The Financially Free Blog

How To Handle Income Inequality In Your Relationship

It’s not surprising that in an American Psychological Association report highlighting the largest stressors of America, work and money were identified as the highest personal stressors. It’s also long known that money problems are large contributors to relationship conflict, often leading to divorce.

Financial issues can vary from not having enough money to dealing with overspending, but one area that’s a large contributor to relationship conflict is income inequality. When one partner earns more income than the other, complex issues can develop from either partner.

Black History Month: How This Tool Shaped My Financial Education

In honor of Black History Month, our wonderful Financial Trainer, Chandra Savage, shares with us about her first financial education experiences as a young black woman.

9 Ways to Spend Less Money On Food

Every dollar counts when you’re trying to save money and keep your finances in order. Groceries are a significant line-item expense for every family’s household budget.

According to the Bureau of Labor Statistics, the average American consumer spent around $4,500 on groceries in 2018. Here’s how to save money on groceries without completely changing your lifestyle.

How to Use a Bullet Journal to Track Your Financial Goals

Are you looking for ways to track your financial goals? A bullet journal is a useful strategy some people use to organize and reach their financial achievements. Not quite sure how a bullet journal works? Here’s how you how to use a bullet journal to help you track your financial goals.

How to Pay Off Credit Card Debt Faster

Revolving lines of credit, like credit cards, are a helpful tool when used responsibly. However, it can also lead to a slippery slope when it comes to wracking-up credit card debt. Although getting out of credit card debt isn’t as easy as snapping your fingers and wishing it away, there are a few strategies to repay your debt faster.

14 Fun and Cheap Ways Singles Can Celebrate Valentine's Day

Valentine’s Day may bring up mixed feelings, whether you’re attached or not. Despite being regarded as an excuse to show your affection in a spendy way, it can isolate those who aren’t in a romantic relationship.

Although it’s conventionally considered a couples-only event, there are endless Valentine’s Day ideas for singles to enjoy the holiday, too. Here’s how to spend Valentine’s Day when you’re single without blowing your budget.

I Turned to Freelancing and Quadrupled My Assets in 3 Months

Analisa Cantu has been an FG client since October 2019. When she’s not bearing her financial soul to her coach, Terri, she’s probably on a flight somewhere and makes her dollars as a freelance content strategist.

What You Need to Know About a Credit Freeze

According to a recent Javelin identity fraud study, 14.4 million consumers were victims of identity fraud in 2018. Identity thieves may target your banking information or access your sensitive personal information through companies whose services you’ve used.

If your personal information is compromised, you may be at risk of having your identity stolen — which can wreak havoc on your finances and quickly consume all aspects of your life. If you’re worried your identity may be at risk, a credit freeze may help prevent further identity theft.

How to Meal Prep on a Budget

Cutting back on expensive restaurant meals in place of meal prepping is an effective way to reduce food spending and regain mindful eating habits. The Bureau of Labor Statistics found that households spend an average of $3,365 annually on food outside of the home.

Planning at least one daily meal, whether it's your workweek lunch or dinners, can literally save you thousands of dollars this year. Meal prep on a budget might make you envision a rice-and-beans diet — and although that can be a filling meal prep option — there are many ways to find meal prep ideas for less.

Here are a few tips to start cheap meal prep habits today.

10 Valentine's Gifts Your Partner Will Remember

Finding the “perfect” Valentine’s Day gift can feel like a lot of pressure, regardless of who you choose to celebrate with. If you want to go above and beyond to show your appreciation for your partner, this list of Valentine’s Day ideas can help you find a present that’s meaningful.

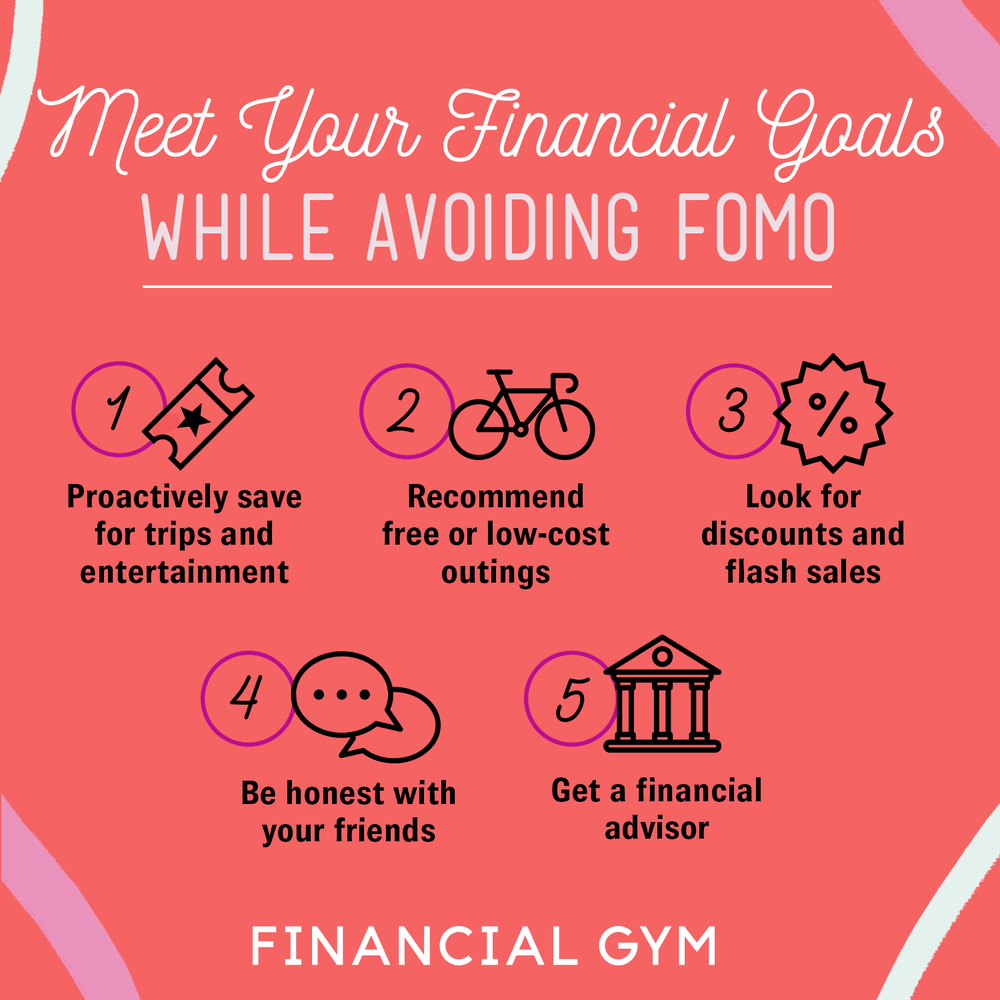

How to Meet Your Financial Goals While Avoiding FOMO

While living in New York, I’ve found it daunting to prioritize my financial goals. With dozens of exciting countries to visit with friends on my bucket list, an invitation to eat out pretty much a few times a week, and a zillion things to do literally at all hours of the day, how could I avoid experiencing FOMO while keeping my financial goals top of mind?

Here are a few tips that have helped me be more financially savvy while maintaining a healthy social life.

9 Things to Do Instead of Dining Out

Having a delicious meal is just the icing on the cake — the real treat is spending time with friends, family or going on an exciting date. Social outings keep us connected by growing relationships, but there are so many things to do with friends and others in your inner circle than spending money at a restaurant.

Here are some ways to have fun without dining out.

How to File for Bankruptcy

If you’re overwhelmed by debt, bankruptcy may be a financial tool that gives you a fresh start. Filing for bankruptcy stops debt collection calls, wage garnishment, and debt lawsuits. It may also give you the opportunity to wipe your slate clean by discharging your outstanding balances.

But it won’t solve all your financial problems. Obligations like alimony and child support won’t be included, and your chances of getting your federal student loans eliminated are slim. You’ll also take a major hit on your credit.

Here’s what you need to know about filing for bankruptcy.

6 Pantry Items to Always Have for a Cheap At-Home Meal

We’re just a couple of weeks into the roaring 20s — 2020, that is. New Year’s resolutions are in full-swing, kickstarting financial and wellness goals. A hybrid resolution you might’ve adopted this year is dining out less.

Cooking at home, instead of grabbing take-out, not only helps you make healthier meal choices but is also a great way to save money. Wellio, a digital meal prep system, found that ordering restaurant delivery is five times more expensive than a homemade meal. Even meal prep subscriptions, albeit convenient, cost three times more money than making cooking at home, from scratch.

To maximize your food savings, and also make it possible to cook easy, healthy dishes, having a well-appointed pantry is essential. Here are the kitchen pantry items you should always have in your home.

7 Tips to Rent an Apartment With Bad Credit

A bad credit score can limit your access to credit cards, loans, and sometimes, even job opportunities. But what you may not know is that a poor credit score can also minimize your housing options.

Property management companies and individual landlords may require prospective tenants to have a minimum credit score to qualify. According to credit bureau Experian, FICO scores of 669 or lower are considered subprime borrowers. Although it might be more challenging to secure your dream apartment with a low credit score, it’s not impossible.

Here are a few ways to help you get approved for your next apartment if you have bad credit.

5 Inspiring Personal Finance Podcasts You Need to Hear

Podcasts can be a great way to mix up your routine and learn a lot of new information, especially when it comes to personal finance. If listening to a personal finance podcast reminds you of just another droning professor in the lecture hall, you’ll be pleasantly surprised. We’ve listened to many podcasts about money and distilled our list to the best in the pack.

With engaging guests that don’t talk just charts and formulas, the concepts in these best podcasts are easily digestible and you can bring them anywhere with you — the car, running on the treadmill — and get insight into expert information for free.

11 Affordable Ways to Stay Healthy This Year

If staying on top of your health is your main mantra this year, knowing how to stay fit, affordably, is just as important as figuring out where to start. Although hopping on the latest luxury gym membership might sound appealing, for example, spending more than $100 a month on exercise can blow your budget.

Fortunately, with a little bit of creativity, you can eat and exercise in a way that keeps your financial wellness intact, too. Here’s how.

5 Money Moves to Make When You Get a Raise

New year, new salary! According to the Economic Policy Institute, nearly seven million people are starting 2020 with a raise. The rise comes from a higher minimum wage across 22 states nationwide.

If you’re starting the year with a bigger paycheck — congrats! Before getting too late into the year, it’s smart to set yourself up for financial growth success throughout the year by taking a few simple steps. Here are a few ideas on what to do after getting a raise at work.

Holistic Wellness Includes Financial Fitness

Hello, beautiful people on a journey to live your best life! I’m Jillian Faulks-Majuta, a mother of 6- and 8-year-old cubs, a lover of travel, food and community events. I’m also a wellness practitioner who was making strides in just about all parts of my life, except my finances.

I became a member of The Financial Gym in October 2018 after having many conversations with my cousin about needing to make some BIG money moves. I’m an avid podcast listener and have gained a bunch of knowledge, tips, and motivation to make adjustments about the way I make, save, spend and respect money so I could stop living from paycheck to paycheck.

Car Repossession: What to Expect & Knowing Your Options

Owning a car can be quite a luxury, but it can also take a nice chunk of your paycheck each month. According to Experian, the average monthly payment is $554 for a new car and $391 for a used car. If you have other major financial obligations, like a mortgage or student loans, you may be struggling to stay on top of your car payments.

Auto loans that become delinquent run the risk of ruining your credit and having your car repossessed. Here’s what you need to know about the car repossession process and your options.