The Financially Free Blog

Tips for Finding Temporary Housing

We’ve partnered with Common to bring you this content. Common is the country's leading community based residential brand. With dozens of homes across 7 major cities, Common makes moving and city living easier than ever before for renters. Every Common co-living home comes fully furnished and move-in ready with household essentials, utilities, WiFi, and access to the Connect by Common App.

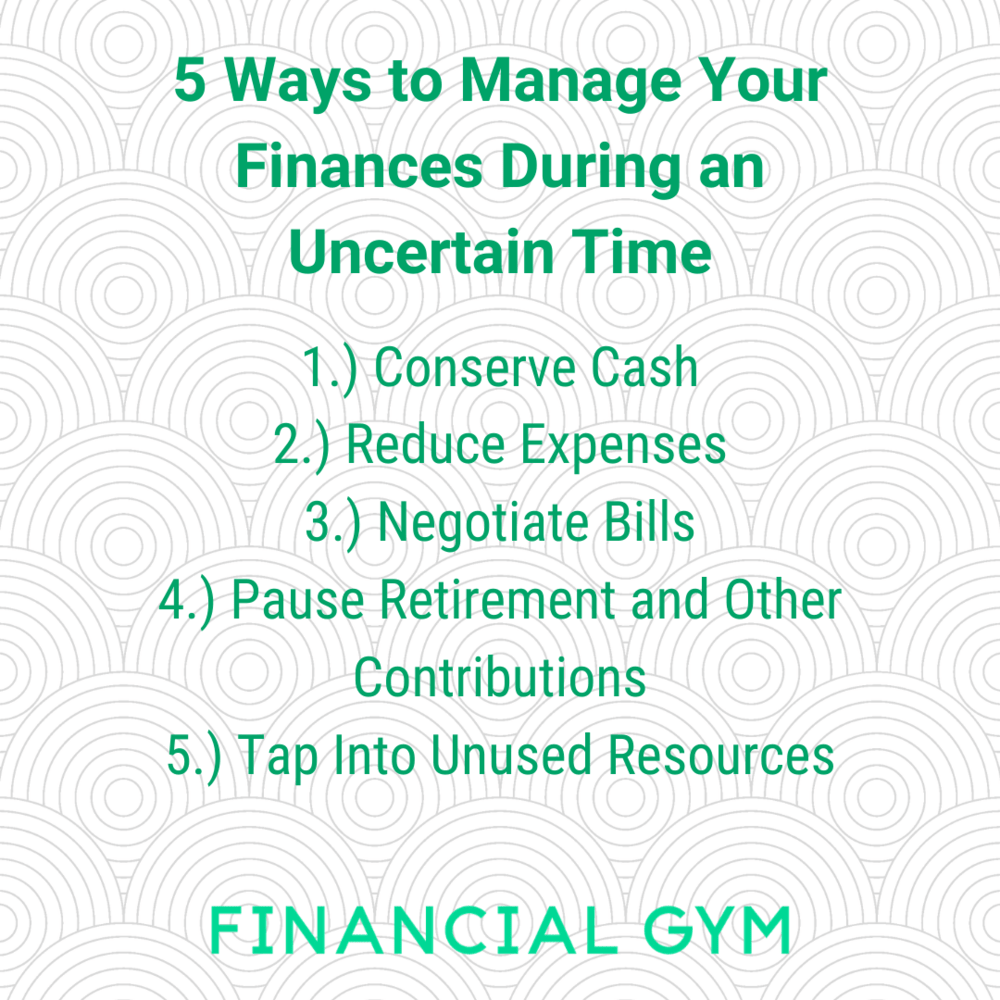

5 Ways to Manage Your Finances During an Uncertain Time

If you are looking to conserve cash during uncertain times, here are some tips you can follow!

5 Job Search Tips During COVID-19

Here are some job search tips to keep in mind during COVID-19.

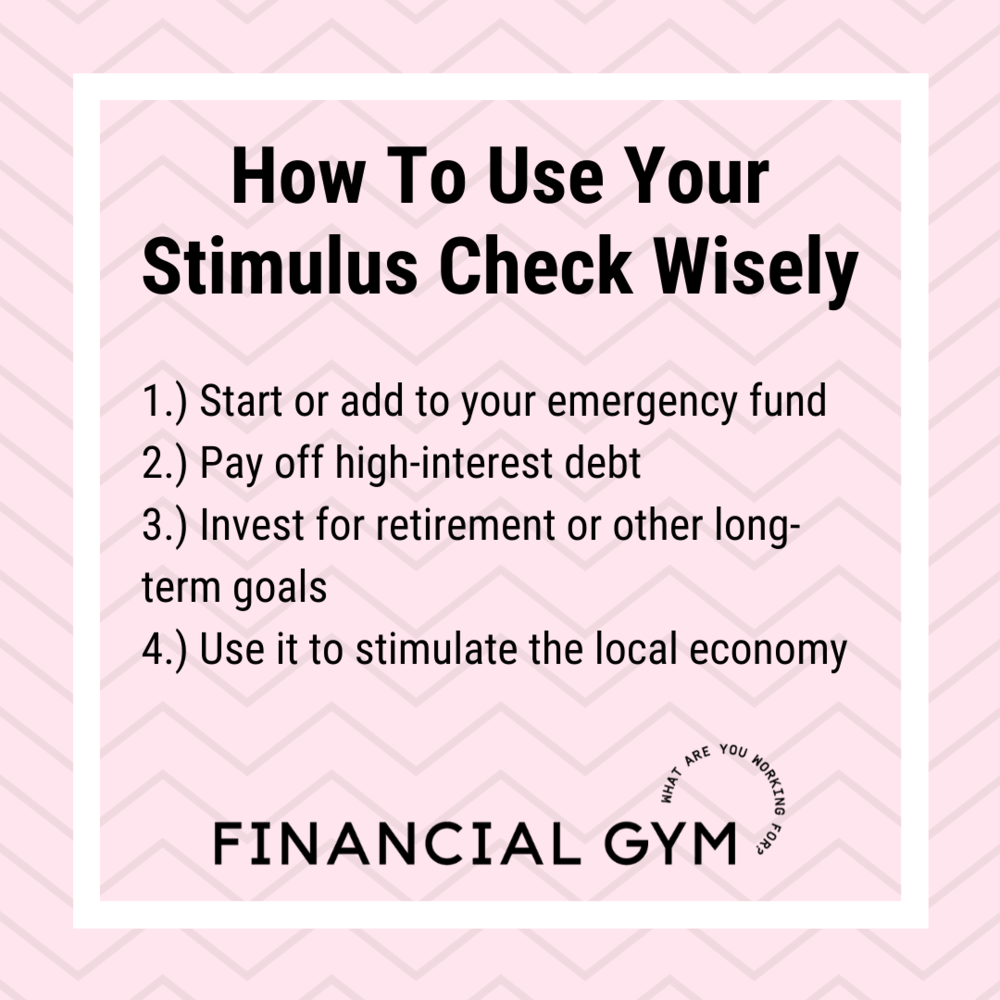

How To Use Your Stimulus Check Wisely

As many of you may know, over 80% of Americans will receive a check from the new government stimulus package. It is important to use this money wisely, so we have compiled a checklist to help guide your use of the money. Here are some guidelines to help you figure out the best use of the check for you.

How to Talk to Your Creditors When You’re Behind on Bills or Payments

Mike Poulin, a Level 2 Financial Trainer here at The Financial Gym uses his prior experience as a Debt Collector to describe how to talk to your creditors when you’re behind on bills or payments.

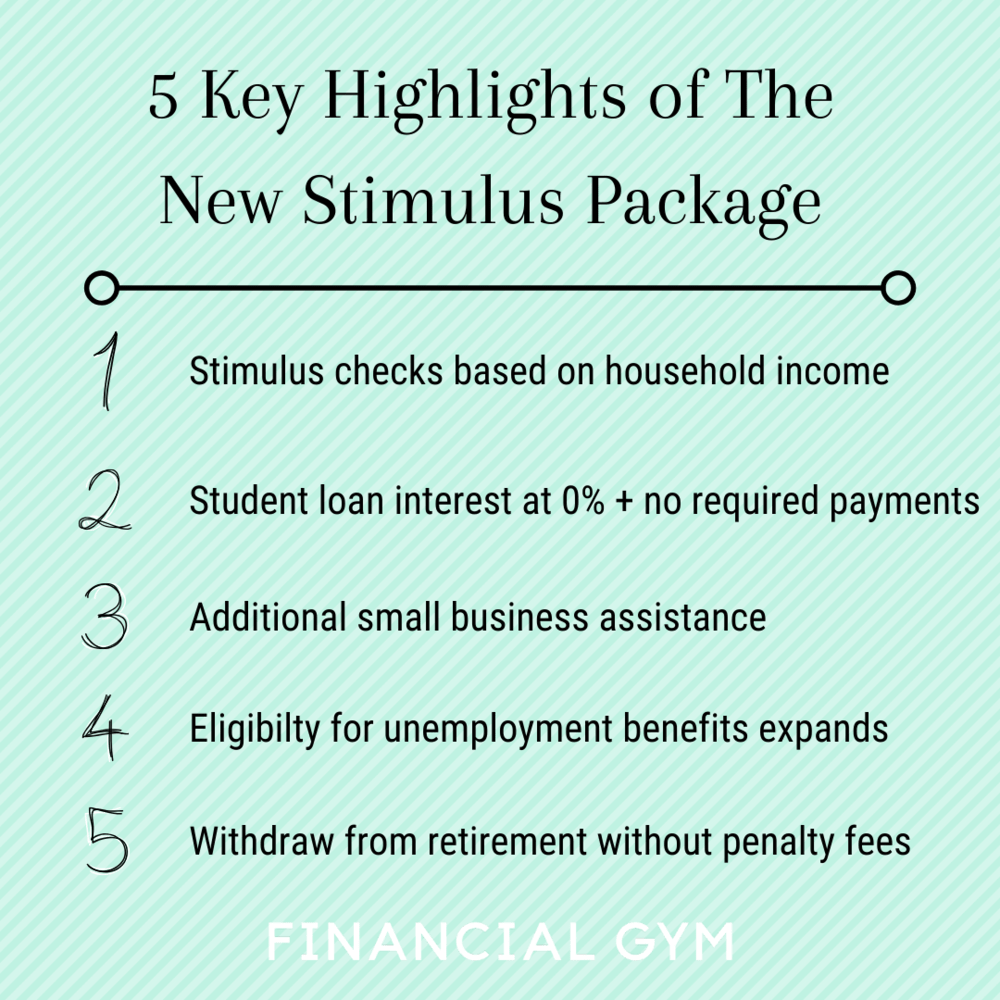

What Are The Highlights of The New Stimulus Package?

You’ve probably heard about the historic $2 trillion stimulus package that was passed last week. There has been a lot of talk about the government giving away free money, expanding unemployment benefits, changing the rules around student loans and retirement accounts, helping small business, and bailing out the airlines, but what does this all mean? How does this affect you and what can you actually expect to gain from this stimulus package? Here’s a quick breakdown of the essential pieces of package and how they affect you.

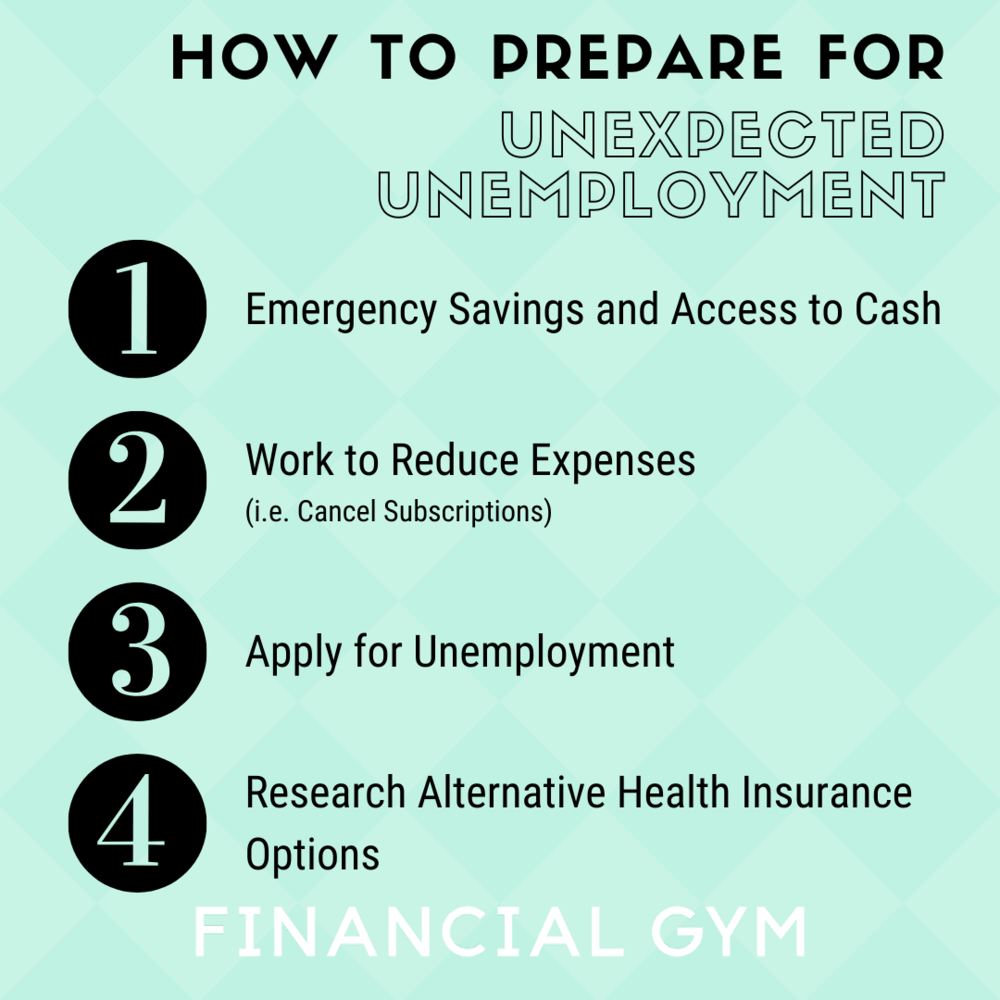

How To Prepare for Unexpected Unemployment

During these unprecedented times, many people have found themselves unexpectedly unemployed. Here are our tips for navigating unemployment.

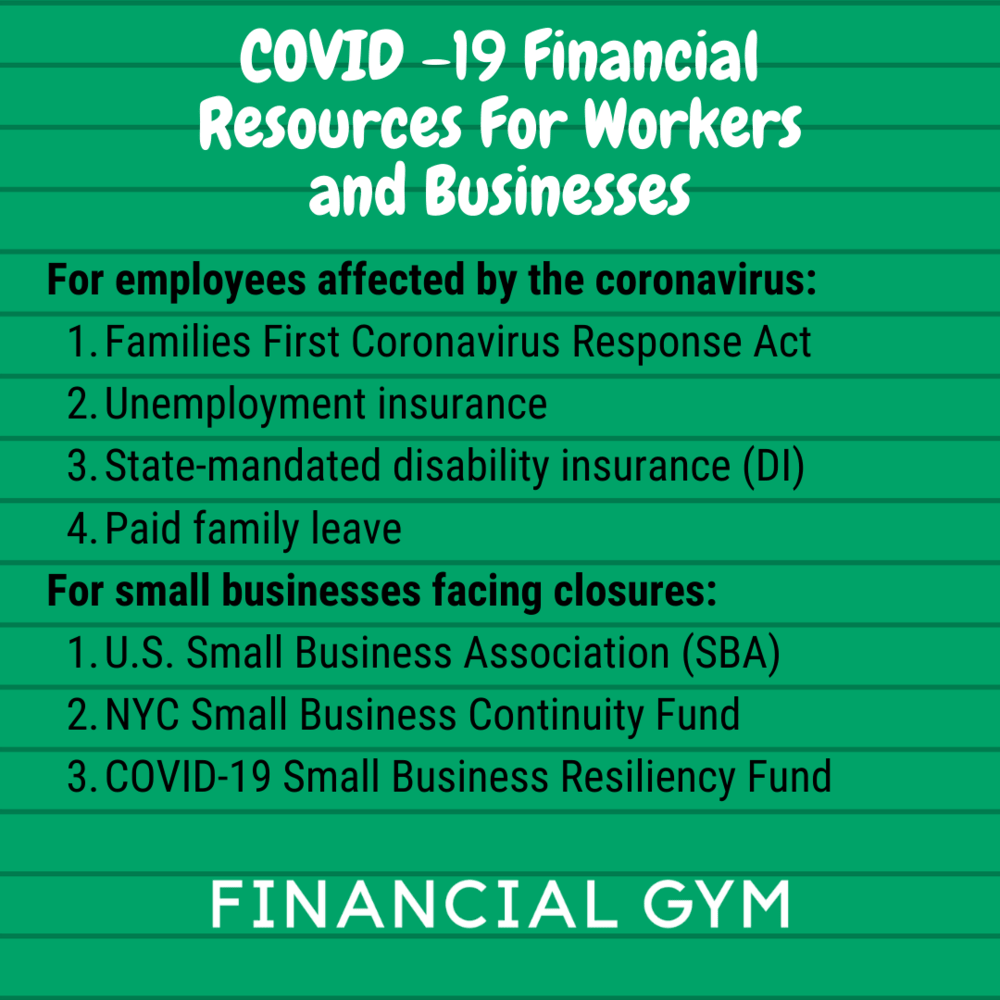

COVID -19 Financial Resources For Workers and Businesses

People all over the country are experiencing economic hardships due to the novel coronavirus, or COVID-19. Many states have mandated closures of restaurants, entertainment venues, and hotels. Leaving many service workers without income and other employment benefits.

The White House recently when it released new guidelines that included avoiding crowds of more than 10 people. In light of heath advisory recommendations, many business owners face uncertainty as Americans hunker down in their homes instead of frequenting local businesses.

As we wait to see what comes of this virus — from both a health and economic perspective — it’s important to know where to find factual information and get the resources and relief that’s desperately needed in some parts of the country.

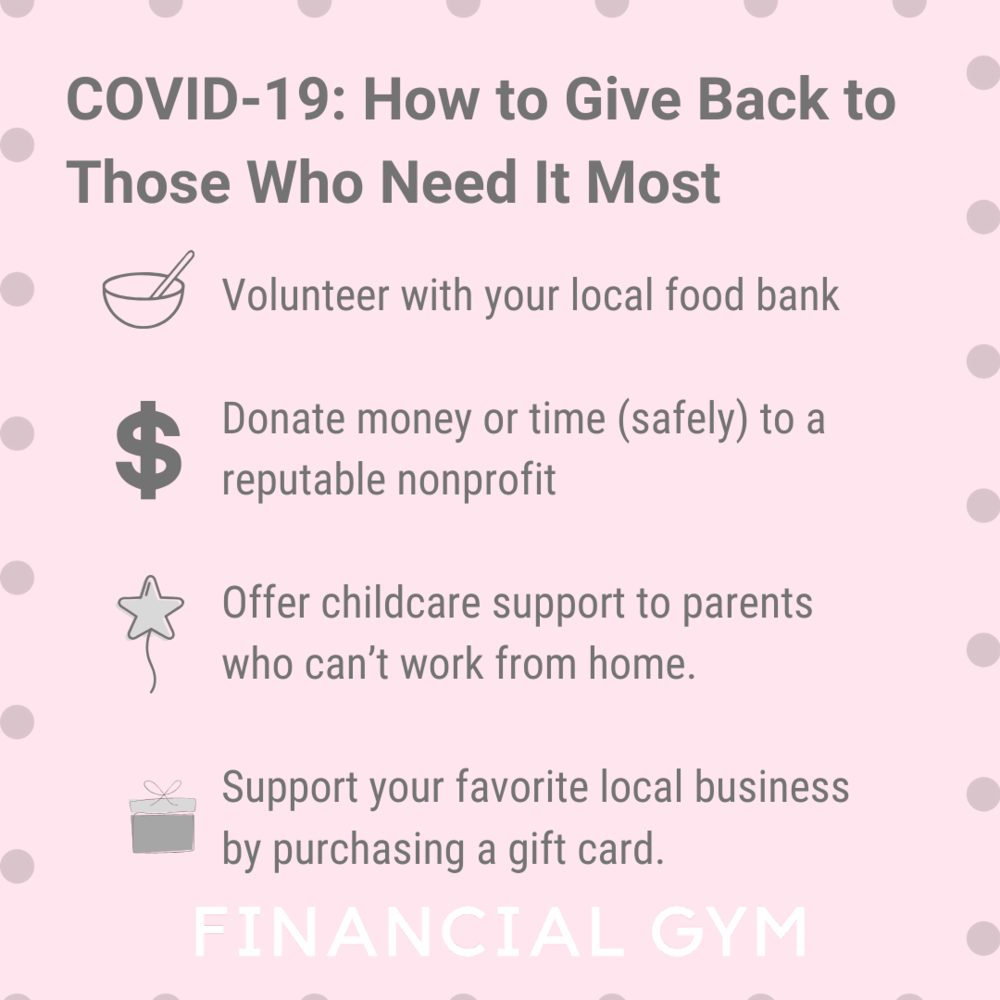

COVID-19: How to Give Back to Those Who Need It Most

The novel Coronavirus, known as COVID-19, is affecting communities worldwide at rapid speed. As of March 18, 2020, the Centers for Disease Control and Prevention (CDC) says there’s been 7,038 total reported cases of COVID-19 in the U.S. These numbers are expected to grow as access to testing becomes more available in the coming weeks.

For many Americans, local and state governments have enacted closure mandates to slow the spread of transmission within communities. The City of Los Angeles, for example, has temporarily closed schools, public buildings, gyms, entertainment venues, and bars, and also ordered a halt to dine-in restaurant service (take-out or delivery orders only).

In the wake of these necessary changes, you’re likely concerned for the well-being of others who lack access to food, medicine, and the financial resources to withstand this pandemic. There are a few ways you can help the people in need in your local community as well as on a larger scale. Here’s how.

The Financial Gym Response to COVID-19

At The Financial Gym, our responsibility is to provide resources and information that will help ease your fears and financial questions at all times -- and especially during volatile and uncertain periods of time.

We realize that your personal finances may be top of mind right now and we strongly believe maintaining financial health is of the utmost importance. In order to make financial health and our services as accessible as possible, we are offering a 20% discount. To get started schedule a consultation call here. Please feel free to share this offer with friends and family.

5 Best Savings Apps to Try This Year

Let’s face it, saving money can be onerous and not as easy as the “put it away and don’t touch it” advice makes it seem. Between all the financial responsibilities constantly tugging for your attention, it’s hard to afford the time to track expenses and savings goals — whether for a large future expense, a trip or emergency fund.

Money-saving apps make the process more manageable for many, but how can you know which ones work the best for your needs? Here’s a list of some of the best savings apps out there.

How to Claim Your Partner as a Dependent on Your Taxes

** Our Trainers are not tax advisors nor do we provide specific tax advice in this blog. The purpose of this blog post is to provide a general overview.

Each tax season, people search for ways to lower their tax bills and increase their refunds. Fortunately, there are many tax deductions and credits to reduce your overall tax burden, including claiming dependents, if your situation qualifies.

The Internal Revenue Service (IRS) has strict requirements as to who can be claimed as your dependent. As you get ready to file your taxes, you may be wondering if you can claim your partner as your dependent.

Here’s what you need to know about claiming dependents on your taxes and where you might run into some barriers.

A Beginner's Guide to Filing a Tax Return

** Our Trainers are not tax advisors nor do we provide specific tax advice in this blog. The purpose of this blog post is to provide a general overview.

If you had an on-going income source this past year, you’ll likely need to file a tax return. Your return is the government’s way of documenting and collecting on the taxes you owe, which pay for all types of government services.

Your employer will typically withhold taxes from your paycheck throughout the year, but it may not be enough to cover your tax bill, in which case you’ll owe Uncle Sam. Your tax contributions throughout the year may also have been too much — resulting in a refund.

But there are many scenarios that make filing your taxes more complicated. For instance, not everyone works in a wage-earning role. Some people earn income as an independent contractor or receive dividends from investments. Additionally, there are numerous ways to reduce your taxable income, thereby, reducing the taxes you’ll owe.

Because of all these nuances, taxes can feel intimidating. Here’s a breakdown of the basics of a tax return to ensure you’re prepared to file your taxes this season.

Coronavirus: How to Protect Yourself and Prevent Spreading the Disease

If you’ve visited your local drugstore only to find that hand sanitizer is out of stock, or received an email from your employer announcing a temporary work-from-home policy for anyone who’s traveled in the last 14 days, you’ve likely felt the effect of the trending Coronavirus.

Related: Understanding Your Employee Benefits

Strategies to Avoid Buyer's Remorse

The excitement of a new purchase — whether it’s a small purchase at the department store or a large purchase, like a new car — feels good. Psychological studies reveal that the excitement and anticipation of getting a reward (i.e. what you’re buying) increases dopamine levels in the brain. This chemical shift gives shopping and spending money almost addictive quality.

Until you realize that you’ve blown your budget or the psychological “high” of the purchase fades and you’re faced with buyer’s remorse. Don’t let your spending habits reach this point. You can preemptively avoid this spending cycle by practicing these tips to avoid buyer’s regret.

Related: What I Learned From a Three-Month Retail Spending Freeze

How to Save $1,000 by July for a Summer Vacation

It might still be winter in many parts of the U.S., but let’s be honest — you’re already dreaming of your next big vacation this summer. If you don’t quite have the funds to book your summertime flight, there’s no better time to put together a vacation savings account than now.

By taking thoughtful steps toward building a vacation fund today, you can save $1,000 by the end of July. These five steps can help you reach #vacationgoals this summer.

7 Tax Deductions & Write Offs That Save You Money

Filing your taxes can be complicated, which makes it easy to overlook tax deductions that could save you money. Whether you choose to claim the standard deduction or itemize your tax return, there are various tax deductions that are worth exploring.

Here’s a list of common tax deductions that many taxpayers often miss.

What is a 1099?

The Internal Revenue Service (IRS) uses a series of “information returns” called 1099s to track income received other than the salaries and wages paid by an employer.

Although most people think of a 1099 as being an independent contractor tax form, there’s a wide variety of forms and types of income that need to be reported.

Here’s a brief overview of the 1099 tax forms you may come across when preparing your taxes.

How to File Your Taxes Jointly for the First Time

When you decided to say “I do”, you may not have considered the future tax implications of getting married. Marriage changes your taxes — from the credits and tax deductions you can claim, to certain tax breaks that come with filing jointly.

However, not everyone chooses to file their taxes together. Depending on your personal circumstances, you may find that filing separately serves each of you better.

Here’s a tax crash course for newlyweds who are filing together for the first time this coming tax season.

How To Handle Income Inequality In Your Relationship

It’s not surprising that in an American Psychological Association report highlighting the largest stressors of America, work and money were identified as the highest personal stressors. It’s also long known that money problems are large contributors to relationship conflict, often leading to divorce.

Financial issues can vary from not having enough money to dealing with overspending, but one area that’s a large contributor to relationship conflict is income inequality. When one partner earns more income than the other, complex issues can develop from either partner.