The Financially Free Blog

6 Ways to Travel Hack Your Way Into an Affordable Vacation

Travel hacking is the art of maximizing credit card, airline, and hotel loyalty programs to get free travel, travel discounts, or travel perks that would otherwise be very costly.

8 Books to Help You Better Your Relationship with Money

It’s the beginning of a new year, so it’s time for those new year's resolutions to kick in right? Whether it’s for your health, to read more, to travel more (hopefully we can do this!), and many others I hope that one news year's resolution is to make sure your finances are in order.

5 Awesome Goals Our Clients Have Accomplished This Year

Although 2020 has been a challenging year for many, it’s still important to reflect upon some of the good that has happened in the past year. For this, we turned to some of the cool and impressive things that our clients have still been able to accomplish, despite everything 2020 threw our way!

Why Remote Work Might Complicate Your 2020 Taxes

Tax season always brings up a lot of questions. Should I file jointly or separately? What’s the difference between an AGI and a MAGI? Which expenses can I deduct? The last few years have thrown us a few curveballs as well, since the Tax Cuts and Jobs Act eliminated a number of exemptions, among other changes. This year, with so many employees working remotely, more confusion may arise as workers struggle to make sense of how to navigate working out of state.

What's Going on with My Student Loans?

For more than nine months, most people with Federal student loans haven’t been required to make monthly payments because of the coronavirus pandemic.

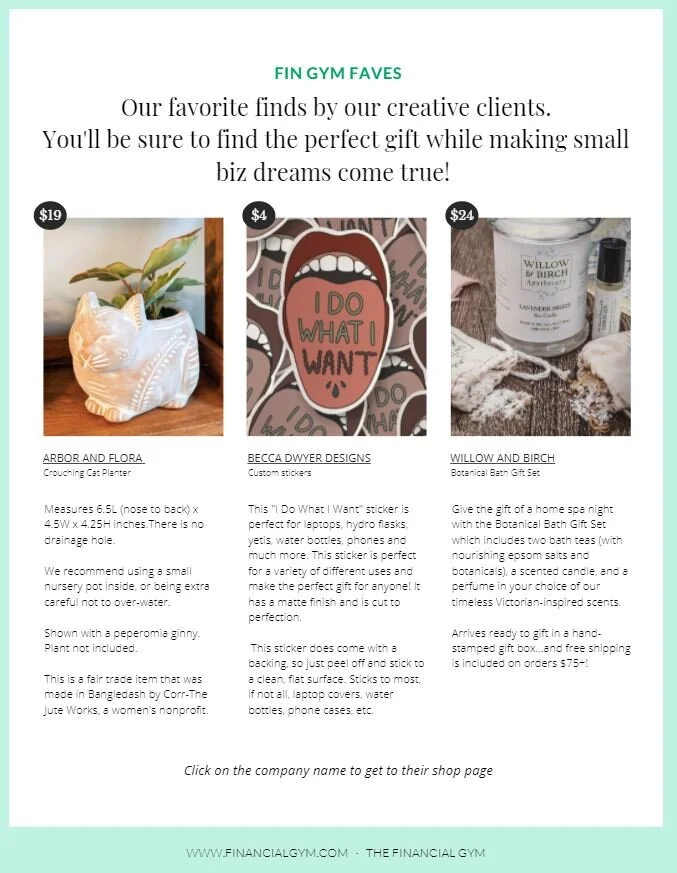

2020 Fin Gym Gift Guide

In an effort to support small this holiday season— we have curated a special gift guide featuring our favorite finds by our creative clients.

6 Actions to Take if You are a Victim of Credit Card Fraud

It is officially the holiday season which means many of us are spending more money than we typically do, especially on our credit cards. And although credit cards are an ideal way to spend thanks to points, rewards, and protection - we are all still susceptible to credit card fraud.

Small Business Saturday-- Virtual Edition

Typically during the holiday season, we are able to host a holiday bazaar where all of our various business-owner clients are able to come and set up a table to sell their products and services. Since we are unable to do an event like that this year-- we wanted to bring it to you, virtually!

Message from the CEO - Grateful

This week, we’re all about to experience a Thanksgiving like no other. A Thanksgiving that only 2020 could produce, one with limited to no travel, limited to no family and friends and the opportunity to spend more time on Zoom as if we haven’t spent enough time Zooming with people this year. Despite what lays ahead, as I sat down to write this, the only word that came to me is “Grateful.”

How To Make Conscious Financial Choices

For many of us Millennials (and let’s be real - anyone living in our modern world), there was likely a time when looking at your bank account brought you immense stress. It doesn’t matter if you have a six-figure salary, or you’ve never had a credit card to your name - simply acknowledging the black-hole-that-is-your-bank-account can feel overwhelming, scary and anxiety-ridden.

4 Unexpected Costs of Home Ownership

Before buying a home, you are usually advised to get pre-approved for a mortgage first, which serves two important purposes — it lets real estate professionals and sellers know that you are serious about your intentions to buy a home, and it provides you with a good idea of how much of a mortgage you can actually afford.

5 Good Reasons to Consider Taking Out a Personal Loan

When it comes to the financial products that empower you to take care of the things that matter most in life, there’s no shortage of available options. Each product has its own strengths and purpose, and your financial situation and personal goals play a large role in deciding what the best choice is for you. In this article, we’re going to cover a few good reasons you might consider taking out a personal loan.

How to Shop Locally (and Safely!) This Holiday

The holiday season is approaching, giving you a chance to bring joy with a well-thought-out gift while also making an impact in your community.

5 Ways to Empower the People Around You

Today, we’re seeing more women leading change than ever before. Opportunities that women have historically been left out of are now within reach. Empowering women benefits society as it helps economic prosperity, security, and safety.

7 HSA Approved Items You May Not Know You Can Make With Your HSA Account

It’s that time of year where you get to pick your health benefits for the new year. It’s important to remember to diligently choose next year’s health benefits, to benefit your needs and your pockets.

If you have a Health Savings Account (HSA), you might be surprised that many common purchases are HSA-eligible expenses.

How Your Employees Can Live Their Best Financial Lives in 2021

Understanding our personal finances --- how to budget, save, pay off, spend, and invest wisely -- is essential for everyone, including your employees. Financial wellness is a growing concern of employees and the Culture and HR managers that we speak to on a daily basis. We have complied free resources so you can create a free financial wellness week for your employees.

What You Should Know if Your Employer Is Opting in to the Payroll Tax Holiday

2020 has been a wild ride in too many ways to count, but last month the Payroll Tax Holiday threw us for another loop. In short, the tax holiday is the result of a presidential memorandum that allows for the deferment of payroll taxes from September 1 to December 31st. During this period, some workers who earn less than $104,000 per year will see a 6.2% increase in their paychecks, since they will not be required to pay social security taxes.

6 Ways to Keep Your Dog Healthy on a Budget

During this pandemic, I’ve seen quite a few of my clients add a furry family member into their homes, and who can blame them! There are countless studies about the relationship between pets and humans. Having a pet is known to provide emotional benefits as well as to improve one’s physical and mental health, and we all could use a little extra help in that department during the pandemic. About 40% of Americans own a dog and 29% own a cat which means pets are definitely an important part of many American households.

Politics and Personal Finances

Election day is quickly approaching in America. Millions of Americans are heading to the polls or sending in their mail in ballots to do the ultimate civic duty of voting for their government representation. In an effort to demonstrate how closely aligned personal finances and politics can be, we’ve rounded up a few issues that impact voter’s wallets for you to consider while researching the candidates on your ballot.

Life Insurance 101

Life insurance offers your family financial protection if you die and are no longer there to provide for them. When you're looking for a policy, you want to make sure that you're getting the best possible coverage at the best possible price. That's where term life insurance comes in. Term life is essentially a no-frills life insurance policy; it ensures your loved ones have a financial safety net without breaking the bank.

Read on to learn everything you need to know about term life insurance.