The Financially Free Blog

A Beginner's Guide to Filing a Tax Return

** Our Trainers are not tax advisors nor do we provide specific tax advice in this blog. The purpose of this blog post is to provide a general overview.

If you had an on-going income source this past year, you’ll likely need to file a tax return. Your return is the government’s way of documenting and collecting on the taxes you owe, which pay for all types of government services.

Your employer will typically withhold taxes from your paycheck throughout the year, but it may not be enough to cover your tax bill, in which case you’ll owe Uncle Sam. Your tax contributions throughout the year may also have been too much — resulting in a refund.

But there are many scenarios that make filing your taxes more complicated. For instance, not everyone works in a wage-earning role. Some people earn income as an independent contractor or receive dividends from investments. Additionally, there are numerous ways to reduce your taxable income, thereby, reducing the taxes you’ll owe.

Because of all these nuances, taxes can feel intimidating. Here’s a breakdown of the basics of a tax return to ensure you’re prepared to file your taxes this season.

Coronavirus: How to Protect Yourself and Prevent Spreading the Disease

If you’ve visited your local drugstore only to find that hand sanitizer is out of stock, or received an email from your employer announcing a temporary work-from-home policy for anyone who’s traveled in the last 14 days, you’ve likely felt the effect of the trending Coronavirus.

Related: Understanding Your Employee Benefits

Strategies to Avoid Buyer's Remorse

The excitement of a new purchase — whether it’s a small purchase at the department store or a large purchase, like a new car — feels good. Psychological studies reveal that the excitement and anticipation of getting a reward (i.e. what you’re buying) increases dopamine levels in the brain. This chemical shift gives shopping and spending money almost addictive quality.

Until you realize that you’ve blown your budget or the psychological “high” of the purchase fades and you’re faced with buyer’s remorse. Don’t let your spending habits reach this point. You can preemptively avoid this spending cycle by practicing these tips to avoid buyer’s regret.

Related: What I Learned From a Three-Month Retail Spending Freeze

How to Save $1,000 by July for a Summer Vacation

It might still be winter in many parts of the U.S., but let’s be honest — you’re already dreaming of your next big vacation this summer. If you don’t quite have the funds to book your summertime flight, there’s no better time to put together a vacation savings account than now.

By taking thoughtful steps toward building a vacation fund today, you can save $1,000 by the end of July. These five steps can help you reach #vacationgoals this summer.

7 Tax Deductions & Write Offs That Save You Money

Filing your taxes can be complicated, which makes it easy to overlook tax deductions that could save you money. Whether you choose to claim the standard deduction or itemize your tax return, there are various tax deductions that are worth exploring.

Here’s a list of common tax deductions that many taxpayers often miss.

What is a 1099?

The Internal Revenue Service (IRS) uses a series of “information returns” called 1099s to track income received other than the salaries and wages paid by an employer.

Although most people think of a 1099 as being an independent contractor tax form, there’s a wide variety of forms and types of income that need to be reported.

Here’s a brief overview of the 1099 tax forms you may come across when preparing your taxes.

How to File Your Taxes Jointly for the First Time

When you decided to say “I do”, you may not have considered the future tax implications of getting married. Marriage changes your taxes — from the credits and tax deductions you can claim, to certain tax breaks that come with filing jointly.

However, not everyone chooses to file their taxes together. Depending on your personal circumstances, you may find that filing separately serves each of you better.

Here’s a tax crash course for newlyweds who are filing together for the first time this coming tax season.

How To Handle Income Inequality In Your Relationship

It’s not surprising that in an American Psychological Association report highlighting the largest stressors of America, work and money were identified as the highest personal stressors. It’s also long known that money problems are large contributors to relationship conflict, often leading to divorce.

Financial issues can vary from not having enough money to dealing with overspending, but one area that’s a large contributor to relationship conflict is income inequality. When one partner earns more income than the other, complex issues can develop from either partner.

Black History Month: How This Tool Shaped My Financial Education

In honor of Black History Month, our wonderful Financial Trainer, Chandra Savage, shares with us about her first financial education experiences as a young black woman.

9 Ways to Spend Less Money On Food

Every dollar counts when you’re trying to save money and keep your finances in order. Groceries are a significant line-item expense for every family’s household budget.

According to the Bureau of Labor Statistics, the average American consumer spent around $4,500 on groceries in 2018. Here’s how to save money on groceries without completely changing your lifestyle.

How to Use a Bullet Journal to Track Your Financial Goals

Are you looking for ways to track your financial goals? A bullet journal is a useful strategy some people use to organize and reach their financial achievements. Not quite sure how a bullet journal works? Here’s how you how to use a bullet journal to help you track your financial goals.

How to Pay Off Credit Card Debt Faster

Revolving lines of credit, like credit cards, are a helpful tool when used responsibly. However, it can also lead to a slippery slope when it comes to wracking-up credit card debt. Although getting out of credit card debt isn’t as easy as snapping your fingers and wishing it away, there are a few strategies to repay your debt faster.

14 Fun and Cheap Ways Singles Can Celebrate Valentine's Day

Valentine’s Day may bring up mixed feelings, whether you’re attached or not. Despite being regarded as an excuse to show your affection in a spendy way, it can isolate those who aren’t in a romantic relationship.

Although it’s conventionally considered a couples-only event, there are endless Valentine’s Day ideas for singles to enjoy the holiday, too. Here’s how to spend Valentine’s Day when you’re single without blowing your budget.

I Turned to Freelancing and Quadrupled My Assets in 3 Months

Analisa Cantu has been an FG client since October 2019. When she’s not bearing her financial soul to her coach, Terri, she’s probably on a flight somewhere and makes her dollars as a freelance content strategist.

What You Need to Know About a Credit Freeze

According to a recent Javelin identity fraud study, 14.4 million consumers were victims of identity fraud in 2018. Identity thieves may target your banking information or access your sensitive personal information through companies whose services you’ve used.

If your personal information is compromised, you may be at risk of having your identity stolen — which can wreak havoc on your finances and quickly consume all aspects of your life. If you’re worried your identity may be at risk, a credit freeze may help prevent further identity theft.

How to Meal Prep on a Budget

Cutting back on expensive restaurant meals in place of meal prepping is an effective way to reduce food spending and regain mindful eating habits. The Bureau of Labor Statistics found that households spend an average of $3,365 annually on food outside of the home.

Planning at least one daily meal, whether it's your workweek lunch or dinners, can literally save you thousands of dollars this year. Meal prep on a budget might make you envision a rice-and-beans diet — and although that can be a filling meal prep option — there are many ways to find meal prep ideas for less.

Here are a few tips to start cheap meal prep habits today.

10 Valentine's Gifts Your Partner Will Remember

Finding the “perfect” Valentine’s Day gift can feel like a lot of pressure, regardless of who you choose to celebrate with. If you want to go above and beyond to show your appreciation for your partner, this list of Valentine’s Day ideas can help you find a present that’s meaningful.

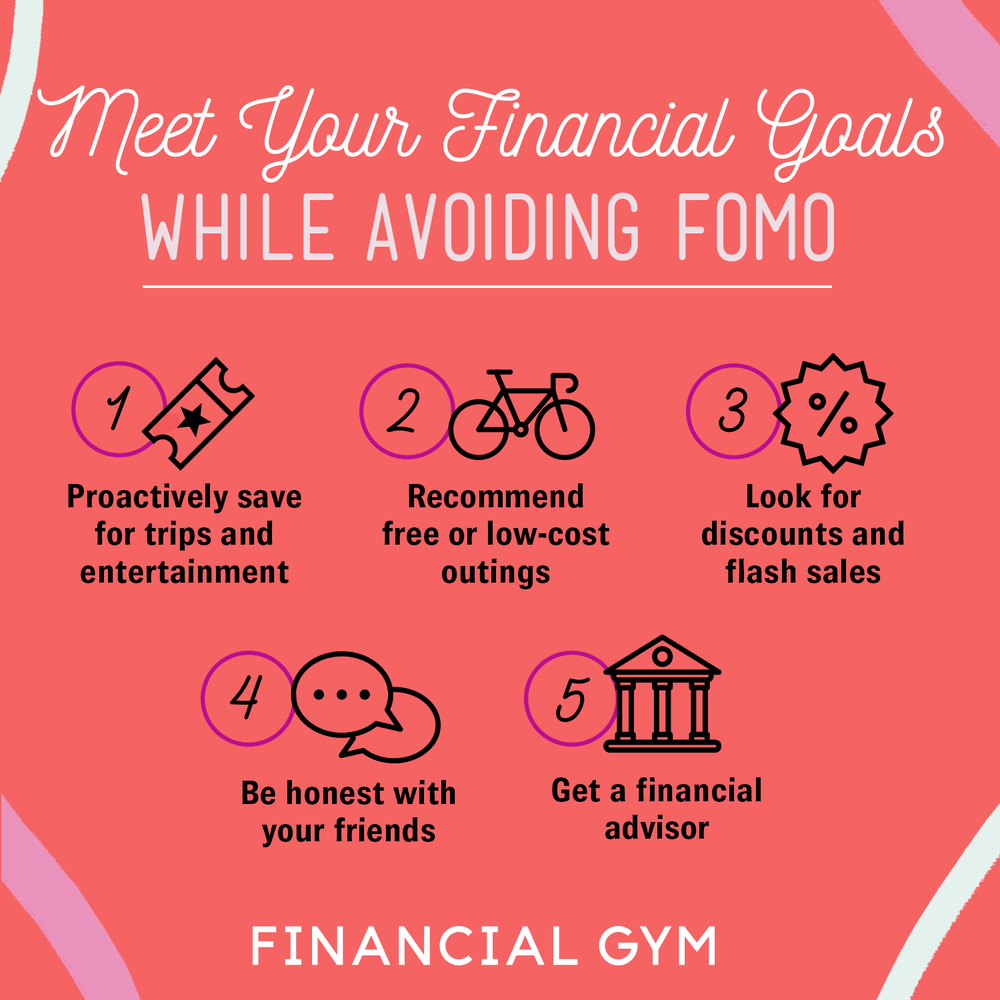

How to Meet Your Financial Goals While Avoiding FOMO

While living in New York, I’ve found it daunting to prioritize my financial goals. With dozens of exciting countries to visit with friends on my bucket list, an invitation to eat out pretty much a few times a week, and a zillion things to do literally at all hours of the day, how could I avoid experiencing FOMO while keeping my financial goals top of mind?

Here are a few tips that have helped me be more financially savvy while maintaining a healthy social life.

9 Things to Do Instead of Dining Out

Having a delicious meal is just the icing on the cake — the real treat is spending time with friends, family or going on an exciting date. Social outings keep us connected by growing relationships, but there are so many things to do with friends and others in your inner circle than spending money at a restaurant.

Here are some ways to have fun without dining out.

How to File for Bankruptcy

If you’re overwhelmed by debt, bankruptcy may be a financial tool that gives you a fresh start. Filing for bankruptcy stops debt collection calls, wage garnishment, and debt lawsuits. It may also give you the opportunity to wipe your slate clean by discharging your outstanding balances.

But it won’t solve all your financial problems. Obligations like alimony and child support won’t be included, and your chances of getting your federal student loans eliminated are slim. You’ll also take a major hit on your credit.

Here’s what you need to know about filing for bankruptcy.