The Financially Free Blog

Grow Your Network And Maximize Your Brand!

A “personal brand” is a theme that other people can understand. It lets people grasp the basic concept of how you fit into their life in an easy and compelling way.

Racial Discrimination in Financial Institutions

We need more Black people in Financial Services. Banks literally hold the wealth of the country and to not accurately represent the true demographics of the economy does a disservice to those in it.

Message from the CEO to Our Clients - Thank You!

7 years ago this month, I left Merrill Lynch because I was consumed with the idea that people of all financial shapes and sizes should have access to another human being just like the wealthy have access to financial advisors. I literally couldn’t sleep at night thinking about this idea of The Financial Gym; and for months I fought the pull of it because I’d never wanted to start a business and I had a successful and growing Merrill Lynch practice. Why would I leave?

How to Plan for the Holiday Season Now

It may seem crazy to start thinking about planning for the holiday season, but holiday planning is starting even earlier than ever this year! This is partially due to “COVID escapism”. It’s always great to plan for the holiday season; we want our clients to be prepared for the influx of expenses, and enjoy the time rather than stressing about their finances. Here are some tips to get ahead of the ball this holiday season!

Unusual Ways to Lower Your Grocery Bill

Eating is something we all do on a regular basis. In fact, the Department of Labor Statistics ranks food costs as the third largest expense category just behind transportation, with housing coming in first. And since it’s not very likely that you can just up and change your housing and transportation costs anytime soon, that leaves food as the biggest category that we can control on a regular basis.

4 FREE Resources to Jumpstart Financial Fitness

Have you ever struggled with money? According to a Forbes article written in 2019, CareerBuilder found that 78% of Americans live paycheck to paycheck. There can be a lot of shame when it comes to discussing finances, so while it may feel like you’re alone, you are not. It’s never too early or late to start thinking about financial health or to learn something new if you’re already on the journey.

How to Successfully Participate in Plastic Free July

Our Trainers coach their clients to understand their goals and how to align these goals with spending. In addition to personal goals, like saving for a house, paying down debt, or taking a vacation (when it’s safe again!), there are also world goals that many of us have. We can make an impact on these goals with our money, and at The Financial Gym, we love when the financially savvy decision also makes a community impact! One way we can all impact our world in a positive way is to reduce our consumption of plastic, especially single use plastic.

3 Myths About The Current Housing Market

We have partnered with Ardley to bring you the latest information regarding the current housing market. Check out this post to explore these three myths about the current market and steps you can take to ensure a safe and healthy home buying experience.

Negotiating Your Worth in a Pandemic

At The Financial Gym, we’re often telling our clients to “Know Your Worth”-and yes, even in a pandemic you should know and advocate for what you are worth! Negotiations can be scary, especially in these unprecedented times when there isn’t a roadmap or guarantee on what the next few months will look like. The good news is that you CAN negotiate in a pandemic, and the secret is that a lot of the pre-pandemic advice still applies! Whether you’re looking for more money in your current job or hitting the job market, read on for tips on negotiating right now.

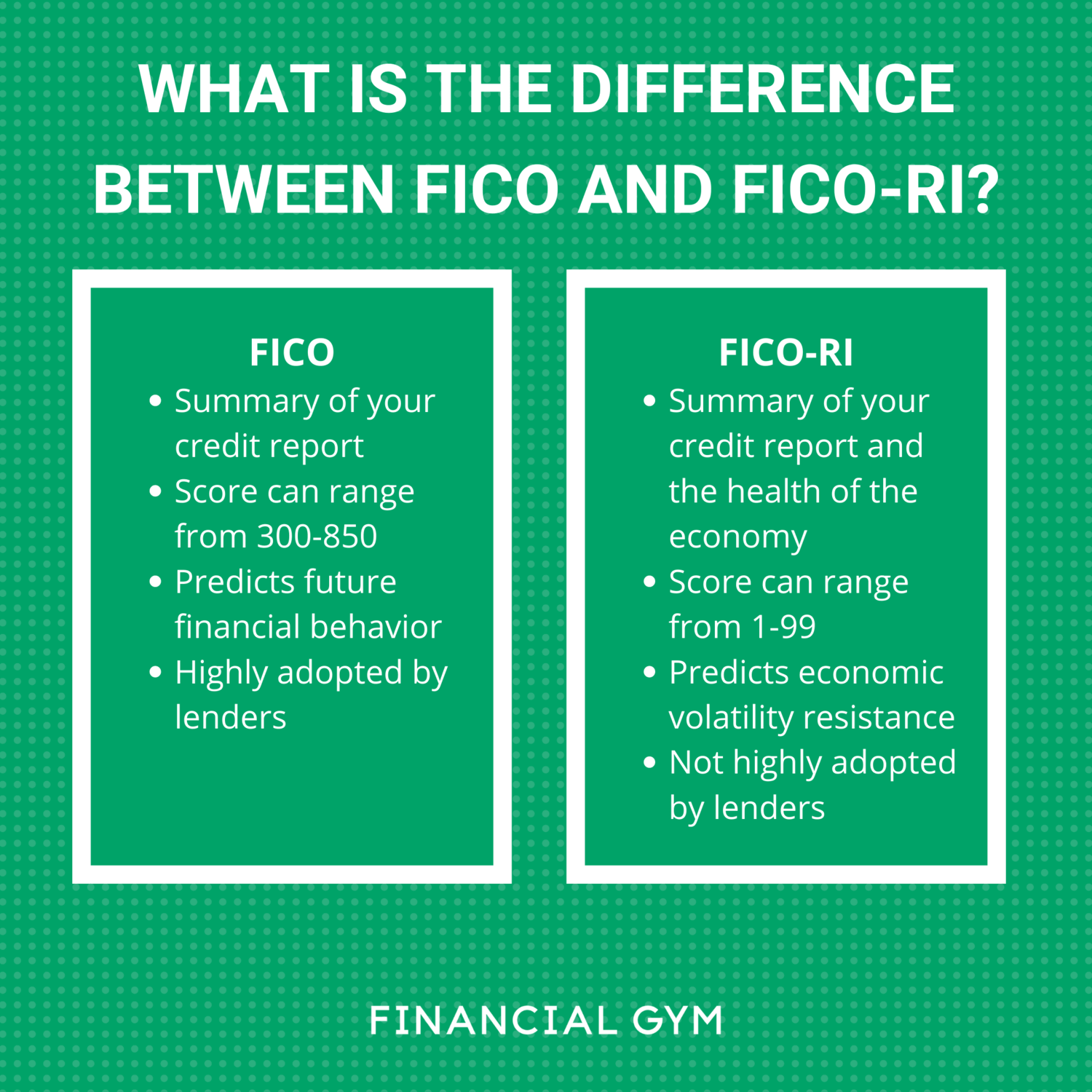

FICO-RI: What You Need to Know

One of the most common concerns of clients at the Financial Gym is maintaining a healthy credit score. Healthy credit scores can get you a lower interest rate on a mortgage, assure a landlord that you’ll be a good tenant, and help you secure favorable rates on debt consolidation loans or student loan refinancing.

Benefits of Using a Black-Owned Bank

Black-owned banks used to be and continue to be a safe place for Black Americans to bank without any discrimination. These banks often help stimulate the economy in under-served communities.

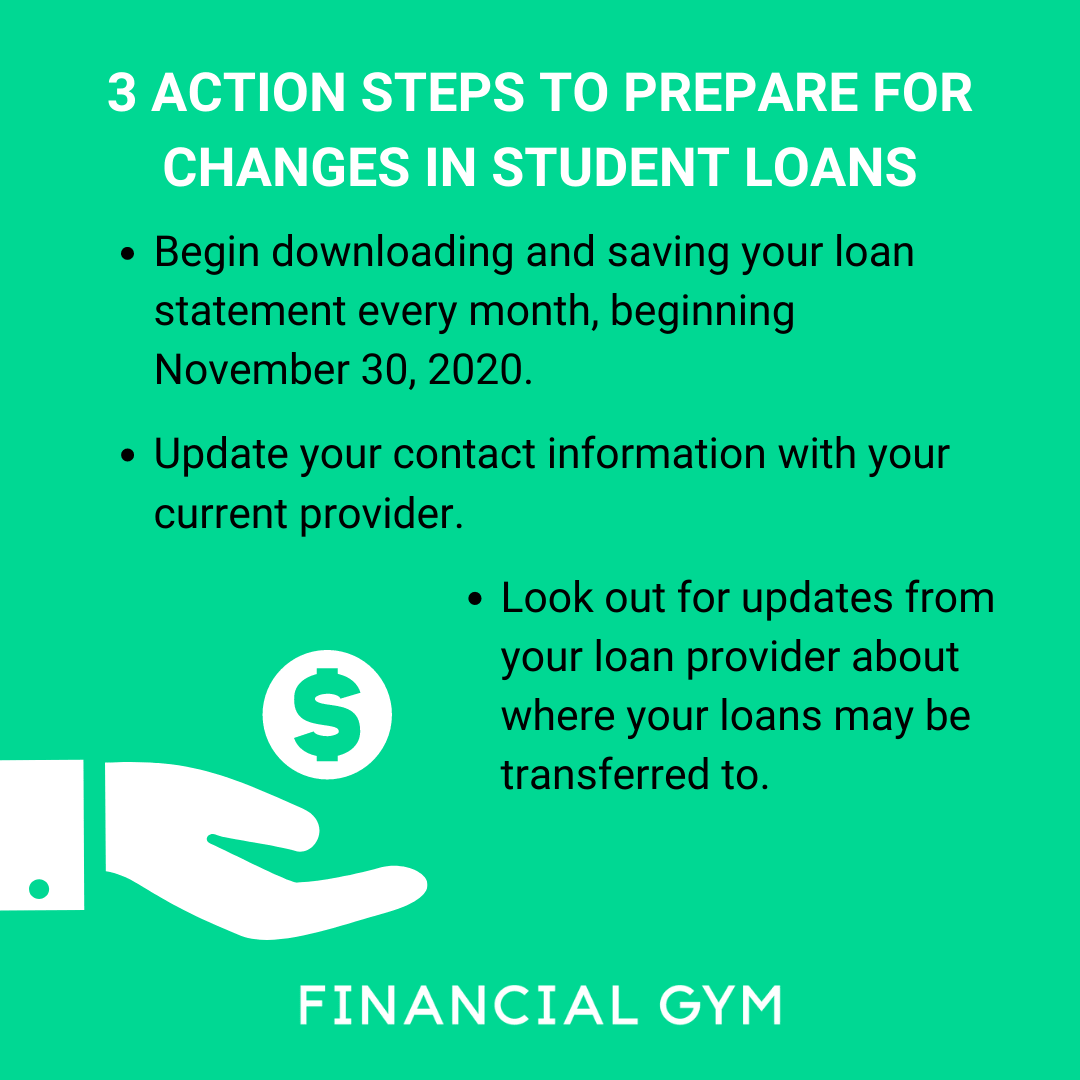

Changes to Look Out For with Your Student Loans

The Federal Student Loan system has seen some major changes over the last few months, with the announcement of the COVID relief program, which brought interest rates to 0% for 6 months, and put a halt on all payments.

How to Make an Impact with Your Money

As Financial Trainers, we’ve had the privilege of witnessing the amazing generosity of our clients throughout the pandemic. An increasingly common question is how to donate and support charities when you’re paying off debt? So, we wanted to compile a list of ways that you can be thoughtfully generous and make your dollar stretch as far as possible!

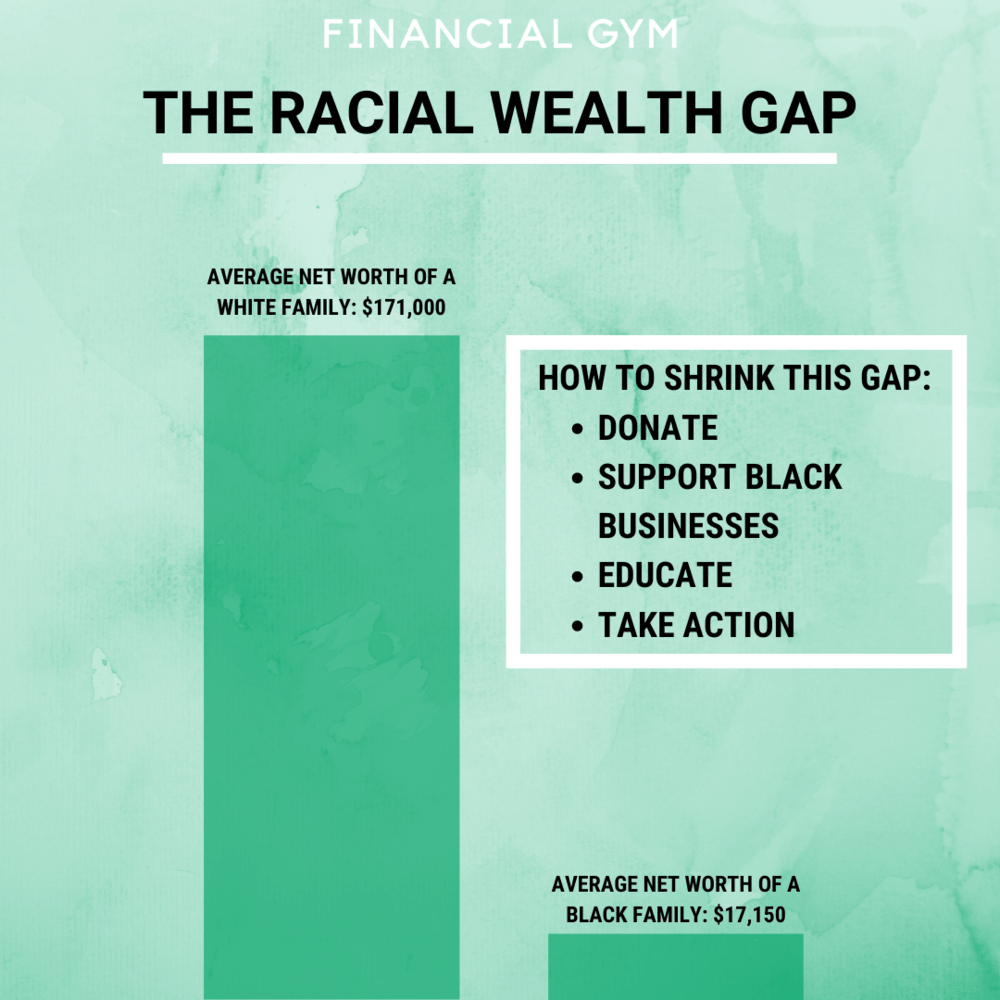

Understanding the Racial Wealth Gap

Ever since the abolition of slavery in 1865, there has been a prevalent racial wealth gap in America. The abolition of slavery was supposed to begin an era of Black wealth in America, but systematic discrimination has made it challenging for Blacks in America to create wealth. There are three main factors driving the racial wealth gap in America, homeownership, household income, and education disparities.

5 Ways to Stay Active in Your Job Search During Covid-19

Your goal is to achieve a job and to be prepared for the expectations that it may come with. All this goes to say, don’t give up! Follow through with these steps to not only achieve your goal, but to be mentally ready! Take breaks, manifest, and think positive! Everything starts with your mind. You got this!

How to Support the Black Community with Your Dollar and Action

It’s no question that the U.S. faces a huge racial wealth gap. The average white family has 10x more wealth than the average Black family. Bringing financial freedom to families all over the nation has always been a priority of ours, and with this goal in mind, we aim to help close this wealth gap.

That being said, there are plenty of ways to help build Black wealth. As a society it is our duty to close this wealth gap. This means supporting Black businesses, donating to charities that help Black Americans, supporting Black creatives, and educating ourselves and our white friends.

Message from the CEO - Trying to Find the Words

Like many people right now, I haven’t been sleeping well. In fact, I’m writing this from my bed at 1:30am and all I can think is that I need to say something but it’s been tough to find the words. Only a week has passed since George Floyd gasped for breath and yet it seems like ages. Probably because George Floyd represents what I hope is the final straw on hundreds of years of racial oppression in the United States. I have been at a loss for words; but there are words for what happened to George Floyd and the unnecessary police brutality against him and the growing number of persons of color and they are: wrong, horrifying, scary, abominable.

How My “Sober October” Has Shaped My Quarantine Spending Habits

Back in October of 2019, I set a lofty goal for myself to abstain from drinking for an entire month. I was in the final weeks of training for the NYC marathon and I thought my body would be better off if I were to cut alcohol out. After *mostly* taking the month off from drinking, I learned a few key things about mindfulness that are very applicable to “Quarantimes” as we like to call it here at the Gym.