The Financially Free Blog

Your Mental Health and COVID-19

As we enter May, we honor Mental Health Awareness Month. Here at The Financial Gym, we know tackling finances often comes with stress and anxiety. This year, May approaches as many of us are navigating a global pandemic and disruptions to our routines. It is so important, now and more than ever, to bring awareness to mental health. If you are struggling with uncertainty, here are some ways that you can take care of your mental health.

8 Tax Myths to Avoid This Filing Season

Even though tax season was extended, we still want to make sure you have all the information you need to file your 2019 taxes properly.

There are many misconceptions about taxes that can hurt taxpayers by adding to their uncertainty and by costing them money.

Here are some of the most common tax myths that often trip-up taxpayers during the income tax filing season.

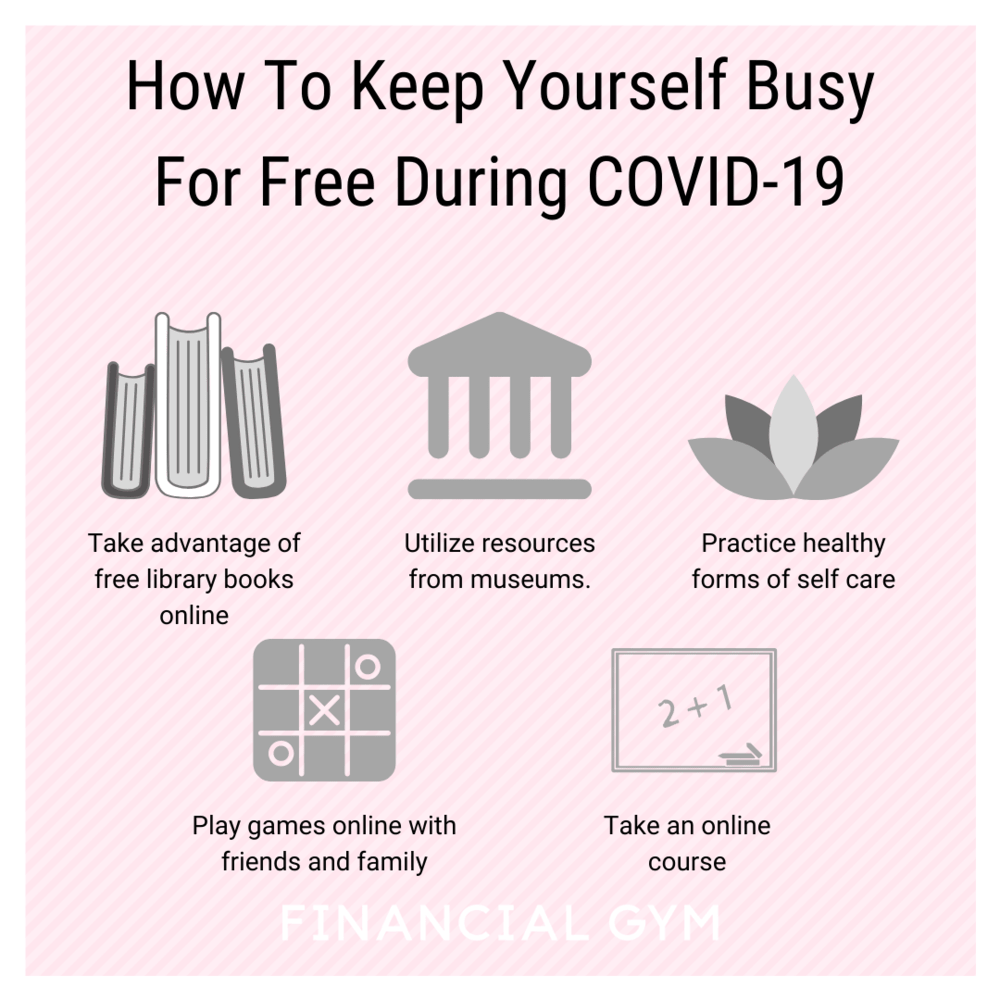

How To Keep Yourself Busy For Free During COVID-19

You might be getting to the point in social distancing where you want to introduce something new or different to your stay at home routine. We’ve rounded up some of our favorite low or no cost ways to pass the social distancing time.

We definitely don’t think everyone needs to come out of this pandemic with a new hobby or side hustle! That said-you might be ready to incorporate something new into your routine, so here’s some inspiration beyond free Instagram workouts and creative pantry cooking.

Tips for Finding Temporary Housing

We’ve partnered with Common to bring you this content. Common is the country's leading community based residential brand. With dozens of homes across 7 major cities, Common makes moving and city living easier than ever before for renters. Every Common co-living home comes fully furnished and move-in ready with household essentials, utilities, WiFi, and access to the Connect by Common App.

How To Handle Your Retirement Savings During COVID-19

By now I’m sure that if you have a retirement account(s) you have seen it drop, by no small amount either. You might be thinking “I’m not going to be able to retire because I keep losing money!”

Don’t fret, as it’s all going to be okay. One of the cardinal rules about investing to remember is that you don’t “lose” any money until you sell.

An economy runs well when people spend money and, well, people aren’t spending as much money right now (except on toilet paper apparently!). Because of this decrease in spending, the economy has taken a hit. A lot of this can also be attributed to fear; not enough savings, job security, unexpected expenses, etc.

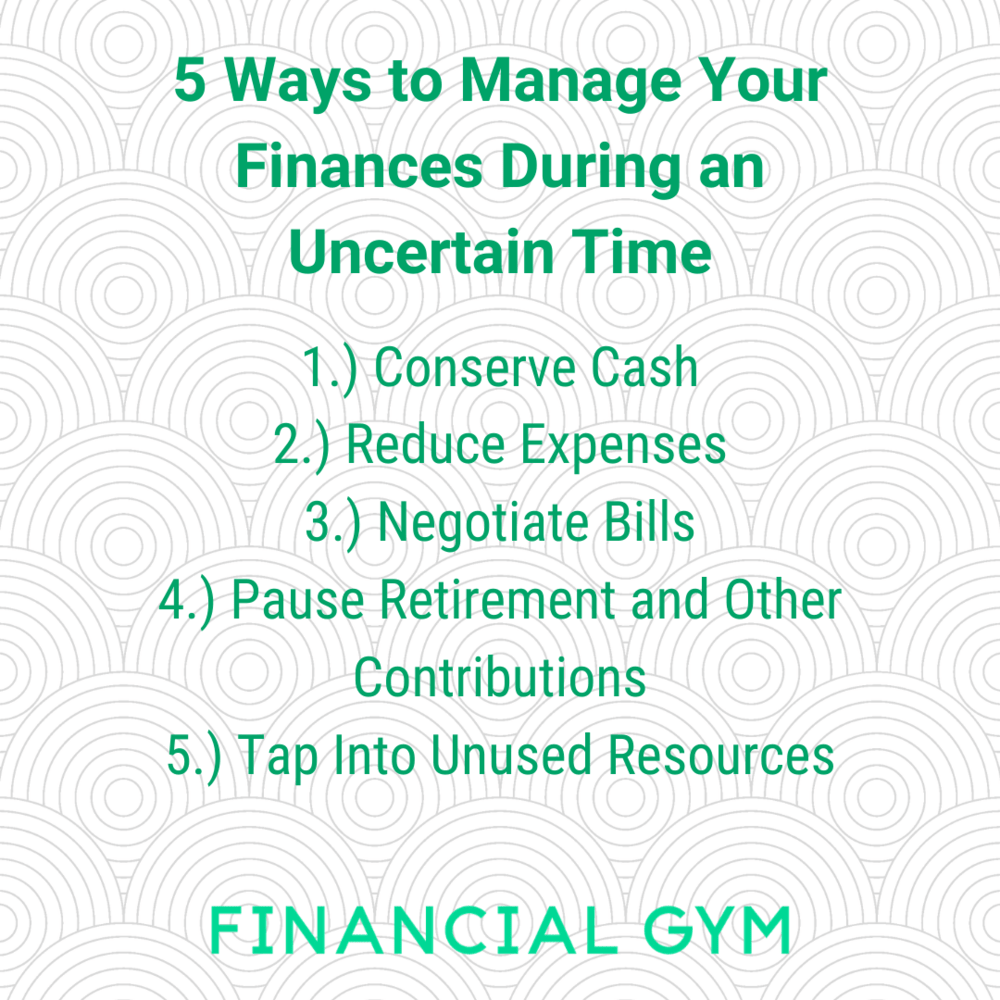

5 Ways to Manage Your Finances During an Uncertain Time

If you are looking to conserve cash during uncertain times, here are some tips you can follow!

5 Job Search Tips During COVID-19

Here are some job search tips to keep in mind during COVID-19.

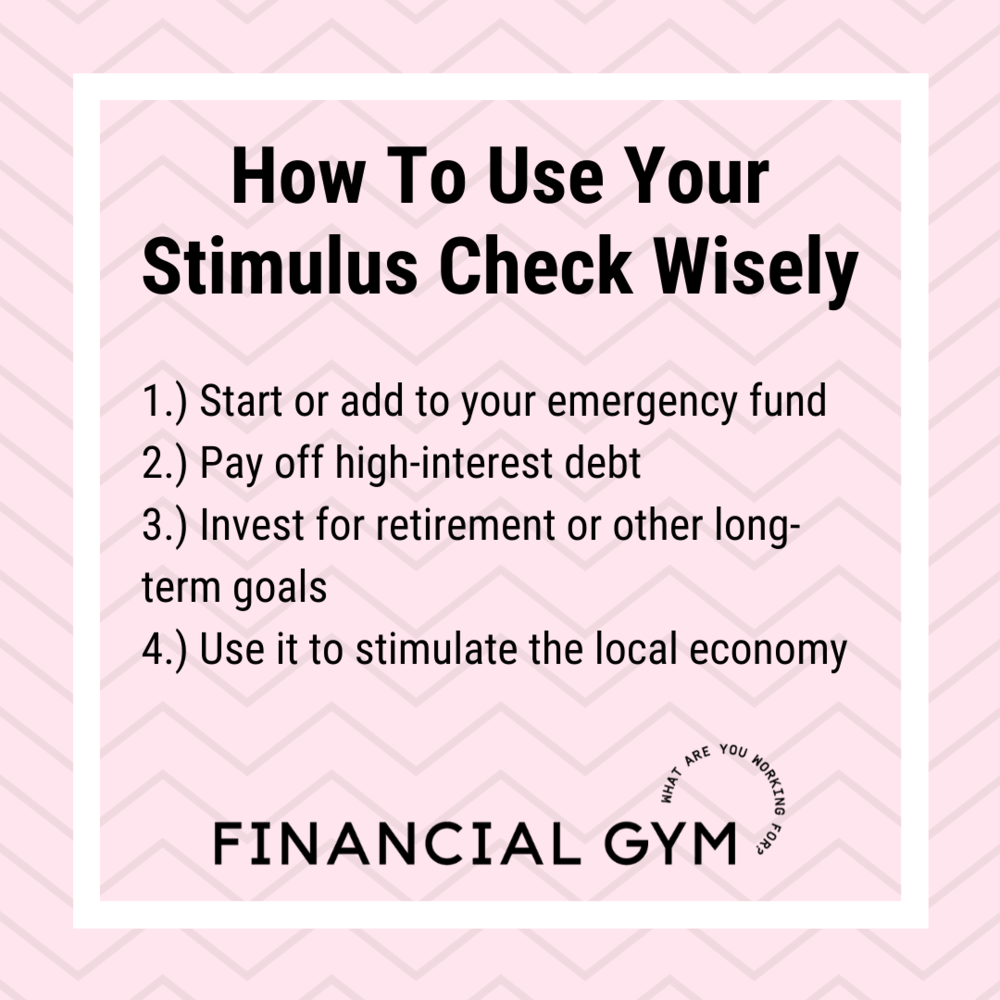

How To Use Your Stimulus Check Wisely

As many of you may know, over 80% of Americans will receive a check from the new government stimulus package. It is important to use this money wisely, so we have compiled a checklist to help guide your use of the money. Here are some guidelines to help you figure out the best use of the check for you.

How to Talk to Your Creditors When You’re Behind on Bills or Payments

Mike Poulin, a Level 2 Financial Trainer here at The Financial Gym uses his prior experience as a Debt Collector to describe how to talk to your creditors when you’re behind on bills or payments.

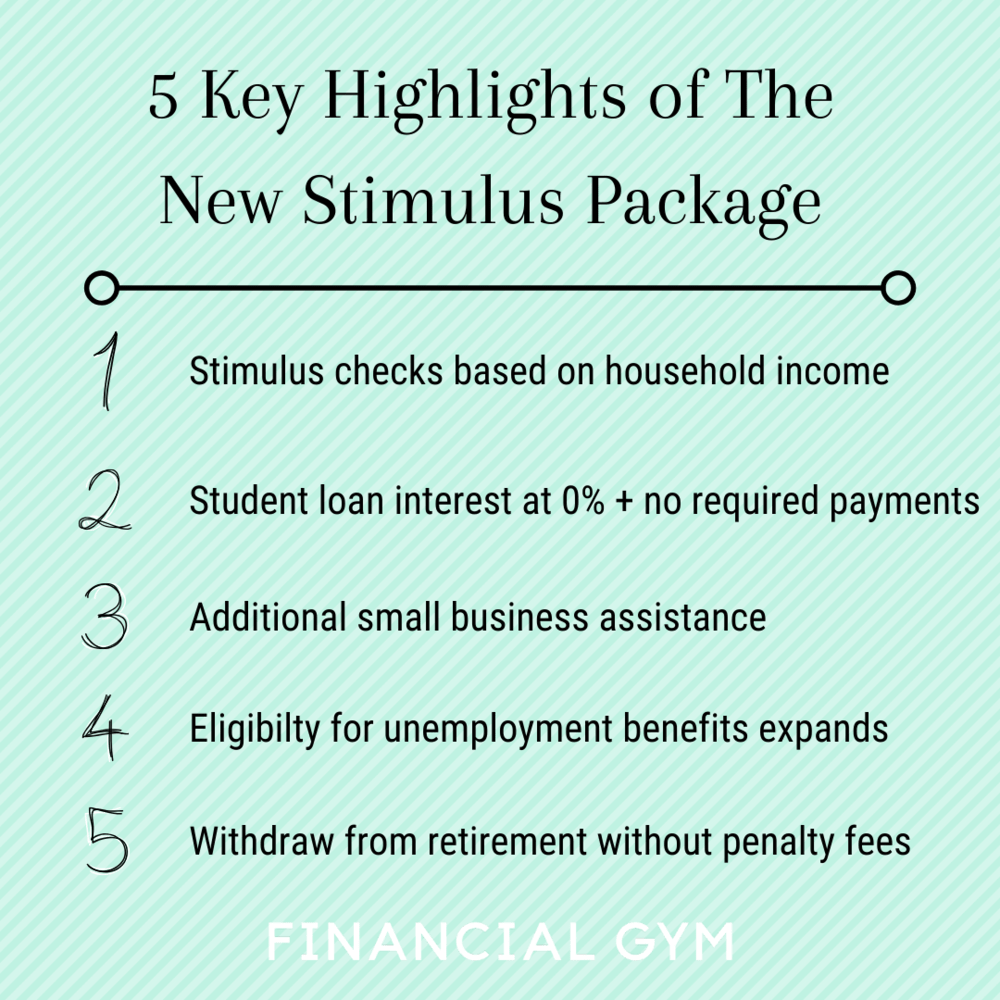

What Are The Highlights of The New Stimulus Package?

You’ve probably heard about the historic $2 trillion stimulus package that was passed last week. There has been a lot of talk about the government giving away free money, expanding unemployment benefits, changing the rules around student loans and retirement accounts, helping small business, and bailing out the airlines, but what does this all mean? How does this affect you and what can you actually expect to gain from this stimulus package? Here’s a quick breakdown of the essential pieces of package and how they affect you.

Four Financial Moves NOT to Make During Coronavirus

Health officials have been telling us all the things to do during this coronavirus outbreak: wash hands thoroughly while singing happy birthday; stay inside; keep a social distance of at least 6 feet from other people; and only leave home for essentials.

Everyone at the Financial Gym hopes you’re staying healthy, but we’re also hoping you can use this time to get your finances in shape! So during this pandemic, instead of telling you what to do, we’re going to tell you what not to do with your money.

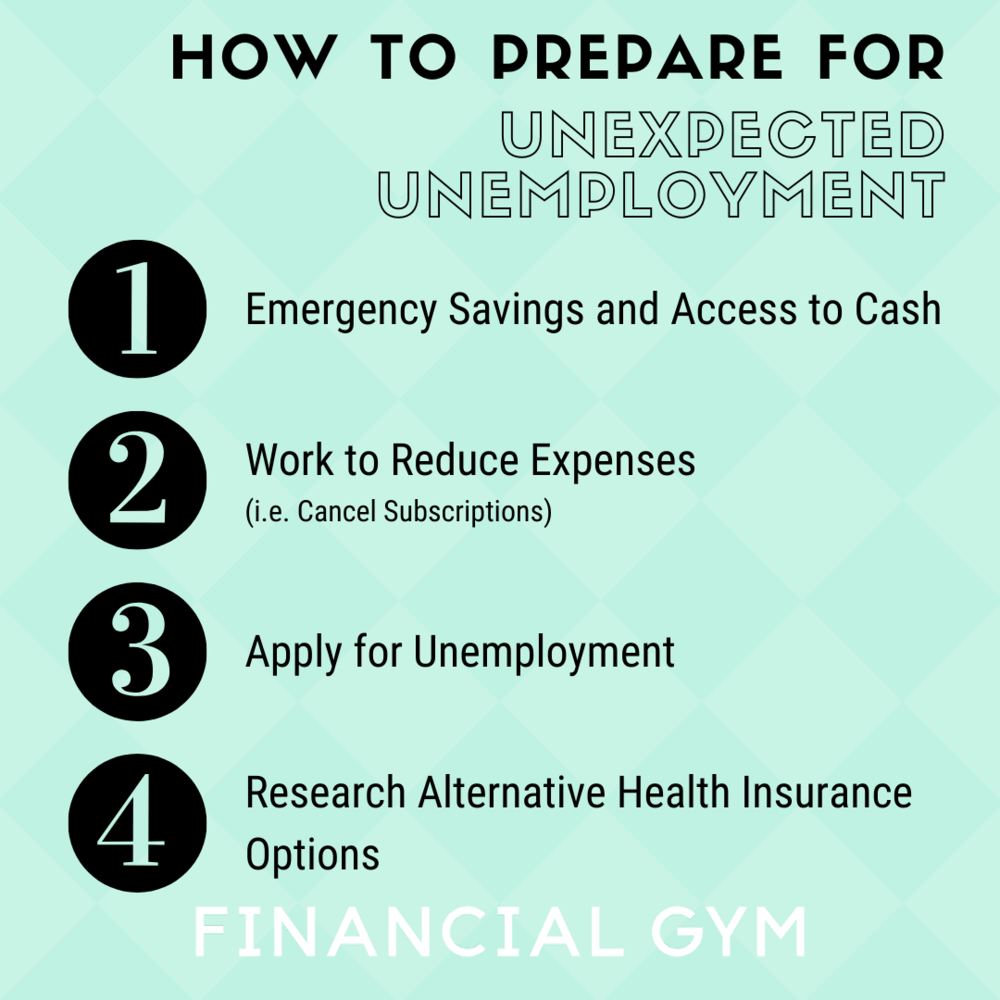

How To Prepare for Unexpected Unemployment

During these unprecedented times, many people have found themselves unexpectedly unemployed. Here are our tips for navigating unemployment.

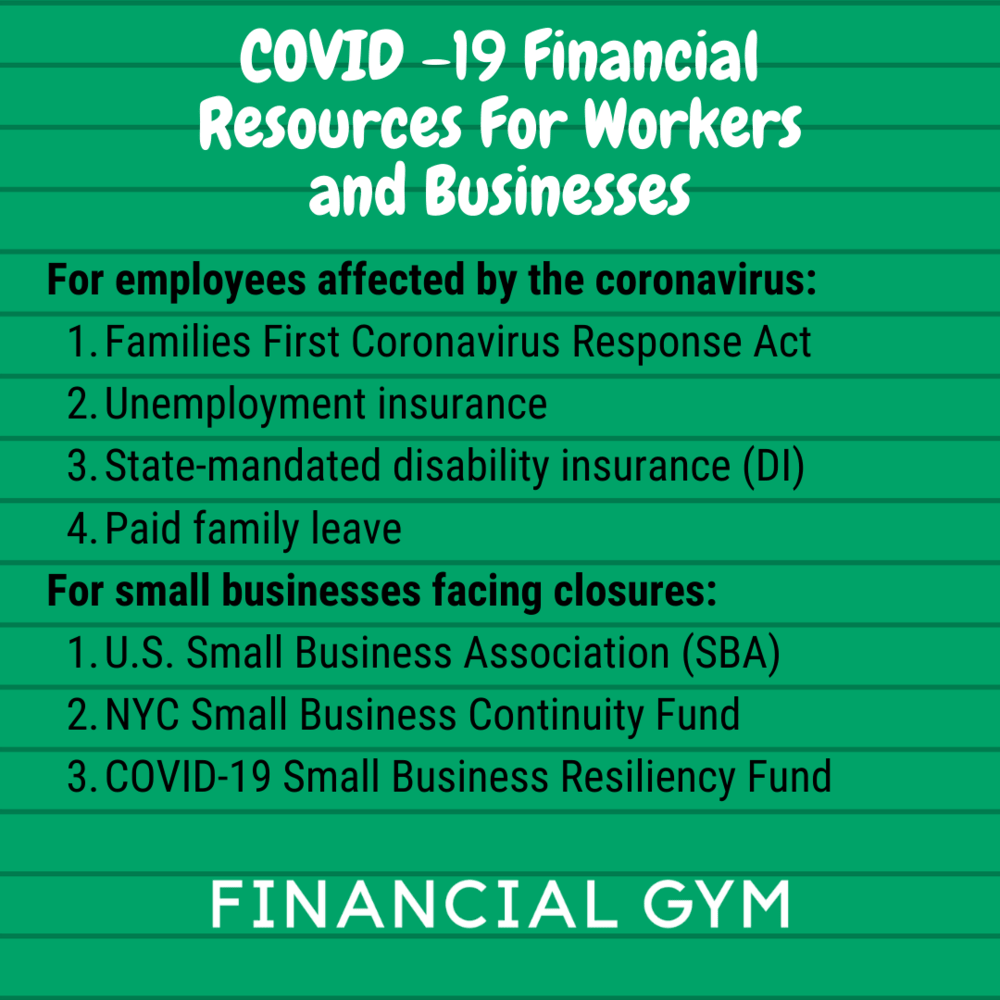

COVID -19 Financial Resources For Workers and Businesses

People all over the country are experiencing economic hardships due to the novel coronavirus, or COVID-19. Many states have mandated closures of restaurants, entertainment venues, and hotels. Leaving many service workers without income and other employment benefits.

The White House recently when it released new guidelines that included avoiding crowds of more than 10 people. In light of heath advisory recommendations, many business owners face uncertainty as Americans hunker down in their homes instead of frequenting local businesses.

As we wait to see what comes of this virus — from both a health and economic perspective — it’s important to know where to find factual information and get the resources and relief that’s desperately needed in some parts of the country.

Side Hustles From Home: How to Earn Extra Money

Despite the uncertainty that the novel Coronavirus brings, one thing’s for sure: staying home helps flatten the curve of infection across the country.

Some Americans have the benefit of working from home with the promise of earning their regular pay — the only inconvenience being cabin fever as a result of self-quarantines. Unfortunately, however, the COVID-19 outbreak has pushed shops and businesses to temporarily close its doors, leaving many retail and restaurant employees unemployed or with severely cut hours.

Whether you’re looking to stay busy while social distancing or need to fill a gap in income stat, there are a few ways to earn extra money from home.

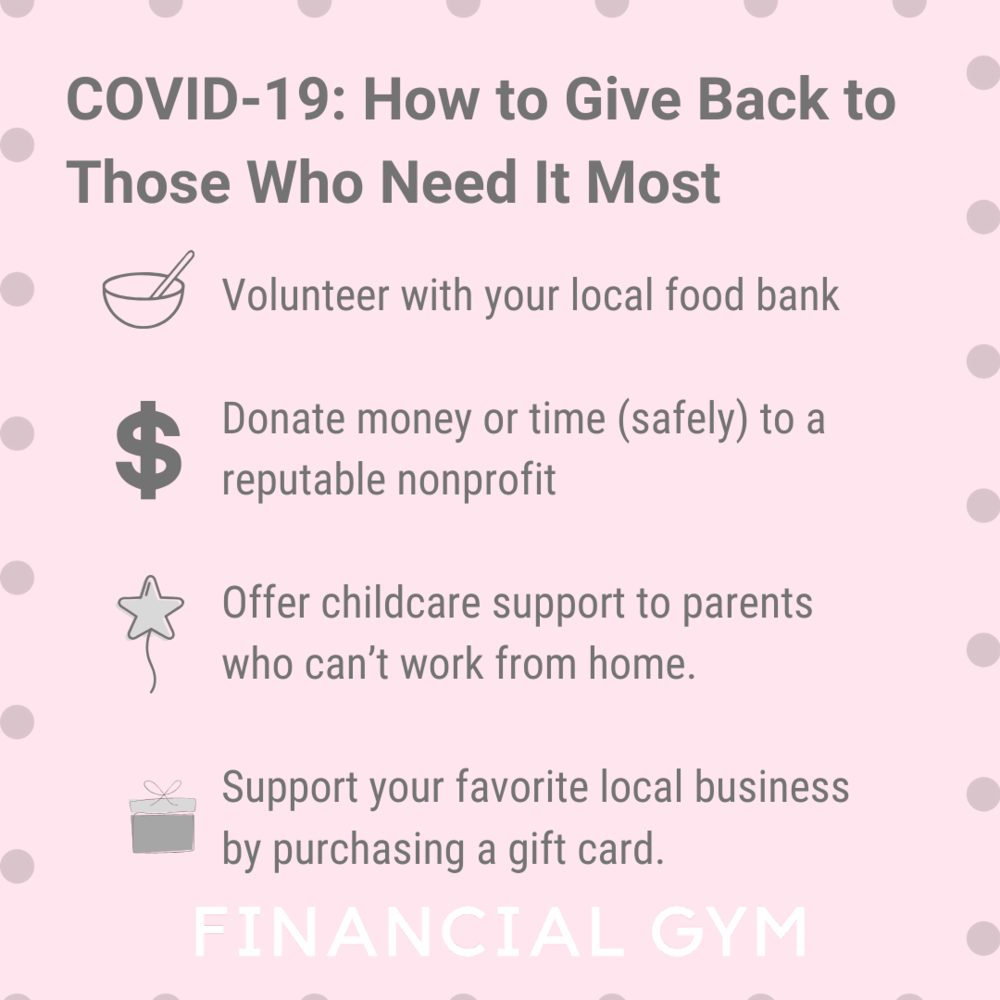

COVID-19: How to Give Back to Those Who Need It Most

The novel Coronavirus, known as COVID-19, is affecting communities worldwide at rapid speed. As of March 18, 2020, the Centers for Disease Control and Prevention (CDC) says there’s been 7,038 total reported cases of COVID-19 in the U.S. These numbers are expected to grow as access to testing becomes more available in the coming weeks.

For many Americans, local and state governments have enacted closure mandates to slow the spread of transmission within communities. The City of Los Angeles, for example, has temporarily closed schools, public buildings, gyms, entertainment venues, and bars, and also ordered a halt to dine-in restaurant service (take-out or delivery orders only).

In the wake of these necessary changes, you’re likely concerned for the well-being of others who lack access to food, medicine, and the financial resources to withstand this pandemic. There are a few ways you can help the people in need in your local community as well as on a larger scale. Here’s how.

4 Financial Moves To Make Before Investing During COVID-19

To invest, or not to invest…that is the question…

And the answer is...well, it depends. With the stock market on a steady decline since the onset of COVID-19, a lot of people think that now is a good time to invest, and they are right, but only if you’re already prepared for the worst case scenario.

Below are 4 financial moves to make before you should start investing, especially during the COVID-19 pandemic. You have to make sure to have...

The Financial Gym Response to COVID-19

At The Financial Gym, our responsibility is to provide resources and information that will help ease your fears and financial questions at all times -- and especially during volatile and uncertain periods of time.

We realize that your personal finances may be top of mind right now and we strongly believe maintaining financial health is of the utmost importance. In order to make financial health and our services as accessible as possible, we are offering a 20% discount. To get started schedule a consultation call here. Please feel free to share this offer with friends and family.

Message from the CEO - Managing Fear

For full disclosure, I had an entirely different email written to go out today speaking to the reality show we produced - Financially Naked, which is premiering tonight and will be launched on YouTube starting tomorrow. It’s a passion project of mine and the team’s that we’ve spent months working on; but due to yesterday’s market halt and ongoing fears about COVID-19, I feel compelled to send an entirely new message.

5 Best Savings Apps to Try This Year

Let’s face it, saving money can be onerous and not as easy as the “put it away and don’t touch it” advice makes it seem. Between all the financial responsibilities constantly tugging for your attention, it’s hard to afford the time to track expenses and savings goals — whether for a large future expense, a trip or emergency fund.

Money-saving apps make the process more manageable for many, but how can you know which ones work the best for your needs? Here’s a list of some of the best savings apps out there.

How to Claim Your Partner as a Dependent on Your Taxes

** Our Trainers are not tax advisors nor do we provide specific tax advice in this blog. The purpose of this blog post is to provide a general overview.

Each tax season, people search for ways to lower their tax bills and increase their refunds. Fortunately, there are many tax deductions and credits to reduce your overall tax burden, including claiming dependents, if your situation qualifies.

The Internal Revenue Service (IRS) has strict requirements as to who can be claimed as your dependent. As you get ready to file your taxes, you may be wondering if you can claim your partner as your dependent.

Here’s what you need to know about claiming dependents on your taxes and where you might run into some barriers.