The Financially Free Blog

Healthcare Considerations for Those with Developmental Disabilities

In our previous blog post, we covered the financial opportunities and challenges for people with developmental disabilities. However, proper healthcare coverage is another crucial part of becoming financially healthy. There are details to consider for people with developmental disabilities, like Medicare, Medicaid, special state services, access to specialists, and long-term care.

What You Should Learn From Finance TikTok and What You Absolutely Shouldn’t

TikTok has brought us many things, from quarantine olympics to happy, happy dogs to Dadosaur. Now it’s bringing bite size financial literacy to the masses, or at least to those who frequent finance TikTok. But not all finance TikToks are created equally, so here’s our thoughts on what you should learn from financial TikTok and what you absolutely shouldn’t.

How to Handle Pay Gap & Inequality in the Workplace

As part of our Women’s History Month series, we want to shine a light on the gender wage gap and discuss ways to address workplace inequality throughout your career.

4 Important Things to Know About Medical Debt

Millions of people in the US have medical debt. It is particularly easy to find yourself in because healthcare in the US is more expensive than anywhere else in the world, the system is difficult to understand, and the pricing for procedures and services is often opaque. On top of that, many of us find ourselves uninsured or underemployed at some point in our lives and have to pay large amounts of our healthcare costs out of pocket.

6 Ways to Teach Your Kids About Money

Teaching financial literacy to children can be a daunting task, but introducing fundamental financial concepts now can set them up for a stable future. Instilling the building blocks of saving, spending, and making money early on can help increase prepare your children to be financially wise.

Certified Financial Trainer™ Columbus Tells His Personal Debt Story

My personal debt story began when I first started undergrad. I did not know anything about managing my finances, and I was easily persuaded to sign-up for my first credit card.

The Black Vintner

Although everyone on our team has a passion for personal finance, many of our teammates' life goals are what drives our passion!

Story from a Client: Saving for a home by moving back to your childhood bedroom

In this article, our client Caitlin Crews shares her decision to save money for a home by moving home during the Covid pandemic.

Everything you need to know: The Home Buying Experience

One of our awesome clients, Mary Whiteside, put together this awesome guide after purchasing her first home that features everything you need to know when purchasing a home for the first time.

Down Payments 101: How much will you need to put down to buy a home?

Home ownership is one of the most common goals our clients share, and as Covid has reshaped what we need and want from our living spaces, interest in buying homes has only increased.

6 Ways to Travel Hack Your Way Into an Affordable Vacation

Travel hacking is the art of maximizing credit card, airline, and hotel loyalty programs to get free travel, travel discounts, or travel perks that would otherwise be very costly.

8 Books to Help You Better Your Relationship with Money

It’s the beginning of a new year, so it’s time for those new year's resolutions to kick in right? Whether it’s for your health, to read more, to travel more (hopefully we can do this!), and many others I hope that one news year's resolution is to make sure your finances are in order.

5 Awesome Goals Our Clients Have Accomplished This Year

Although 2020 has been a challenging year for many, it’s still important to reflect upon some of the good that has happened in the past year. For this, we turned to some of the cool and impressive things that our clients have still been able to accomplish, despite everything 2020 threw our way!

Why Remote Work Might Complicate Your 2020 Taxes

Tax season always brings up a lot of questions. Should I file jointly or separately? What’s the difference between an AGI and a MAGI? Which expenses can I deduct? The last few years have thrown us a few curveballs as well, since the Tax Cuts and Jobs Act eliminated a number of exemptions, among other changes. This year, with so many employees working remotely, more confusion may arise as workers struggle to make sense of how to navigate working out of state.

What's Going on with My Student Loans?

For more than nine months, most people with Federal student loans haven’t been required to make monthly payments because of the coronavirus pandemic.

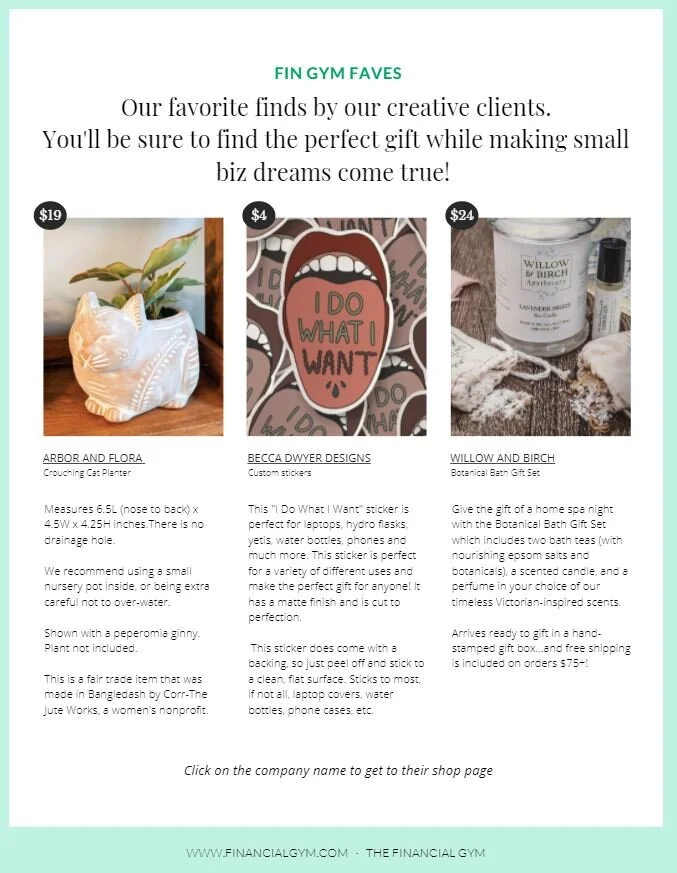

2020 Fin Gym Gift Guide

In an effort to support small this holiday season— we have curated a special gift guide featuring our favorite finds by our creative clients.

6 Actions to Take if You are a Victim of Credit Card Fraud

It is officially the holiday season which means many of us are spending more money than we typically do, especially on our credit cards. And although credit cards are an ideal way to spend thanks to points, rewards, and protection - we are all still susceptible to credit card fraud.

Small Business Saturday-- Virtual Edition

Typically during the holiday season, we are able to host a holiday bazaar where all of our various business-owner clients are able to come and set up a table to sell their products and services. Since we are unable to do an event like that this year-- we wanted to bring it to you, virtually!

How To Make Conscious Financial Choices

For many of us Millennials (and let’s be real - anyone living in our modern world), there was likely a time when looking at your bank account brought you immense stress. It doesn’t matter if you have a six-figure salary, or you’ve never had a credit card to your name - simply acknowledging the black-hole-that-is-your-bank-account can feel overwhelming, scary and anxiety-ridden.