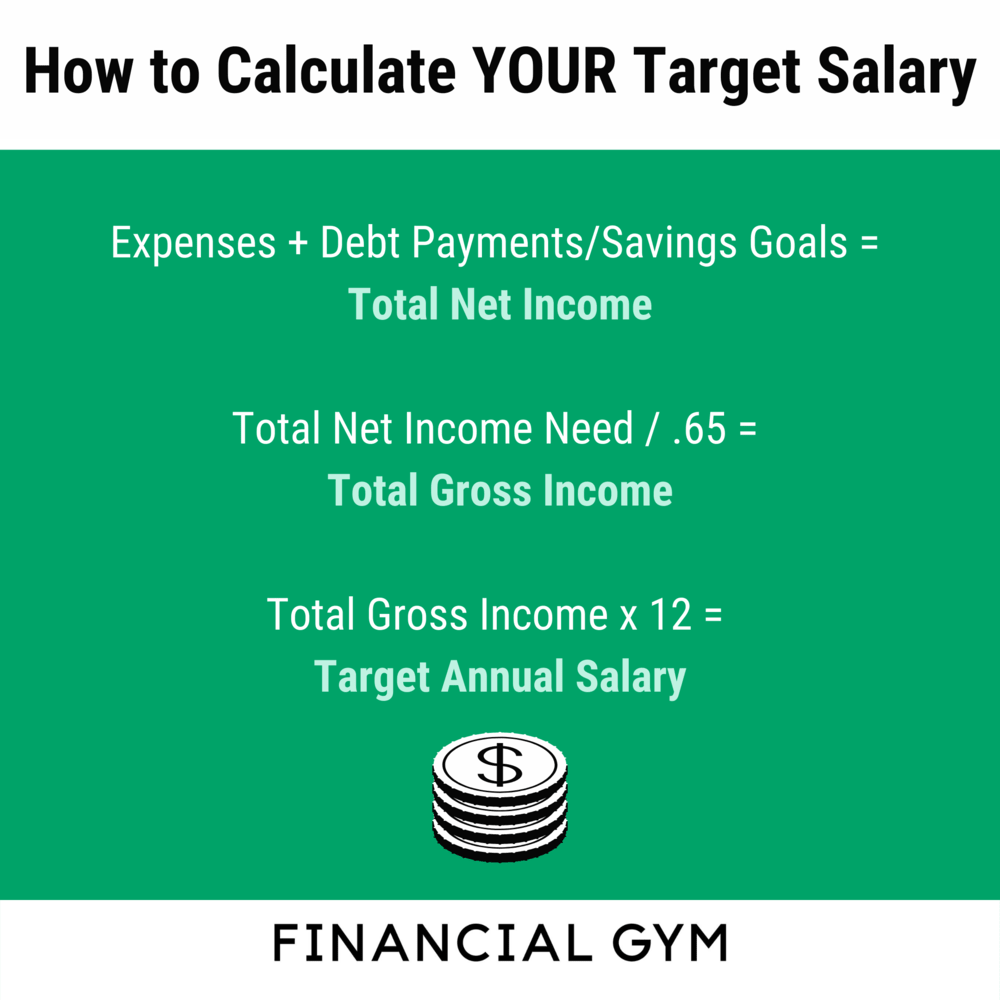

4 Ways to Figure Out What You Need to Earn

Much of the time we find that our clients who are struggling to make all of their expenses and save money on a monthly basis simply need to make more money. This may sound like a no-brainer, but it is important to recognize your worth! If you think this situation is applicable to you, check out our salary negotiation tips during a pandemic.

5 Creative Savings Tips When Attending a Summer Wedding

Does it feel like your calendar in the next few months is inundated with wedding festivities? Don’t worry — you’re not alone: about 30% of couples tie the knot during the summer.

How to Live Rent-Free

These days, affording day-to-day expenses—including a place to live—is putting a strain on renters’ budgets. The numbers back that up: between 2019 and 2023, rent prices increased by over 30% across the country. However, if you are willing to get creative, there are options for living rent-free!

Mid-Year Check-In: Are You on Track With These 5 Goals?

The summer months are a good reminder of how time flies when you’re working toward your personal goals. With the end of 2024 creeping up on the horizon, now’s a perfect time to do a financial wellness check and keep your finances in tip-top shape.

Here are a few areas to check-in with to make sure you’re on track for a financially fit year.

3 Essential Concepts To Reach Financial Independence

Financial independence—having enough financial resources to cover your expenses without working—is appealing to just about everyone. Even if you love your job and plan to work all your life, you might not always have that luxury as layoffs or health issues could affect your plans. For that reason, we at the Financial Gym believe that financial independence should be on everyone’s goal list, and no matter where you are starting financially, you can actively work toward financial independence. Here are three financial independence concepts that will help you get there.

What You Should Know About Challenges to the SAVE Plan

Do you ever feel like you just can’t catch a break? That’s the sentiment among many student loan borrowers ever since the Supreme Court struck down President Biden’s initial student loan forgiveness plan last year. Just last week, borrowers got more bad news from the courts: two provisions of the SAVE plan have been (at least temporarily) halted by legal challenges.

How to Choose a 529 Plan

Whether you’ve just had your first child or it’s been a few years, at some point, saving for your child’s college education has likely crossed your mind. Choosing where to set up an account can be a major barrier to getting started, and for that reason, many people default to their own state’s 529 plan, but that might not always be the best option. Follow these steps to pick the best 529 plan for your family.

The Cost of Keeping Cool: Managing Air Conditioning Expenses in Summer

As the summer heat ramps up, so does the temptation to crank up the air conditioning. While it's a relief to have a cool oasis indoors, it can also lead to a spike in energy bills. Managing air conditioning expenses effectively can help keep your home comfortable without breaking the bank. In this blog post, we'll explore strategies for controlling and reducing air conditioning costs during the summer months.

4 Steps to Financially Prepare for Parenthood

Starting a family is a life-changing—and budget-altering—experience. The transition of welcoming a new family member into your home (and tending to their every need) will come with challenges. While parenthood overall is not something that you can entirely prepare yourself for, you can prepare yourself financially with these four steps.

4 Mental Spending Loopholes That Are Keeping You Stuck

When it comes to making financial changes, you might be your own worst enemy. One of the ways you may be working against yourself is by exploiting mental loopholes: rather than sticking to what you said you would do, you find a reason or justification not to follow through. It’s not really your fault—your brain is trying to protect you from having to do extra work. Even so, if you want to make a change to how you spend money, you’ll need to learn how to spot and avoid these loopholes.

Why You Should Still Apply for Jobs That You Aren't Qualified For

As a Recruiter, the number one question people ask me is - “Do you think I qualify for this position?” I never give a concrete answer because I feel as if it is the candidate’s job to feel confident in what they are applying for. Here, at The Financial Gym, we hire people with an array of skills and backgrounds for positions that do not technically align with their resume. What are some reasons employers will still interview a candidate who does not have the technical skills for the current position?

What Does APR Mean for My Credit Cards?

Paying off debt is the most common financial goal of 2024. Getting out of debt is simple, but it’s not easy. To get out of debt (and stay out), it’s crucial to understand the details of your debt, especially the APR. Here are five common questions about APR.

3 Work-Sponsored Benefits To Check Before Starting a Family

Having a child is a deeply personal decision, but also a financially impactful one—studies estimate that the average middle-income family will spend $310,605 to raise a child to age 17. In the United States, where you work has a major impact on the cost of starting your family. Here are three employer-sponsored benefits you should review to help estimate how much it will cost you to have and care for a new baby.

How to Get Physically Fit (While Staying Financially Fit)

Do you want to work out without breaking the bank? The typical gym membership costs between $40-$70 per month but premium gyms and personal trainers can cost up to ten times that amount. Here are five ways to get physically fit without compromising on your financial fitness.

Is Moving to A Cheaper Place Worth It?

With rent prices up about 30% compared to pre-pandemic, moving to a place with cheaper rent sounds like a great way to save money. In some cases, a move can pay off, but moving is also expensive, and the costs associated with it (along with extra hidden monthly costs) mean you might be saving less than you thought—or it could even mean that you end up paying more! To figure out whether moving will actually put money back in your pocket, make sure you consider these expenses.